Preventing Global Warming

- Basic Approach

- Initiatives Aimed at Preventing Global Warming

- Goals and Achievements of Major Initiatives

- Framework for Promotion

- Sustainability-Related Disclosure

- 01 Governance

- 02 Strategy

- 03 Risk Management

- 04 Metrics and Targets

- Principal Initiatives in Fiscal Year 2024

01 Energy Consumption and CO2 Emissions by the Global DIC Group (Scope 1 and 2) - 02 Grasping CO2 Emissions Across the DIC Group’s Supply Chains (Scope 3)

- Protecting the Ozone Layer

Basic Approach

The DIC Group works to reduce CO2 emissions over the entire life cycle of its products and, through its business activities, to lower risks associated with climate change.

Initiatives Aimed at Preventing Global Warming

In line with its goal of contributing to the realization of sustainability for the global environment and for society, in June 2021 the DIC Group announced DIC NET ZERO 2050, which sets a target of achieving carbon neutrality—net zero CO2 emissions (Scope 1 and 2)—by fiscal year 2050. In January 2023, the Group’s CO2 emissions target received official endorsement from the Science Based Targets initiative (SBTi),* which was established with the purpose of driving CO2 emissions reduction in the private sector. (Information regarding the impact of the acquisition of the Colors & Effects pigments business has been communicated to the SBTi secretariat and the Group is taking action regarding the increase in base year emissions resulting from the integration of this business.) The DIC Group currently comprises 171 companies in 62 countries and territories. The Group is committed to working as one to cut emissions to ensure achievement of this target.

- The SBTi is a global entity that encourages companies to set science-based greenhouse gas emissions reduction targets that are in line with the goal of the Paris Agreement. The SBTi is a partnership of the CDP, the United Nations Global Compact (UNGC), the World Resources Institute (WRI) and the World Wide Fund for Nature (WWF).

Goals and Achievements of Major Initiatives

Reduce CO2 emissions at sites (Scope 1 and 2).

| Fiscal year | Goals | Achievements | Evaluation |

|---|---|---|---|

| 2024 | DIC Group (global): Reduce CO2 emissions at DIC Group sites (Scope 1 and 2) by 50% from the fiscal year 2013 level by fiscal year 2030 (average annual decrease of 2.9%). |

DIC Group (global): CO2 emissions: 549,886 tonnes

|

★★★ |

| DIC Group (Japan): Reduce energy consumption per unit of production by 17.0% from the fiscal year 2013 level by fiscal year 2030 (average annual decrease of 1.0%). (Comply with the Energy Conservation Act.) |

DIC Group (Japan): Energy consumption per unit of production: 4.61 GJ/tonne

|

★ | |

| 2025 | DIC Group (global): Reduce CO2 emissions at DIC Group sites (Scope 1 and 2) by 50% from the fiscal year 2013 level by fiscal year 2030 (average annual decrease of 2.9%). |

― | ― |

| DIC Group (Japan): Reduce energy consumption per unit of production by 1.0%-plus from fiscal year 2024 or by an annual average of 1.0%-plus over five years. (Comply with the Energy Conservation Act.) |

― | ― |

- Evaluations are based on self-evaluations of current progress.

Key: ★★★ = Excellent; ★★ = Satisfactory; ★ = Still needs work

Framework for Promotion

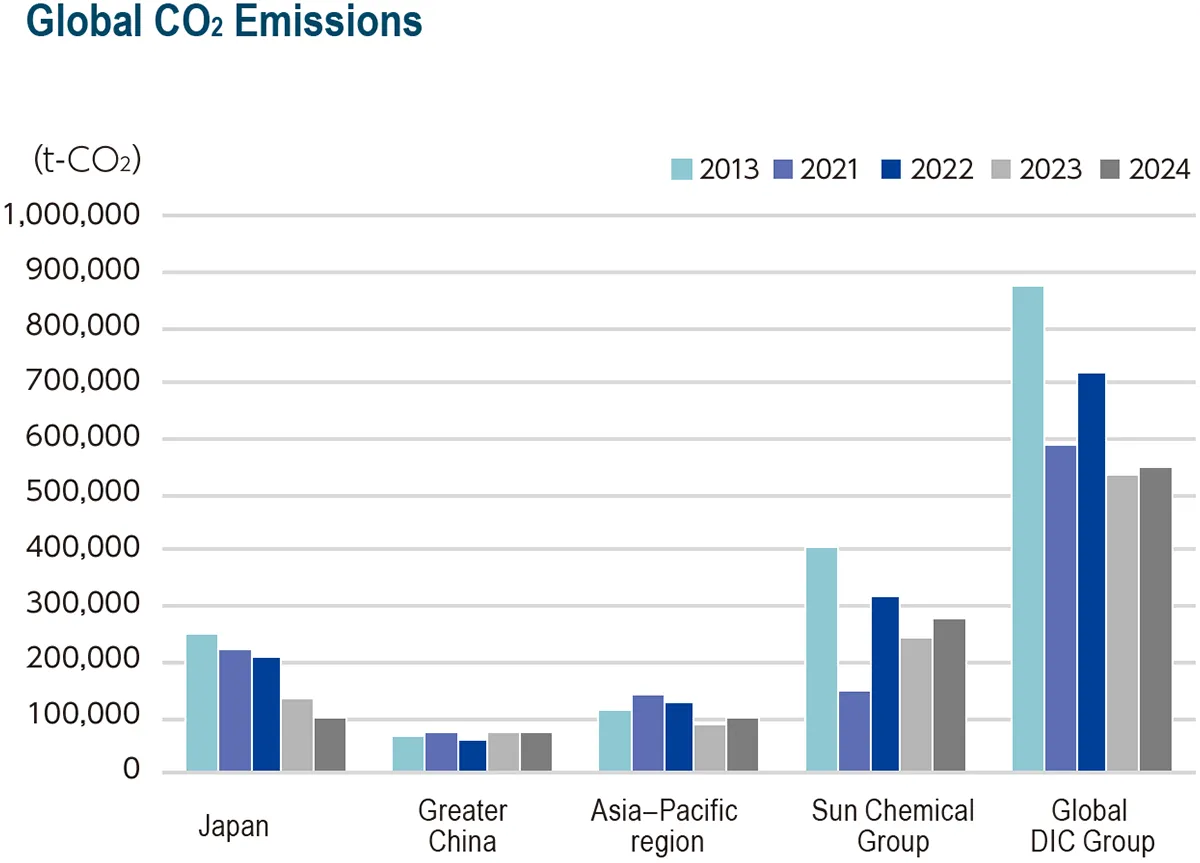

The DIC Group works to reduce CO2 emissions through its business activities in four regions: Japan, the Americas and Europe (overseen by Sun Chemical), the Asia–Pacific region and Greater China. Despite differences in energy requirements and access to renewable energy depending on region and site location, the Group is committed to working as one to ensure it achieves its target of reducing its Scope 1 and 2 CO2 emissions by 50% from the fiscal year 2013 level by fiscal year 2030.

Recognizing climate change as a key societal imperative, the DIC Group is working to reduce CO2 emissions from its sites. Important measures are proposed to the Sustainability Committee, which reports directly to the president and CEO. In October 2024, establishment of the Climate Change Subcommittee was approved. This committee commenced activities in January 2025. The purpose of this group is to confirm CO2 emissions targets appropriate for the DIC Group, as well as to develop plans for the achievement thereof.

In Japan, an Energy-Saving Promotion Committee has been established at each Group company site. Committee activities include confirming the progress of initiatives, engaging in discussions and conducting patrols. An Energy-Saving and Decarbonization Working Group has also been set up at each site comprising members selected by the site itself. These working groups foster the exchange of information and research pertaining to new energy-saving measures, as well as advance the horizontal deployment of effective measures across domestic Group sites. This combination of site- and Group-level initiatives forms the framework under which the DIC Group endeavors to reduce its CO2 emissions.

In the Americas and Europe, Sun Chemical is promoting efforts to reduce its CO2 emissions in North, South and Central America, as well as in Europe. In the Asia–Pacific region and Greater China, Group companies are encouraging a variety of independent energy-saving initiatives that align with related Group policies. DIC’s Production Management Unit provides support on multiple fronts, including managing overall progress.

Efforts at all DIC Group companies worldwide under this framework are making progress toward achieving the Group’s target of reducing its Scope 1 and 2 CO2 emissions by 50% from the fiscal year 2013 level by fiscal year 2030.

Managing Progress

The progress of efforts to reduce the DIC Group’s Scope 1 and 2 CO2 emissions by 50% from the fiscal year 2013 level by fiscal year 2030 is reported annually at a meeting of the Sustainability Committee. Following a review of policies and activities, the Group’s plans for reducing Scope 1 and 2 CO2 emissions is publicly announced to all stakeholders through inclusion in the subsequent DIC Report.

Principal Efforts

- Undertake energy-saving initiatives Groupwide.

- Promote DX to optimize energy management for production and utility equipment.

- Actively establish energy-saving facilities.

- Install renewable energy generation facilities—e.g., biomass boilers and net solar power—at suitable locations.

- Set a target for Scope 1 CO2 emissions that aligns with Japan’s nationally determined contribution (NDC) greenhouse gas emissions reduction target and develop specific initiatives for implementation at sites in Japan.

- When installing or expanding facilities, make use of internal carbon pricing to advance decarbonization.

