A Message from the President

Reflecting on the DIC111 Medium-Term Management Plan

■Aiming for Sustainable Growth by strengthening profitable businesses and building on success

Between fiscal 2019 years and 2021, the DIC Group promoted our DIC111 Medium-Term Management Plan. In line with the plan’s basic concept, which was to evolve as a unique global company that is trusted by providing value, i.e., safety and peace of mind, color and comfort, in fiscal year 2021 we continued promoting initiatives in line with two basic strategies—Value Transformation, which focused on advancing qualitative reforms in existing businesses, and New Pillar Creation, which sought to create new businesses that respond to environmental, social and health (ESH)-related issues and social changes—with the aim of achieving the ambitious targets set for the period, namely, consolidated net sales of ¥950 billion and operating income of ¥70 billion.

Amid growing U.S.–China trade friction, the prolomged COVID-19 pandemic and a series of supply chain disruptions, we experienced sluggish sales and fell significantly short of forecasts. However, despite major global trade disruptions, we steadily promoted our two basic strategies and achieved measurable gains.

In a major achievement, we instantly established a leading position in organic and inorganic pigments globally by acquiring the Colors & Effects pigments business , now called the Colors & Effects Group, from BASF SE of Germany,. We are also keeping pace with rapidly accelerating digitalization. Moreover, we managed to capture 5G-related demand by developing low-dielectric materials that enable high-speed communications.

In addition to adding economic value, we accelerated efforts to shift the focus of our printing inks business to packaging inks, which deliver outstanding social value, contributing to greater sustainability amid growing awareness of climate change and a circular economy. We continue to steadily advance Value Transformation in our existing businesses, with packaging inks already contributing some 80% of printing inks sales. Among our new businesses, we are announcing new products in each of the four priority areas (electronics, automotive, next-generation packaging and healthcare), and we can already see a clear path toward our goal of New Pillar Creation.

While we have delivered a level of results under our basic strategy, to make up for any gaps in sales or profit plans, we must continue to tackle challenges in four remaining areas: (1) Further clarify our business portfolio, while achieving sustainable growth via portfolio transformation, (2) develop synergies in the early stage of acquisitions, including the growth-driving Colors & Effects pigment business acquisition, to further improve our performance, (3) establish new businesses as new business pillars by promoting more key investments and acquisitions, and (4) promote further structural reforms for greater efficiency and business conversion in the shrinking publishing and news inks business, as well as the struggling thinfilm transistor (TFT LC) business—which is now experiencing intense competition.

DIC Vision 2030 Long-Term Management Plan (Fiscal years 2022–2030)

■Our Redefined Vision statement: Enhancing Corporate Value by Maximizing Our Social Significance

The global climate crisis has clarified our social goals for the next 10 years. Given the introduction of the United Nations’(UN’s) Sustainable Development Goals (SDGs), to be achived by 2030, and from the perspective of achieving carbon neutrality by 2050, the world is making great strides toward devising a global solution aimed at realizing sustainability.

Moreover, COVID-19 has drastically changed people's behavioral patterns: People are more proactive about the “new normal” and the transition to a digital society, including remote work and digital marketing. Unless we take appropriate measures, a failure to adapt to this new normal will affect our competitiveness. In the face of this paradigm shift, our typical three-year management plan inevitably felt shortsighted. Thus, I made the decision to shift to a long-term management plan.

What is the proper long-term perspective for a large company like ours? We considered what maximizes our social significance beyond merely maximizing profits, and based our evaluation on the recognition that taking a long-term perspective and improving corporate value favors overall shareholder value. In other words, we see social interests as inclusive of shareholder value.

Moving forward, we shall find our purpose in leveraging our company’s unique attributes (our raison d'être) to maximize our social significance, and continuously promote purpose-driven management by recognizing this as our mission, sharing our purpose with all of our many stakeholders, beginning with our employees. Accordinary, we have revised our vision statement.

Based on our evolved Color & Comfort value proposition, we’ve refined our vision statement as follows:

We have evolved our Color & Comfort value proposition to provide a wide range of value beyond chemistry, securing a brighter future for the planet and humanity. We devised a new long-term management plan, DIC Vision 2030, with a basic policy of pursuing social benefits that include shareholder interests, striving to enhance long-term corporate value and leveraging our evolved Color & Comfort value proposition.

