With Shareholders and Investors

Ties with Shareholders and Investors

Policy Regarding Constructive Dialogue with Shareholders

The DIC Group promotes constructive dialogue with shareholders to underpin sustainable growth and increase corporate value over the medium to long term. Views and concerns expressed by shareholders are shared with management and incorporated into operations as appropriate.

Key Individuals Responsible for Dialogue with Shareholders and Investors

The president, vice president, CFO, head of the Corporate Strategy Unit, head of the General Affairs and Legal Unit, outside directors and individual in charge of investor relations (IR) are responsible for advancing ties with shareholders.

Activities and Status of Implementation

| Results presentations | Four sessions | The president participated in the second- and fourth-quarter results presentations. |

| Small-group meetings | Four sessions | Two sessions were conducted by the president. One session was conducted by outside directors. One session was conducted by the general manager of the Corporate Communications Department. |

| One-on-one meetings | 162 | 36 meetings were conducted by the management team. |

| Individual investor briefings | Placement of interview with president in IR and business journals, posting of a corporate presentation video and an interview with the president on DIC’s global website | |

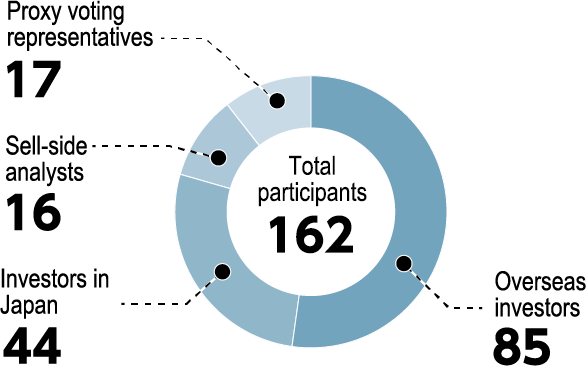

Breakdown of Participants in One-on-One Meetings with Shareholders and Investors

Status of Feedback to Management and the Board of Directors in Fiscal Year 2024

- The content of constructive dialogue with shareholders and investors was reported to the Board of Directors twice during the period.

- The content of dialogue with shareholders and investors was reported to management monthly.

Principal Themes of Dialogue and Feedback to Management and the Board of Directors

| Principal themes of dialogue/matters of concern expressed | Examples of actions taken in response |

|

|

Related link