Progress

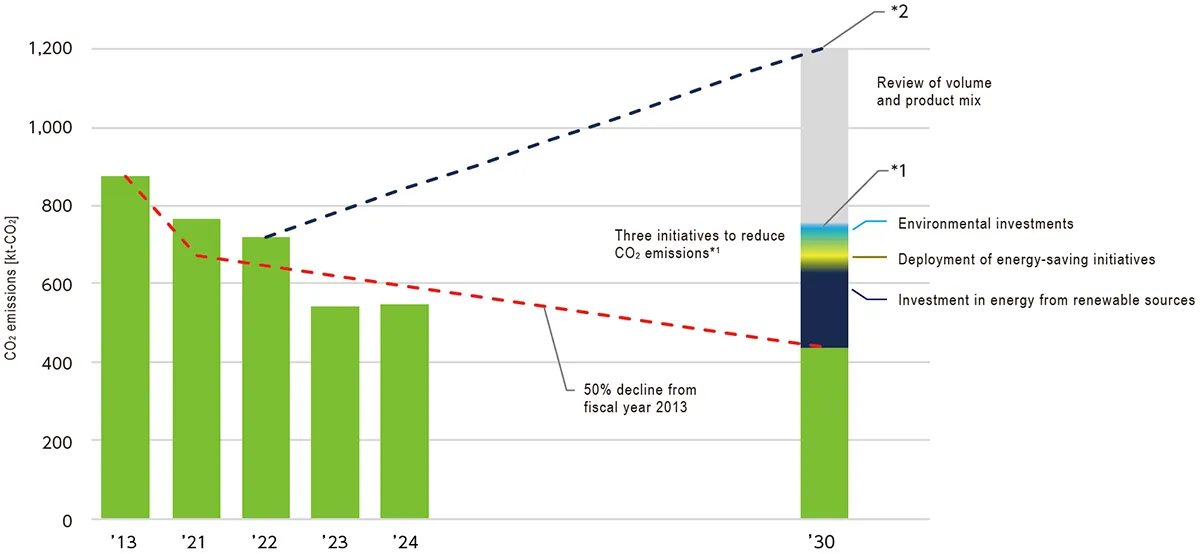

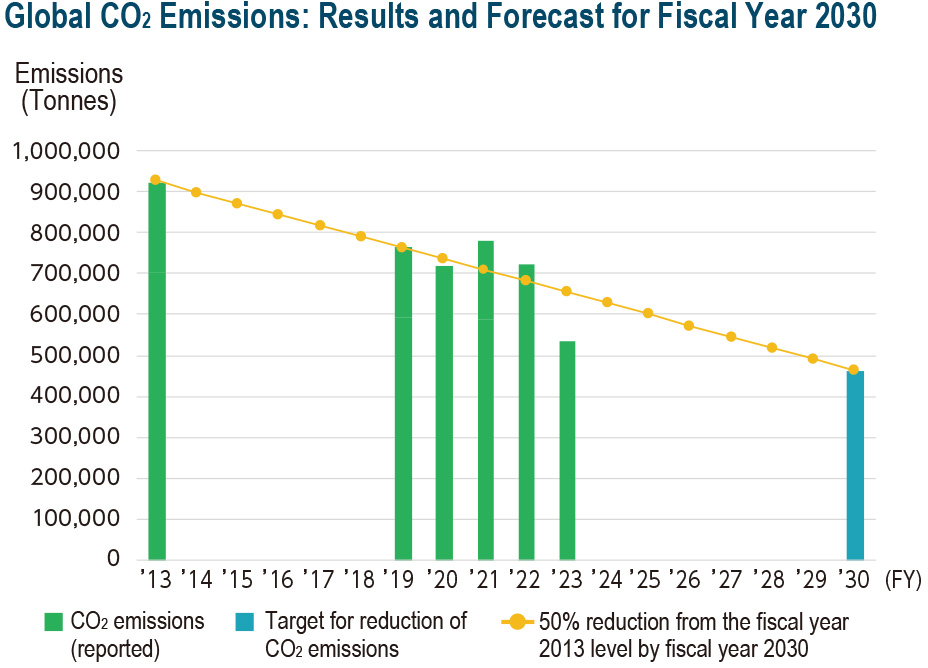

The DIC Group has set long-term targets to reduce Scope 1 and 2 CO₂ emissions by 50% from the fiscal year 2013 level by fiscal year 2030 and to achieve carbon neutrality—net zero CO₂ emissions—by fiscal year 2050. The Group is currently on track to meet both of these targets. In fiscal year 2024, CO₂ emissions by the global DIC Group amounted to 549,886t-CO₂, a decrease of 37% from fiscal year 2013.

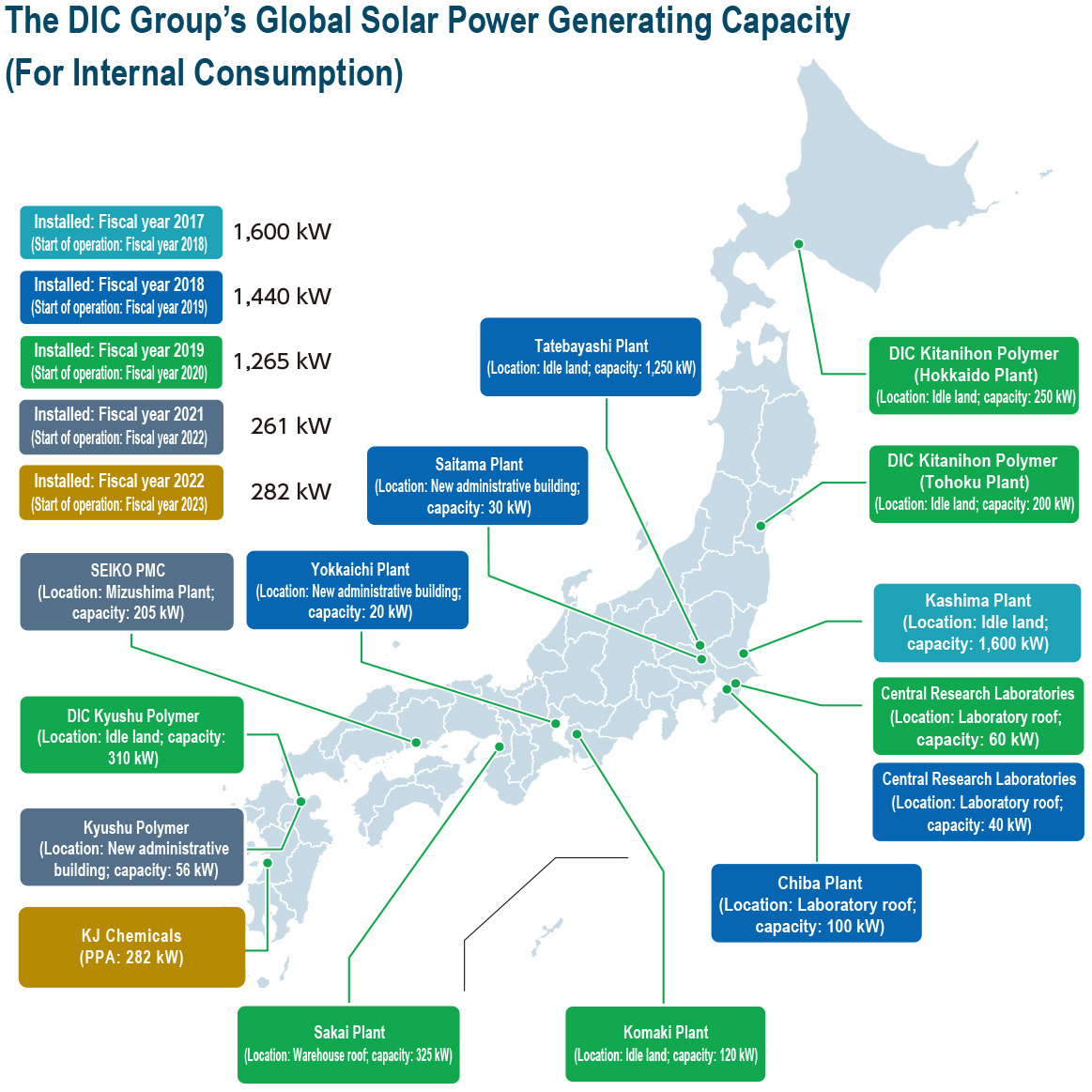

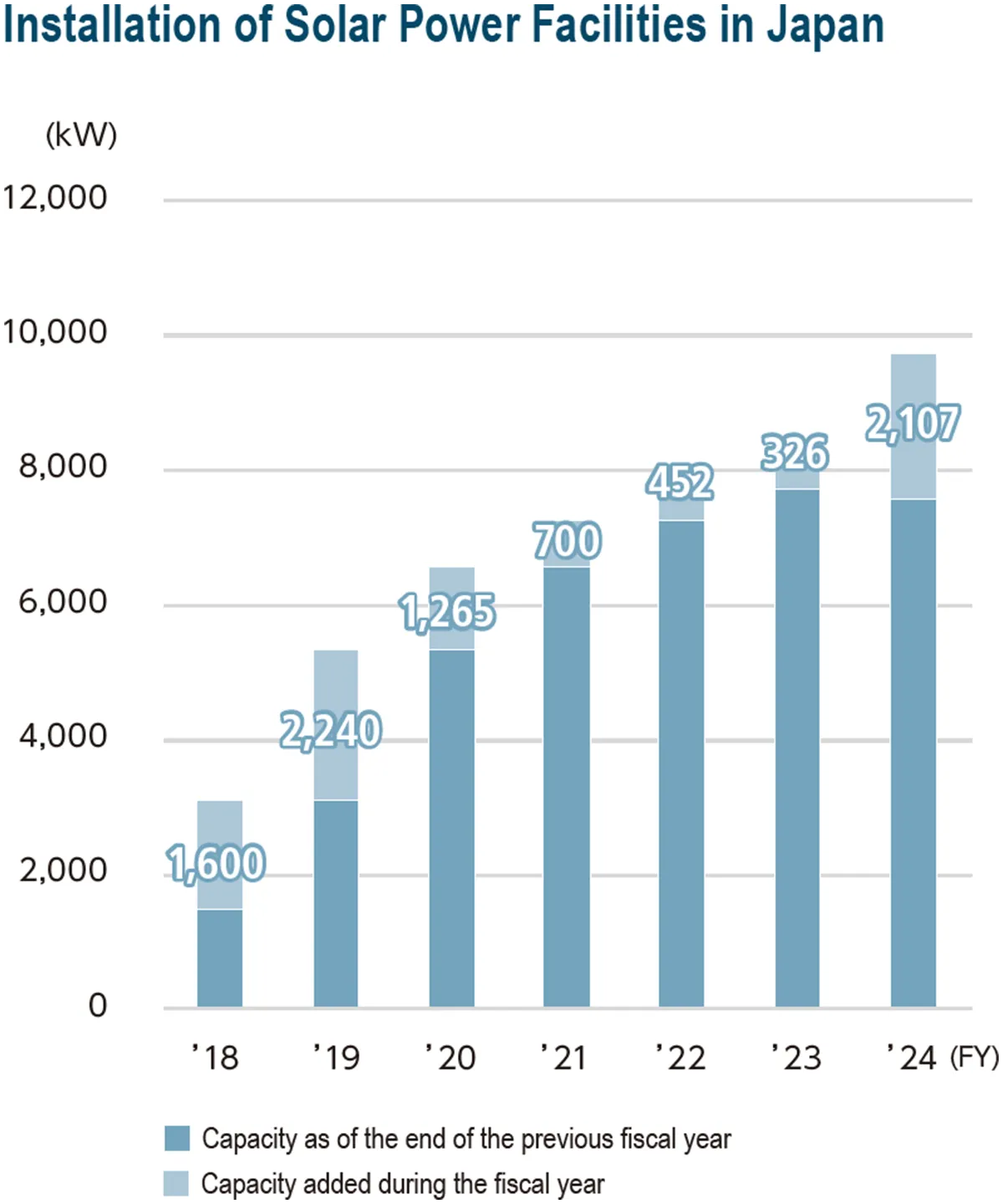

To ensure the achievement of its targets, the entire DIC Group is working to improve production processes and implement energy-saving initiatives. In particular, when updating equipment Group companies explore a broad range of initiatives to lower energy consumption, including choosing high-efficiency models, promoting electrification, switching to clean fuels such as biomass, and installing solar power or other renewable energy generation facilities, and choose those best suited to the particular site or sites in question, thereby helping improve energy efficiency Groupwide. The Group also works to develop and promote energy-saving measures, focusing on particularly energy-intensive sites.

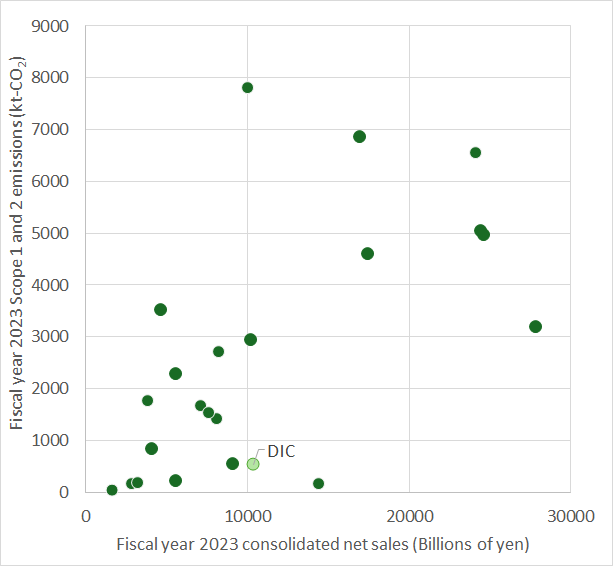

As a consequence, emissions per unit of net sales in fiscal year 2024 were 0.513t-CO₂/¥1 million (549,886t-CO₂/¥1,071,127 million), down 41% from 0.871t-CO₂/¥1 million (722,955t-CO₂/¥830,078 million) in fiscal year 2013. This figure of 0.513t-CO₂/¥1 million (the gradient of a straight line passing through the data points and the origin in the graph) indicates a more efficient emissions performance than that of other chemicals manufacturers in Japan with comparable consolidated net sales.

In fiscal year 2025, the DIC Group’s Scope 1 (direct) CO₂ emissions will be positively impacted by plans to install and begin operating a new biomass boiler at its Sakai Plant. As in fiscal year 2024, the Group will seek to reduce Scope 2 (indirect) emissions by procuring green power to satisfy all purchased power needs in Japan and encouraging the purchase of green power overseas, including in the People’s Republic of China (PRC), Southeast Asia and South America. The Group will continue to advance these and other efforts with the aim of achieving its net zero CO₂ emissions target by fiscal year 2050.

Sustainability-Related Disclosure

Following amendments to Japan’s Cabinet Office Ordinance on Disclosure of Corporate Affairs, Japanese companies are now required to include an “Approach to Sustainability and Our Initiatives” section in the annual securities reports that they file and are compelled to disclose sustainabilityrelated information. Climate change is an issue of particular concern to the DIC Group, so it structures its disclosure using a framework comprising four thematic areas: Governance, strategy, risk management, and metrics and targets. The Group is striving to improve its sustainability-related disclosure in the countries and territories in which it operates, reviewing its approach as required to reflect changes in its operating environment.

01Governance

The DIC Group has established the Sustainability Committee, which answers directly to the president and CEO and is responsible for formulating responses to key social imperatives. The committee is also tasked with reinforcing sustainability initiatives and deliberating on critical related matters. Recognizing climate change as a key management challenge, the committee deliberates on important matters, including the setting of medium- and long-term targets for the reduction of CO2 emissions. Chaired by the president and CEO, the committee includes the executive vice president, the general managers/heads of the Production Management Unit, Technical Management Unit, Corporate Strategy Unit, General Affairs and Legal Unit, Finance and Accounting Unit and ESG Unit, as well as the CEOs of regional headquarters, presidents of the business groups and general managers of the product divisions. As part of the auditing process, one Audit & Supervisory Board member also participates. The committee meets four times annually and reports on the results of its deliberations on all agenda items to the Board of Directors, ensuring appropriate supervision.

Principal Climate Change–Related Issues Managed by the Sustainability Committee in Fiscal Year 2024

| Principal issues |

|---|

| Report on sustainability themes for fiscal year 2023 |

| Formulation of message regarding the circular economy |

| Revision of TCFD scenario analysis |

| CO2 emissions reduction plans |

| Annual sustainability activity plans for fiscal year 2025 |

| Establishment of the Climate Change Subcommittee |

02Strategy

With pressure on the global community to achieve carbon neutrality by 2050 intensifying rapidly, changes to rules governing competitiveness are expected to transform the socioeconomic system going forward. The DIC Group is promoting sustainable business strategies, recognizing the importance of risks and opportunities associated with climate change. Because the impacts of climate change are likely to surface over the medium to long term, the Group is working to enhance its awareness of the principal climate-related risks and opportunities that are likely to have a financial impact over this period based on a scenario analysis it conducted in fiscal year 2024. In addition to improving the Group’s understanding of foreseeable risks and opportunities from a longer-term perspective, this will also enable it to formulate and execute effective strategies on an appropriate timeline.

The DIC Group recognizes achieving net zero CO2 emissions by fiscal year 2050 as a material issue. The Group will continue to promote decarbonization not only by reducing its own energy use but also by providing information on the carbon footprint of its products.

Transitional Plan for Reducing CO2 Emissions

As an organization with a CO2 emissions reduction target, the DIC Group will promote a variety of related initiatives in line with a transitional plan. To advance these initiatives, the Group currently plans to make environmental investments of approximately ¥1.4 billion in Japan between fiscal years 2025 and 2027.

-

Notes:

- In Japan, Scope 1 CO2 emissions are calculated using emissions factors set by the country’s Ministry of the Environment. In other regions, Scope 1 emissions are calculated using emissions factors set by the United States Environmental Protection Agency (EPA). Sun Chemical uses EPA emissions factors from the Sphera Cloud Corporate Sustainability System (SCCS) Impact Library.

- In Japan, Scope 2 emissions attributable to the consumption of purchased electric power are calculated using emissions factors set by the Ministry of the Environment. Scope 2 emissions in the Asia–Pacific region, the PRC and other regions are calculated using the International Energy Agency (IEA)’s Emissions Factors 2024 database. Sun Chemical uses emissions factors from the following sources, in order of priority, depending on the site: Supplier data, residual mix libraries and the EPA’s static library. In Japan, the Asia–Pacific region, the PRC and other regions, emissions from steam are calculated using supplier data. Sun Chemical uses emissions factors from the following sources, in order of priority, depending on the site: Supplier data, residual mix libraries and the EPA’s static library.

- This figure for CO2 emissions is an estimate assuming no initiatives to curb emissions had been implemented and business had expanded 3% annually since fiscal year 2024.

- This figure for CO2 emissions in fiscal year 2030 is an estimate made in fiscal year 2022 assuming no initiatives to curb emissions had been implemented and business had expanded.

TCFD Scenario Analysis

Conditions for Scenario Analysis

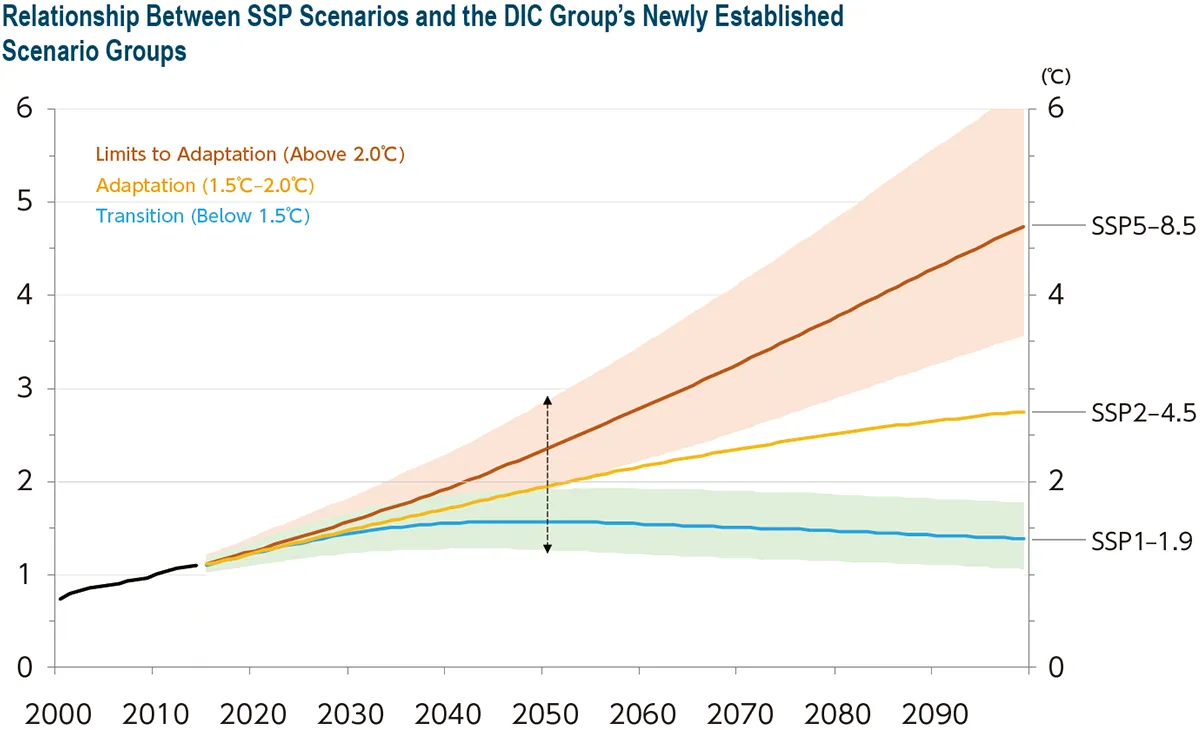

In fiscal year 2024, DIC revised the results of its previous scenario analysis, conducted in fiscal year 2020, taking into account shared socioeconomic pathway (SSP) scenarios SSP1–1.9, SSP2–4.5 and SSP5– 8.5 in the Sixth Assessment Report (AR6), published by the United Nations Intergovernmental Panel on Climate Change (IPCC) in March 2023, and the environmental scenarios explored in World Energy Outlook (WEO) 2023, released by the IEA in October 2023.*1 While the time frame of the previous analysis concluded in 2030, this was extended to 2050. Based on the outlook for the situation surrounding climate change and energy, DIC established three scenario groups, which it calls “transition,” “adaptation” and “limits to adaptation,”*2 and has analyzed risks and opportunities, as well as formulated measures for each. For more information, please see pages 67–68.

・Three Scenario Groups

Transition: Countries immediately and decisively implement measures to reduce CO2 emissions with the goal of limiting the rise in global temperature to 1.5°C above preindustrial levels. The efficient use of energy is required, including through energy conservation and the joint transport of goods. The use of carbon pricing *3 will begin and expand in many countries and territories and the prices used will continue to increase.

Adaptation: Global warming continues through the mid 2040s, with the rise in global temperature to above preindustrial levels exceeding 1.5°C but remaining below 2.0°C. Adapting to rising global temperatures requires strategies and actions to strengthen resilience. Insulation and heat shielding are effective approaches. The frequency of extreme climate events may go from once in a century to once in a decade or even once a year.

Limits to Adaptation: Global warming persists and the rise in global temperature to above preindustrial levels exceeds 2.0°C in 2050 and approaches 5.0°C in 2100. Unpredictable weather and climate extremes increase, leading to food insecurity and supply instability, and forcing people to migrate from the places people have lived for centuries. Changes are complex and cascading, and have negative impacts on quality of life across borders. Pandemics, conflicts and other non-climate risks may be amplified by these impacts.

- References used in revising scenario analysis results

- Relationship between adaptation and limits to adaptation: As temperatures rise, limits to the capacity to adapt—key vulnerabilities—emerge. It is assumed that this will trigger an unremitting shift from the adaptation scenario to the limits to adaptation scenario.

- International carbon price forecast (per tonne of CO2 emitted): $135 in 2030, $200 in 2050

Results of Scenario Analysis for the Three Scenario Groups

Transition

R = Response to risks, O = Response to opportunities

| Risks | Opportunities | Countermeasures | |

|---|---|---|---|

| Policies and laws | |||

| Implementation of carbon pricing around the world |

|

The promotion of energy efficiency and a shift to green electric power, both purchased and generated on-site, helps reduce fossil fuel consumption. | R: Apply reasonable carbon pricing in appropriate regions to hasten the reduction of CO2 emissions. R: Avoid the financial impact of CO2 emissions by promoting electrification and the use of renewable energy to reduce Scope 1 and 2 emissions. O: Promote enhanced functionality and contribution to decarbonization to deliver products that minimize the impact of carbon pricing. |

| Demand for disclosure of nonfinancial information increases globally | Building and operating a system for responding to disclosure requests around the world incurs costs. | R: Act on a request to respond to the EU’s Corporate Sustainability Reporting Directive (CSRD)* by proceeding with plans to release a report in 2026. | |

| Technological innovations | |||

| Changes in demand occur and the idea of a circular economy dominates |

|

|

O: Step up consideration of chemical and material recycling in collaboration with customers and consumers. O: Focus on using bioderived materials and developing sustainable materials that make products easy to recycle. |

| Development focuses on products that are low carbon or carbon neutral | Demand for products that are low carbon or carbon neutral—thereby helping to reduce emissions attributable to customers’ processes—increases. | O: Promote products that contribute to decarbonization (e.g., have low emissions of VOCs, low energy consumption, etc.). | |

| Behavioral changes | |||

| Necessity of responding to demands to reduce CO2 emissions attributable directly to production and across the supply chain | Efforts to reduce CO2 emissions with the aim of achieving the target rise in temperature of 1.5°C begin and the trend toward demanding such efforts spreads across supply chains. | R: Implement measures to reduce Scope 1 and 2 emissions by 50% and Category 2, 3, 4, 5 and 12 Scope 3 emissions by 13.5%, and achieve a supplier engagement rate of 80% in Category 1 of Scope 3. R: Give consideration to shifting to an SBT that corresponds to the 1.5°C target. R: Continue to make investments in energy-saving and renewable energy facilities. |

|

| Necessity of addressing biodiversity needs directly in production and across supply chains | Products that do not take biodiversity into account are removed from the market. | R: Take biodiversity into consideration in the purchasing of raw materials and at production sites. |

- The European Commission announced an omnibus proposal regarding responding to the CSRD on February 26, 2025, which will be deliberated by the Council of the European Union and the European Parliament. DIC will continue to monitor developments and take appropriate action when new legislation comes into force.

Adaptation

| Risks | Opportunities | Countermeasures | |

|---|---|---|---|

| Acute | |||

| Increase in frequency of extreme climate events from the current once in a century to once in a decade or even once a year |

|

R: For key raw materials, promote two-company shared procurement in multiple regions and strengthen business continuity plan (BCP) responses. R: For key products, ensure ample inventories of raw materials and products. R: Locate printing inks and other production facilities around the world to ensure complementary capabilities. R: Cooperate with other companies to minimize impact in the event port facilities are damaged due to storm surges or flooding. R: Strengthen measures for sites located in coastal areas. |

|

| Chronic | |||

| Depletion of groundwater resources | Countermeasures are needed in areas where there are concerns regarding increased water-related risks. | R: Implement measures to address water-related risks and reinforce the effectiveness of BCPs by providing related training. | |

| Changes in lifestyles and consumption patterns as a result of climate change | Demand for existing products may decrease as new lifestyles suited to high temperatures become necessary. | New lifestyles suited to high temperatures bring opportunities in such areas as coatings, packaging materials and healthcare. | O: Develop products that respond to increased demand for insulated and heat-shielding offerings as temperatures rise. O: Leverage changes in dietary habits to develop/expand longlife packaging for beverages and frozen food products. O: Expand operations in the areas of healthcare and life science and promote health. |

| Frequent poor harvests due to a loss of biodiversity | Supply of plant-derived raw materials will come to a halt as a consequence of poor harvests. | R: Strengthen resilience. |

Limits to adaptation

| Risks | Opportunities | Countermeasures | |

|---|---|---|---|

| Acute | |||

| Sudden changes in weather patterns and extreme climate change that result in problems in terms of public health and the environment |

|

R: Reinforce the effectiveness of BCPs by providing related training. |

|

| Chronic | |||

| Difficulties using edible plants as chemical raw materials or fuel from a food security perspective | The use of raw materials derived from edible plants becomes difficult. | R: Switch from edible to nonedible biomass raw materials. | |

| Amplification of non-climate risks as a consequence of instability caused by climate change |

|

R: Reinforce the effectiveness of BCPs by providing related training. R: Formulate an emergency plan that includes the strategic downsizing of operations; protection of core assets, data and hazardous chemicals; evacuation procedures; and support for employees’ families. R: Prepare emergency plans that are better than those of competitors. |

Post-Scenario Analysis Initiatives (Fiscal Years 2020–2024)

- Introduced internal carbon pricing.

- Resolved to introduce internal carbon pricing to quantify CO2 emissions and climate change risks, as well as to provide economic incentives for reducing CO2 emissions. Beginning in fiscal year 2021, introduced internal carbon pricing for projects in Japan, the Asia–Pacific region and Greater China entailing capital investments of ¥50 million or more. Built a system that factors reductions in costs related to CO2 emissions into the impact of capital investments.

- Raised funds through sustainable finance.

- Began introducing green power at 34 sites in Japan. Promoted use of low-carbon energy by, among others, bringing a new low-carbon liquefied natural gas (LNG)-fired boiler online at the Karawang Plant in Indonesia, installed to replace a coal-fired unit.

- Provided information on the carbon footprint of products; in the future, consideration will be given to revising methodology used to account for biomass and recycled material content.

- Resolved to introduce a new biomass boiler at the Sakai Plant as part of a program of investment in energy-saving and renewable energy equipment.

- Completed facility at the Yokkaichi Plant for the dissolution and separation recycling of polystyrene used in colored and/or patterned foamed food trays in fiscal year 2024.

03Risk Management

Processes Used to Identify and Assess Climate Change–Related Risks

DIC recognizes risks related to its response to climate change—a key component of its framework of sustainability themes, the foundation of its sustainability activities—and works to evaluate, address and manage them effectively.

The Risk Management Working Group, a subordinate entity of the Sustainability Committee, is charged with identifying and debating priority risks. Risks designated as priorities are submitted for consideration to the Sustainability Committee.

Key Risk Management Perspectives

- Should carbon pricing or carbon border taxes be introduced in the future, there is a risk that raw materials, fuel and electric power prices will rise and/ or that taxes will be imposed on exported products, making CO2 emissions a factor that directly affects costs.

- Should the Group be unable to respond to any sudden changes in demand resulting from the shift to a circular economy to advance decarbonization, there is a risk of a significant decline in profits generated by its businesses (climate change–related transition risk).

- Should climate-related disasters arising from the increasing seriousness or frequency of extreme weather events occur, resulting in product supplies becoming impossible or being delayed due to the suspension of operations at production facilities and the instability of raw materials supplies, there is a risk that it will cause a significant decline in profits generated by Group businesses or threaten business continuity (extreme physical risk).

04Metrics and Targets

The DIC Group uses Scope 1 and 2 emissions as KPIs to evaluate transition risks. In light of accelerated global efforts to decarbonize, the Group pledges to work actively to help decarbonize society. DIC has set a long-term target for reducing CO2 emissions (Scope 1 and 2) by 50% from the fiscal year 2013 level by fiscal year 2030 and has pledged to step up related efforts. The Group also aims to achieve carbon neutrality—net zero CO2 emissions—by fiscal year 2050.

Principal Initiatives in Fiscal Year 2024

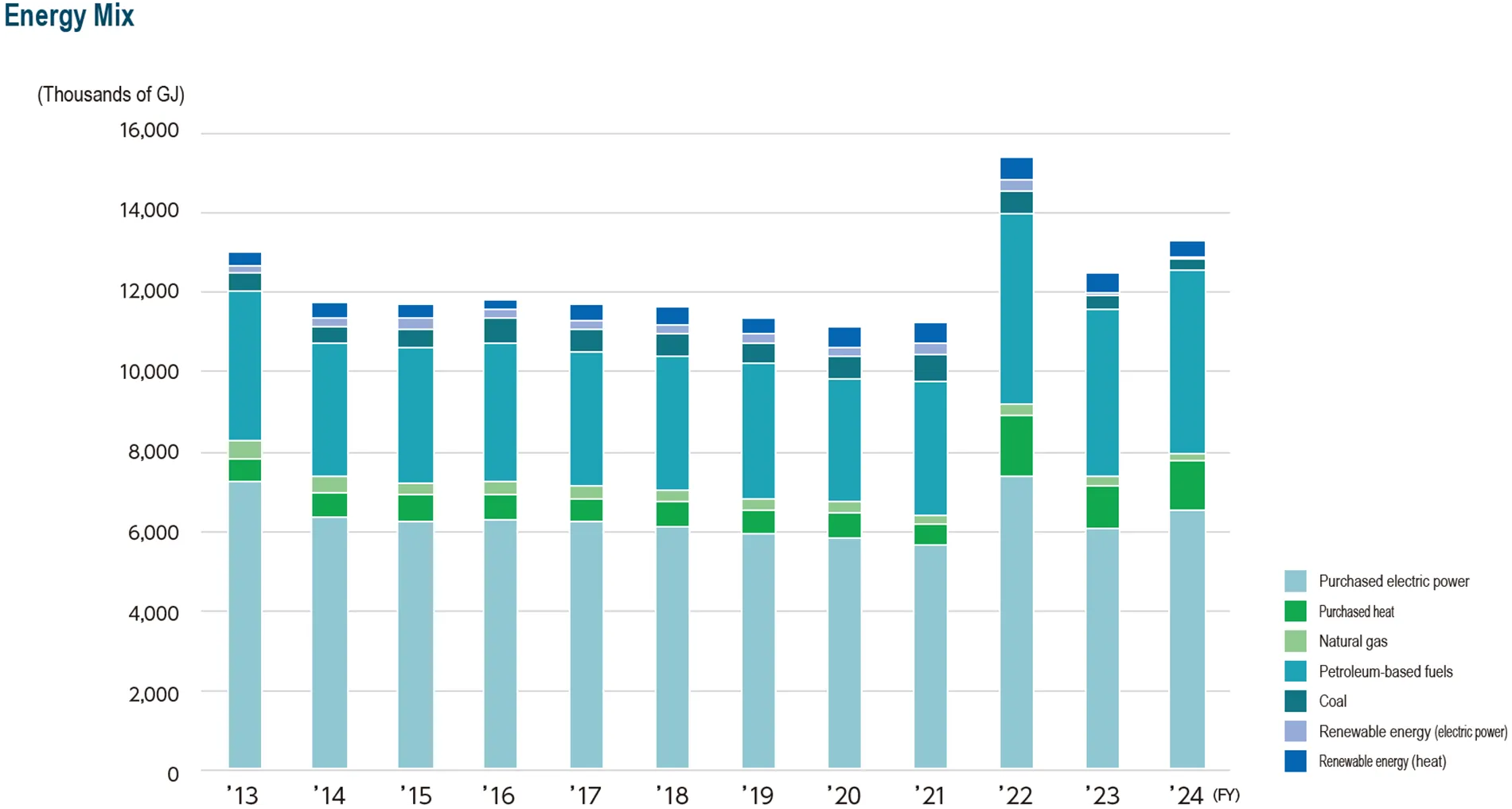

01Energy Consumption and CO2 Emissions by the Global DIC Group (Scope 1 and 2)

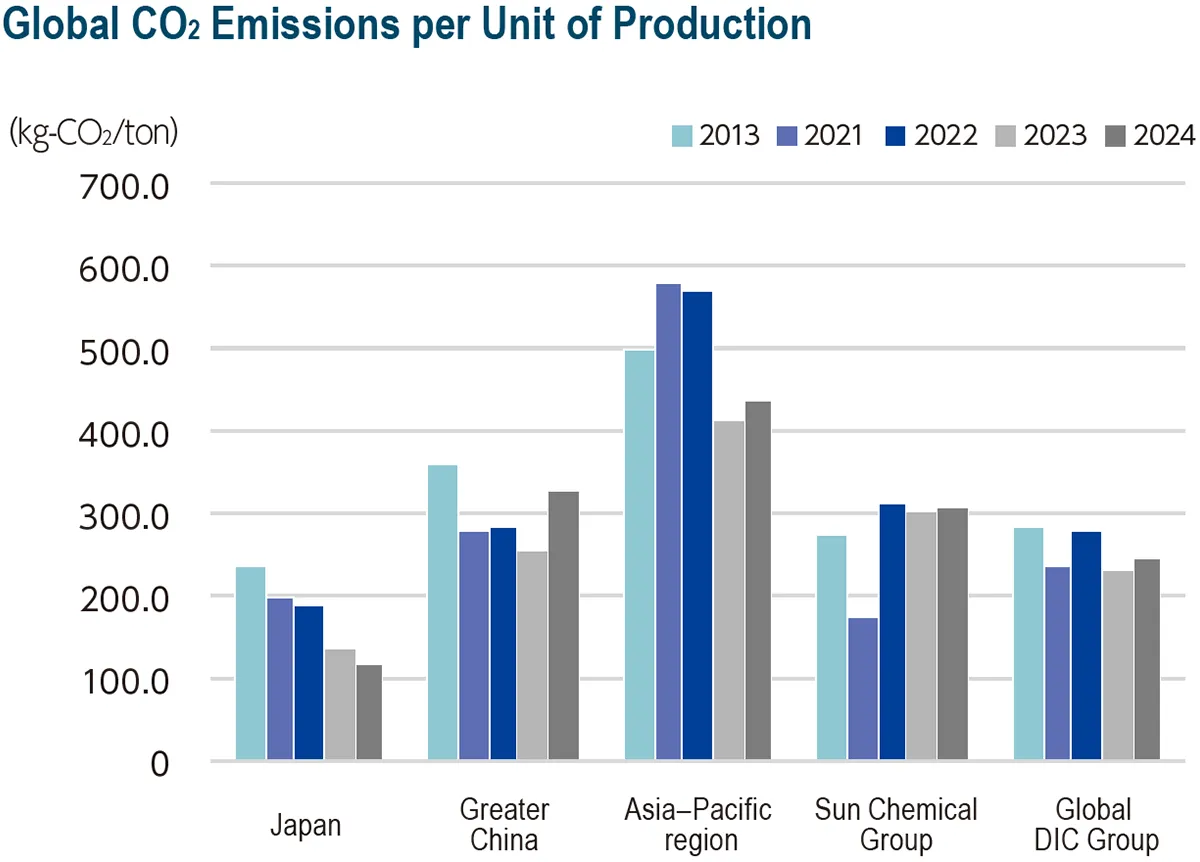

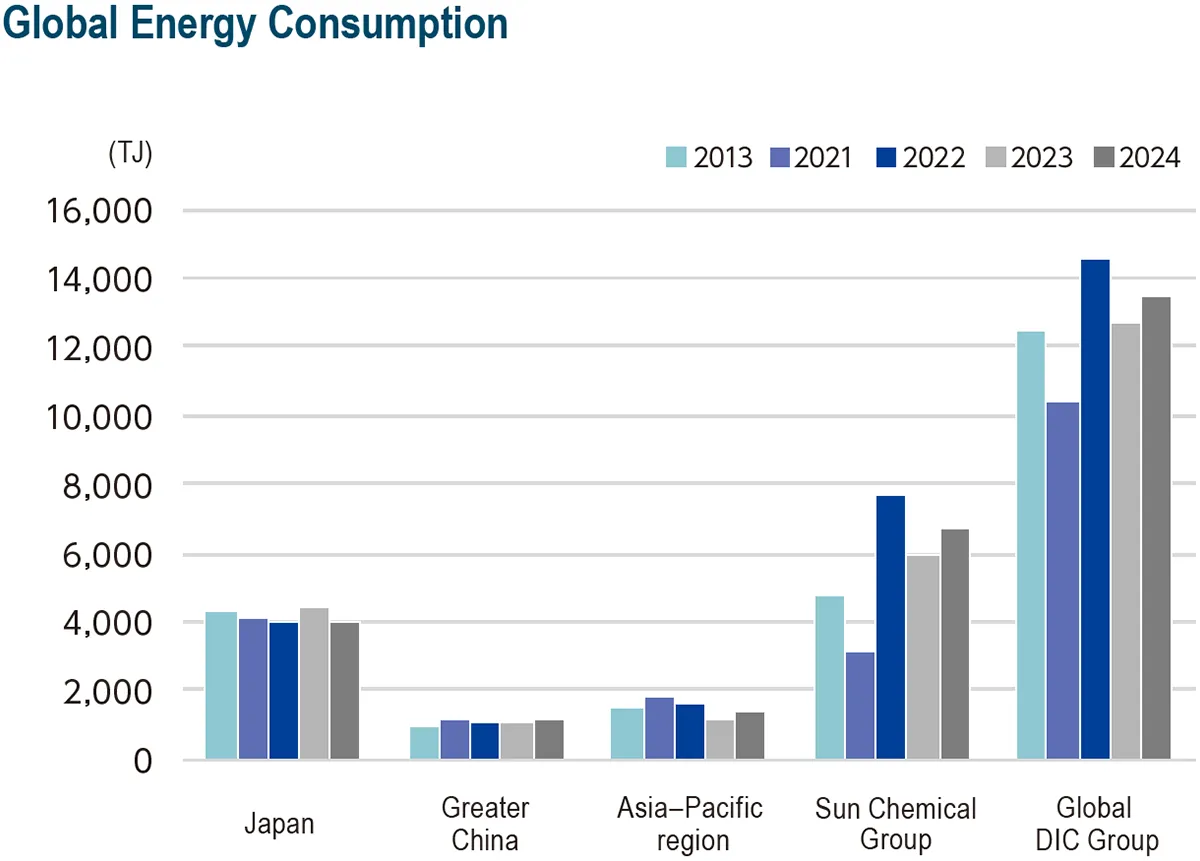

Energy consumption by the global DIC Group in fiscal year 2024 amounted to 13,486 TJ, while CO2 emissions totaled 549,886 tonnes. CO2 emissions per unit of production were 247.6 kg/tonne. The Group achieved its target for reducing CO2 emissions from fiscal year 2023, owing to the continued use of green power at sites in Japan, which helped lower Scope 2 emissions. These results also reflected the promotion of more ambitious energy-saving and decarbonization initiatives, including the adoption of internal carbon pricing.

The DIC Group continues to implement a variety of energy-saving measures, including introducing highly efficient facilities, promoting process improvements and boosting capacity utilization rates, while at the same time further advancing its use of renewable energy by shifting to biomass and other clean fuels and installing solar power generating facilities. Some of these initiatives are outlined below. The Group has obtained third-party verification of its Scope 1 and 2 CO2 emissions.

| Factors | Impact on CO2 emissions (tonnes) | Decrease (%) | ||

|---|---|---|---|---|

DIC Group in Japan |

Shift to green power | -21,494 | -36,417 | 6.8 |

| Energy-saving initiatives at sites | -3,725 | |||

| Divesture of business | -18,162 | |||

| Other factors (including for legal compliance) | 6,964 | |||

DIC Group in other countries and territories |

Asia–Pacific region: Shift to green power | -2,224 | 13,571 | -9.6 |

| Asia–Pacific region: Energy-saving initiatives at sites | -420 | |||

| Asia–Pacific region: Increase in production volume | 9,541 | |||

| Asia–Pacific region: Change in number of sites used in calculation | 8,953 | |||

| Asia–Pacific region: Other factors (including consolidation of sites, divesture of business, other) | -2,279 | |||

| Greater China: Energy-saving initiatives at sites | -2,807 | 1,764 | ||

| Greater China: Increase in production volume | 9,512 | |||

| Greater China: Other factors (including consolidation of sites, divesture of business, other) | -4,941 | |||

| Sun Chemical Group: Increase in production volume | 44,405 | 36,475 | ||

| Sun Chemical Group: Change in number of sites used in calculation | -7,930 | |||

| Other: Decrease in production volume | -1,487 | -395 | ||

| Other: Acquisition of business | 1,092 | |||

| Change in CO2 emissions | 14,997 | -2.8 | ||

| Global CO2 emissions in fiscal year 2023 | 534,889 | |||

| Global CO2 emissions in fiscal year 2024 | 549,886 | |||

Regional Initiatives

Japan

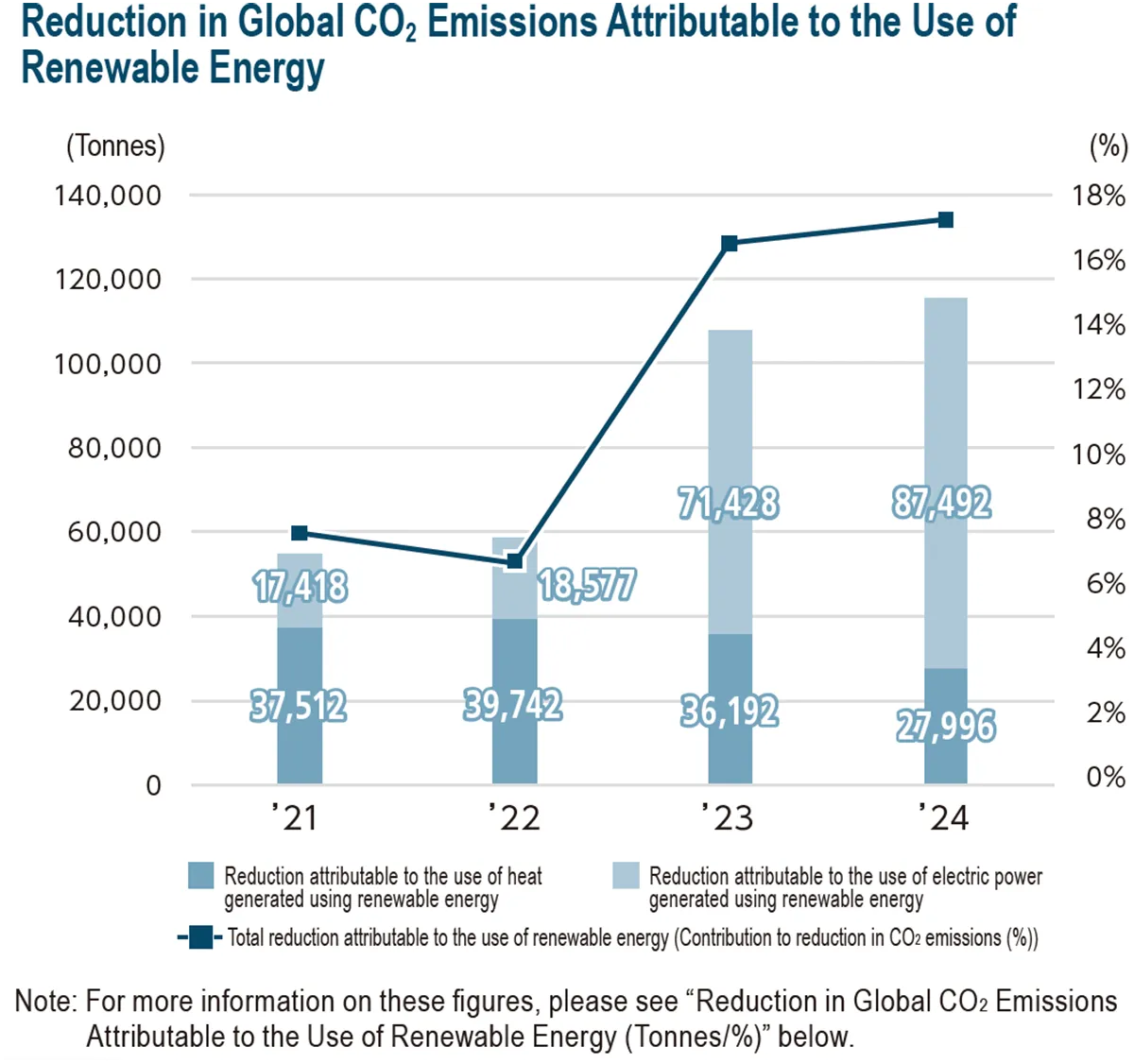

The bulk of renewable energy used by DIC Group companies in Japan is natural energy generated by a biomass boiler, as well as the use of solar power. In fiscal year 2024, the DIC Group in Japan used 414,000 GJ of renewable energy (equivalent to 10,677 kl of crude oil), or 10.3% of total energy (steam and electric power) used by these companies. The use of renewable energy by DIC Group companies in Japan in fiscal year 2024 accounted for a reduction in CO2 emissions of 28,684 tonnes, equivalent to 22.3% of the total reduction achieved by the Group in Japan.

Total energy consumption by the DIC Group’s 15 offices and research sites (excluding the Central Research Laboratories) in Japan in the period under review was on a level with the previous fiscal year. A key factor behind this result was implementation of energy-saving initiatives by these facilities, including replacing aged light fixtures and air conditioning equipment with newer high-efficiency models that comply with the standards set by the Energy Conservation Center, Japan (ECCJ) for its Top Runner program; turning off lights when not needed and implementing mandatory air conditioning temperature settings; and working with facility management to promote diligent measures to reduce energy use. In addition, a year-round no-jacket/no-tie dress code has been instituted since November 2021 under the Work Style Revolution (WSR) 2020 project.

The use of electric power generated using energy from renewable sources at 34 sites had a significant positive impact on CO2 emissions by the DIC Group, which were down 107,738 tonnes, or 26.7%, from fiscal year 2023. Looking ahead, the Group will continue taking decisive steps to achieve the new medium- to longterm targets for reducing CO2 emissions goals of DIC NET ZERO 2050.

Asia–Pacific Region and Greater China

The installation of solar power generating facilities at DIC Compounds (Malaysia) Sdn. Bhd., DIC Siam Chemical Industry Co., Ltd., in Thailand, and DIC Synthetic Resins (Zhongshan) Co., Ltd., in the PRC, contributed significantly to reducing CO2 emissions attributable to production.

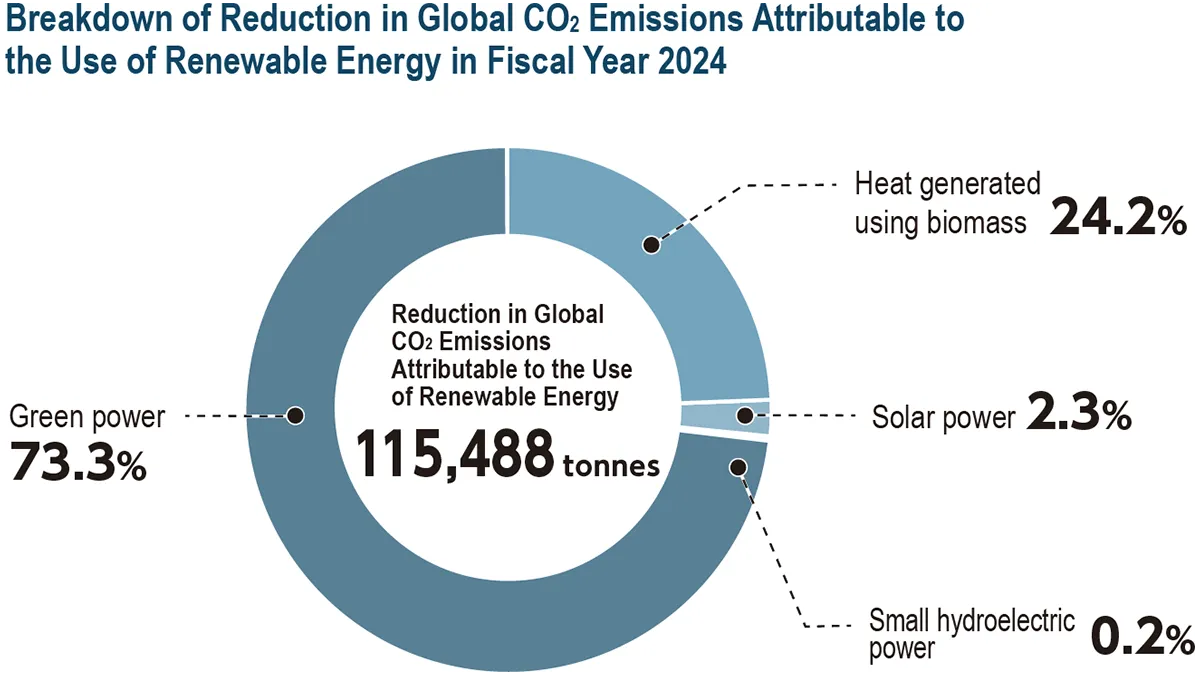

Reduction in Global CO2 Emissions Attributable to the Use of Renewable Energy

| Unit | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|

| Reduction attributable to the use of heat generated using renewable energy (biomass) | t-CO2 | 37,512 | 39,742 | 36,192 | 27,996 |

| Reduction attributable to the use of electric power generated using renewable energy (power generated on-site) | t-CO2 | 17,418 | 12,568 | 6,874 | 2,855 |

| Reduction attributable to the use of electric power generated using renewable energy (green power) | t-CO2 | 0 | 6,009 | 64,554 | 84,637 |

| Total reduction attributable to the use of renewable energy | t-CO2 | 54,929 | 58,319 | 107,620 | 115,488 |

| CO2 emissions by the global DIC Group | t-CO2 | 588,985 | 720,444 | 534,889 | 549,886 |

| Total reduction attributable to the use of renewable energy + CO2 emissions by the global DIC Group | t-CO2 | 643,914 | 778,763 | 642,509 | 665,374 |

| Total reduction attributable to the use of renewable energy (%) | % | 8.50% | 7.50% | 16.70% | 17.40% |

| Reduction attributable to the use of electric power generated using renewable energy (biomass) | t-CO2 | 6,542 | 7,277 | 1,100 | 0 |

| Reduction attributable to the use of solar power | t-CO2 | 8,054 | 2,320 | 3,072 | 2,645 |

| Reduction attributable to the use of wind power | t-CO2 | 2,451 | 2,683 | 928 | 0 |

| Reduction attributable to the use of small hydroelectric power | t-CO2 | 371 | 288 | 1,774 | 210 |

| Reduction attributable to the use of electric power generated using renewable energy (power generated on-site) | t-CO2 | 17,418 | 12,568 | 6,874 | 2,855 |

02Grasping Greenhouse Gas Emissions Across the DIC Group’s Supply Chains (Scope 3)

The DIC Group recognizes the importance of reducing emissions of CO2 across its supply chains and is actively engaged in measuring and reducing emissions in all relevant categories of Scope 3. In fiscal year 2024, the Group revised calculations used for emissions in all categories. Owing to, among others, a change in the basis used for calculating emissions attributable to purchased goods and services from purchase price to actual data and a change to the scope of calculations, the Group’s Scope 3 emissions were approximately 30% higher than would have been the case using the previous calculation, which the Group believes is more accurate.

| Category number | Category | Emissions (t-CO2) |

|---|---|---|

| 1 | Purchased goods and services | 6,428,219 |

| 2 | Capital goods | 161,103 |

| 3 | Fuel- and energy-related activities (not included in Scope 1 or 2) | 146,833 |

| 4 | Upstream transportation and distribution | 301,079 |

| 5 | Waste generated in operations | 111,666 |

| 6 | Business travel | 8,027 |

| 7 | Employee commuting | 42,948 |

| 10 | Processing of sold products | 192,640 |

| 12 | End-of-life treatment of sold products | 1,598,880 |

| 15 | Investments | 80,012 |

- Categories 8, 9, 11, 13, and 14 have been excluded from our Scope 3 calculation, as their impact is considered immaterial and less relevant in the context of our operations.

Procurement Initiatives

DIC formulated and promotes awareness of the DIC Group Sustainable Procurement Guidelines, encouraging suppliers to reduce their emissions of greenhouse gases. The Group also surveys suppliers to assess the status of their emissions reduction efforts and their reduction targets, and to enhance understanding. With the objective of better grasping and lowering the carbon footprint of DIC products, the Group is also making provisional calculations at the raw materials level, as well as expanding its exploration of the use of bioderived and recycled raw materials. (For more information, please see “Initiatives to Reduce the Environmental Impact of Raw Materials” in “Sustainable Procurement” on page 98.)

Logistics Initiatives

DIC investigated the use of a calculation service to gain a clearer understanding of CO2 emissions from logistics at DIC Group companies in Japan, the Asia– Pacific region and Greater China. Use of this service is now scheduled to commence in fiscal year 2025.

In Japan, the Company participates in the Physical Internet Realization Council’s Chemicals Working Group* and is exploring joint logistics to improve loading efficiency and reduce the number of trucks used. Sun Chemical continues working to reduce its CO2 emissions through a variety of logistics initiatives. These include, but are not limited to, using aggregate shipment, optimizing shipping practices and improving shipping efficiency. Specific projects include those targeting reducing the overall number of shipments, migrating from small to larger shipments and reducing rush shipments by managing delivery dates. Such projects have helped the company lower its CO2 emissions.

- In logistics, a physical internet is a logistics model that applies concepts from internet communications to shipping processes, using digital technology to enable the joint transport of standardized cargo across multiple logistics networks. The Physical Internet Realization Council’s Chemicals Working Group was established in July 2023 by Japan’s Ministry of Economy, Trade and Industry and Ministry of Land, Infrastructure, Transport and Tourism with the goal of building a physical internet for the chemicals industry.

Calculating Product Carbon Footprint

To achieve carbon neutrality, it is crucial to reduce CO2 emissions across the supply chain. To this end, it is necessary to calculate and reduce the CO2 emissions of each DIC Group company and product. The DIC Group has formulated unified guidelines for calculating product carbon footprint based on information from, among others, European nonprofit Together for Sustainability (TfS) and the International Organization for Standardization’s ISO 14067:2018 standard, in line with which it is currently calculating the carbon footprint of its products. In fiscal year 2024, the Group received requests for product carbon footprint calculations for 12,871 products (DIC: 621 and Sun Chemical: 12,250), which it provided to customers in order of receipt. Beginning in fiscal year 2025, DIC and Sun Chemical will calculate product carbon footprint using aligned CO2 emissions factors for raw materials. To address ever-increasing demand for product carbon footprint calculations, the Group will continue exploring ways to speed up this process, including by automating procedures.

Avoided Emissions

The term “avoided emissions” refers to greenhouse gas emissions that can be avoided through the use of a product. Examples include products that contribute to improving fuel efficiency by reducing vehicle body weight and products that help reduce energy used for heating and cooling by improving insulation. In recent years, avoided emissions have attracted attention as a way to envisage the positive impact of corporate activities on climate change. While there remains room for improvement in terms of the precision of calculation methods and the reliability of calculations, DIC is promoting the use of avoided emissions as a way for it to clarify its contributions to decarbonization across its supply chain.

Innovation

The DIC Group supplies polystyrene, the principal raw material for foamed food trays. White trays are recycled into new food trays using material recycling, but colored and/or patterned trays have traditionally been recycled into materials for clothes hangers and other household items because the pellets yielded when the trays are pulverized are black. Leveraging technologies and resin design expertise cultivated in the printing inks business, the Group succeeded in developing a new dissolution and separation technology (a deinking chemical process)*1. This technology transforms black pellets from colored and/or patterned trays into clear pellets. In November 2024, the Group commenced the recycling of such trays at its Yokkaichi Plant. The Company is working with FP Corporation (FPCO), Japan’s largest manufacturer of food containers, to establish a system that enables DIC to supply approximately 10,000 tonnes of recycled polystyrene from postconsumer colored and/or patterned foamed food trays collected by FPCO. DIC is also conducting R&D into the chemical recycling*2 of colored and/or patterned foamed food trays into polystyrene pellets. The objective is to realize a hybrid recycling system that combines material and chemical recycling, thereby contributing further to sustainability for society.

- This technology dissolves the black polystyrene pellets, separates out colored components and reconstitutes the remainder into clear pellets.

- Chemical recycling is the process of converting waste chemicals and waste products into chemical raw materials by chemically decomposing them and turning them back into chemical raw materials.

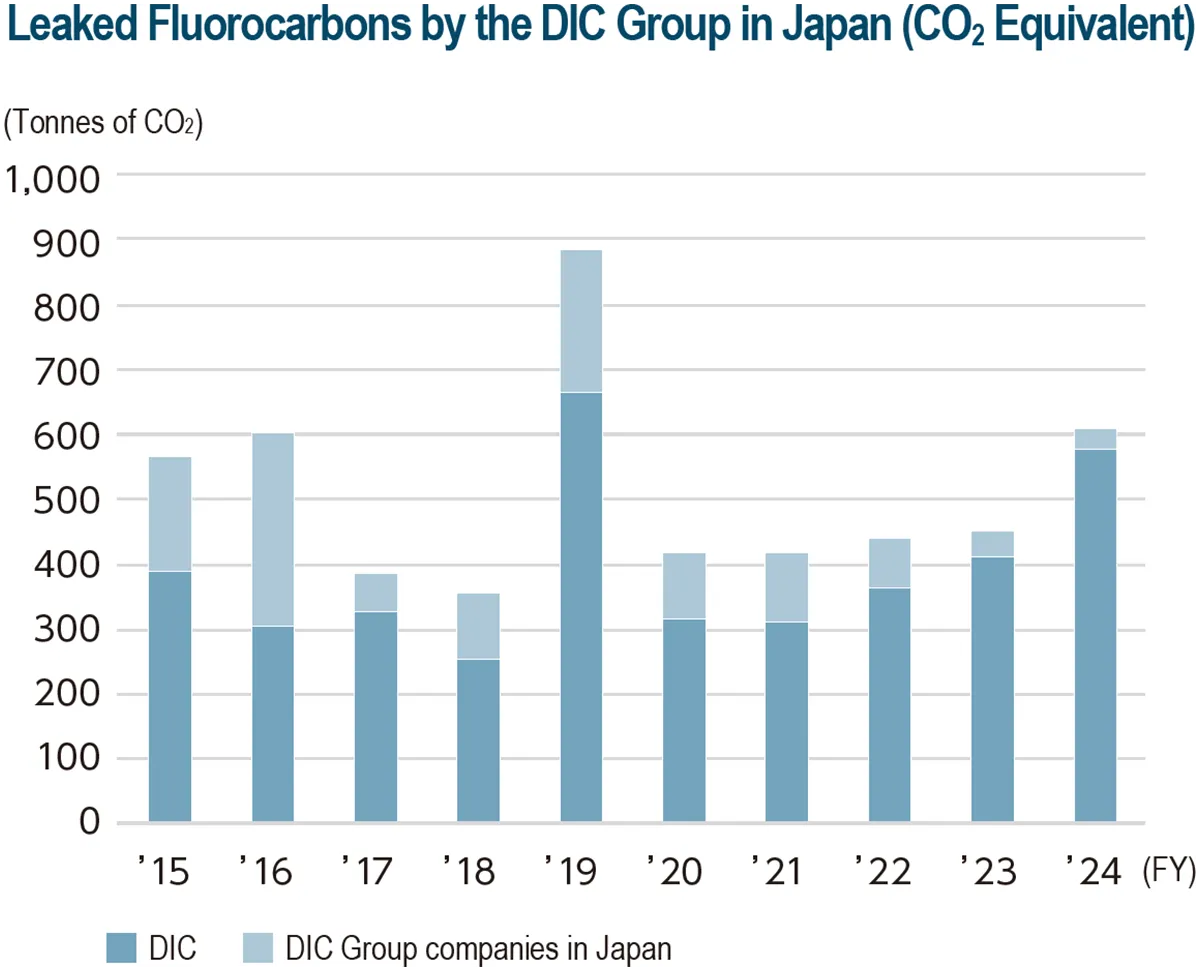

Protecting the Ozone Layer

Hydrofluorocarbons (HFCs) are used widely as refrigerants in equipment and facilities. While not an ozone-depleting substance, HFCs have a warming potential 100–10,000 times that of CO2 and their use is expected to account for an increase in the global average temperature of approximately 0.5°C by the end of the 21st century. In April 2015, Japan revised its Fluorocarbons Recovery and Destruction Law. The same month, the Act on Rational Use and Proper Management of Fluorocarbons entered into force, compelling stakeholders to ascertain and report leaks of fluorocarbons from commercial equipment and facilities. In April 2020, a revised version of the Act on Rational Use and Proper Management of Fluorocarbons came into effect, introducing direct penalties for violations in instances where fluorocarbons are not recovered by users.

In fiscal year 2024, leaked fluorocarbons from DIC sites in Japan were equivalent to 568 tonnes of CO2. (Leaks in excess of 1,000 tonnes per site or per company must be reported to the Japanese authorities.) The Company has worked to effectively manage fluorocarbons since fiscal year 2015, when the Act on Rational Use and Proper Management of Fluorocarbons entered into force, and has managed to keep leaks below the level requiring reporting. In fiscal year 2024, the Group’s efforts to promote understanding of and ensure compliance with laws governing leaked fluorocarbons, calculation of emissions, inspections and disclosure of related information, among others, were recognized in the Japan Refrigerant and Environmental Organization’s fourth JRECO Fluorocarbon Rating. DIC has earned an A rank every year since this program began.

Going forward, the DIC Group will continue working to ensure compliance with pertinent laws and regulations, as well as to reduce leaked fluorocarbons from its sites by, among others, choosing air conditioning equipment with low environmental impact refrigerants, including those containing no fluorocarbons.

Environmental Education

DIC promotes a variety of environmental education initiatives. In May and June 2025, the Company provided an e-learning program for employees at sites in Japan aimed at raising awareness of facts and issues surrounding climate change. More than 80% of eligible employees participated in this program. Over 70% of Sun Chemical employees have taken part in environmental training programs between fiscal years 2018 and 2023. In total, more than 55% of DIC Group employees worldwide have participated in environmental education programs over the past six years. Going forward, DIC will continue working to improve the content and expand the scope of its environmental education initiatives.

Key Data

| Category | Unit | Boundary | Fiscal year 2019 | Fiscal year 2020 | Fiscal year 2021 | Fiscal year 2022 | Fiscal year 2023 | Fiscal year 2024 |

|---|---|---|---|---|---|---|---|---|

| Energy consumption | TJ | Japan | 4,184 | 3,827 | 4183 | 4,028 | 4,447 | 4,004 |

| PRC | 1,056 | 1,036 | 1197 | 1,066 | 1,110 | 1,168 | ||

| Asia–Pacific region | 1,623 | 1,606 | 1835 | 1,650 | 1,178 | 1,441 | ||

| Sun Chemical | 3,784 | 3,791 | 3196 | 7,767 | 6,017 | 6,805 | ||

| Other | 69 | 118 | 63 | 58 | 48 | 67 | ||

| Global | 10,717 | 10,379 | 10474 | 14,569 | 12,800 | 13,486 | ||

| Recycled energy consumption | TJ | Japan | 519 | 687 | 703 | 742 | 1,875 | 2,123 |

| PRC | 19 | 19 | 19 | 18 | 16 | 5 | ||

| Asia–Pacific region | 59 | 18 | 18 | 33 | 48 | 71 | ||

| Sun Chemical | 54 | 58 | 56 | 50 | 36 | 84 | ||

| Other | 0 | 0 | 0 | 0 | 0 | 0 | ||

| Global | 651 | 782 | 796 | 843 | 1,975 | 2,283 | ||

| Energy consumption per unit of production | GJ/tonne | Japan | 3.706 | 3.733 | 4 | 3.687 | 4.391 | 4.608 |

| PRC | 5.574 | 5.698 | 5 | 4.881 | 3.914 | 5.162 | ||

| Asia–Pacific region | 6.81 | 7.151 | 7 | 7.331 | 5.825 | 6.456 | ||

| Sun Chemical | 4.371 | 4.705 | 4 | 7.603 | 7.557 | 7.54 | ||

| Other | 133.44 | 3.03 | 108 | 110.776 | 102.07 | 313.569 | ||

| Global | 4.423 | 4.559 | 4 | 5.695 | 5.577 | 6.071 | ||

| CO2 emissions | Tonnes | Japan | 232,028 | 209,018 | 224916 | 208,231 | 136,412 | 99,995 |

| PRC | 63,000 | 60,163 | 70342 | 62,457 | 71,998 | 73,762 | ||

| Asia–Pacific region | 122,812 | 123,227 | 144107 | 127,851 | 83,583 | 97,153 | ||

| Sun Chemical | 173,146 | 153,374 | 147553 | 319,946 | 241,182 | 277,656 | ||

| Other | 2,107 | 5,267 | 2068 | 1,958 | 1,715 | 1,320 | ||

| Global | 593,093 | 551,049 | 588985 | 720,444 | 534,889 | 549,886 | ||

| CO2 emissions (Scope 1) | Tonnes | Japan | 135,428 | 118,786 | 135612 | 128,458 | 112,591 | 97,445 |

| PRC | 14,004 | 13,098 | 15287 | 14,635 | 22,896 | 24,629 | ||

| Asia–Pacific region | 66,199 | 69,597 | 88575 | 76,127 | 44,028 | 49,060 | ||

| Sun Chemical | 53,780 | 50,283 | 51503 | 121,361 | 97,600 | 111,226 | ||

| Other | 1,236 | 1,299 | 1085 | 1,029 | 944 | 495 | ||

| Global | 270,647 | 253,064 | 292063 | 341,610 | 278,059 | 282,856 | ||

| CO2 emissions (Scope 2) | Tonnes | Japan | 96,600 | 90,231 | 89304 | 79,773 | 23,821 | 2,549 |

| PRC | 48,996 | 47,065 | 55054 | 47,822 | 49,102 | 49,133 | ||

| Asia–Pacific region | 56,613 | 53,630 | 55531 | 51,725 | 39,555 | 48,094 | ||

| Sun Chemical | 119,366 | 103,091 | 96050 | 198,585 | 143,582 | 166,430 | ||

| Other | 871 | 3,967 | 982 | 929 | 771 | 824 | ||

| Global | 322,446 | 297,986 | 296922 | 378,834 | 256,830 | 267,030 | ||

| CO2 emissions per unit of production | kg/tonne | Japan | 206 | 204 | 197 | 191 | 135 | 115 |

| PRC | 332 | 331 | 279 | 286 | 254 | 326 | ||

| Asia–Pacific region | 515 | 549 | 580 | 568 | 413 | 435 | ||

| Sun Chemical | 200 | 190 | 173 | 313 | 303 | 308 | ||

| Other | 4,053 | 135 | 3579 | 3,731 | 3,616 | 6,151 | ||

| Global | 245 | 242 | 236 | 282 | 233 | 248 |

-

Notes:

- The Colors & Effects pigments business is included in data from fiscal year 2022.

- Non-fossil fuels and renewable energy are included in energy from fiscal year 2023.

- Owing to rounding, some totals may differ from sums achieved by adding individual figures.

Back number

- Principal Initiatives in Fiscal Year 2023

- Principal Initiatives in Fiscal Year 2022

- Principal Initiatives in Fiscal Year 2021

- Principal Initiatives in Fiscal Year 2020

- Principal Initiatives in Fiscal Year 2019

- Principal Initiatives in Fiscal Year 2018

- Principal Initiatives in Fiscal Year 2017

- Principal Initiatives in Fiscal Year 2016

- Principal Initiatives in Fiscal Year 2015

- Principal Initiatives in Fiscal Year 2014

- Principal Initiatives in Fiscal Year 2013