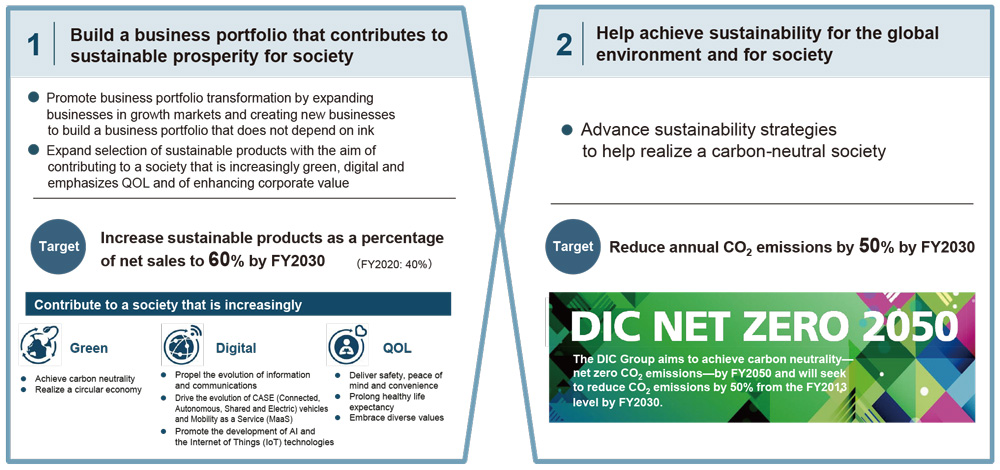

■The DIC Group in 2030

In DIC Vison 2030, we sets our sights on building a business portfolio that contributes to sustainable prosperity while also helping to the realize of sustainability for the global environment and for society. Moreover, to increase the sustainable products as a percentage of net sales from the current 40% to 60% by 2030 and to achieve carbon neutrality by 2050 (“DIC NET ZERO 2050”), we have set a goal to reduce annual CO₂ emissions by 50% from the fiscal year 2013 level by fiscal year2030” (figure 1).

Figure 1: DIC Vision 2030 Targets

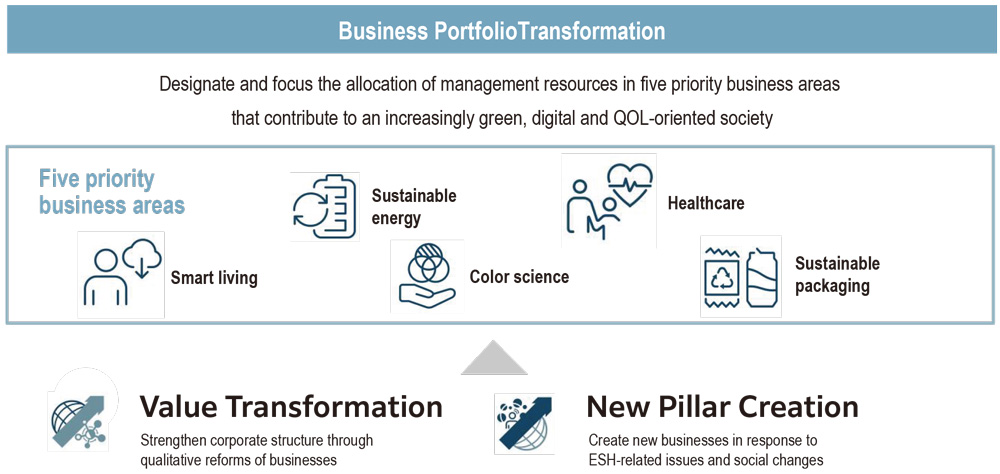

Addressing our business portfolio, we will seek to avoid an overreliance on our traditional ink products, building a diversified portfolio by more actively allocating management resources to five newly established priority business areas to further increase social value. Moreover, we will work to expand our delivery of uniguely DIC sustainable products, with the aim of contributing to a society green, that is increasingly digital, and quality of Life (QOL).

We created two phases; Phase one, the first four years, will be a foundation building period, in which management will emphasize investment efficiency and earning power using return on invested capital (ROIC) as a metric. and promote business the portfolio transformation that began under the previous management plan. Phase two, the next five years, will be a period of realizing our goal of increasing the weighting of sustainable products that help assress social imperatives (figure 2).

Figure 2: Numerical Plan

■Basic Strategy for Achieving Our Targets

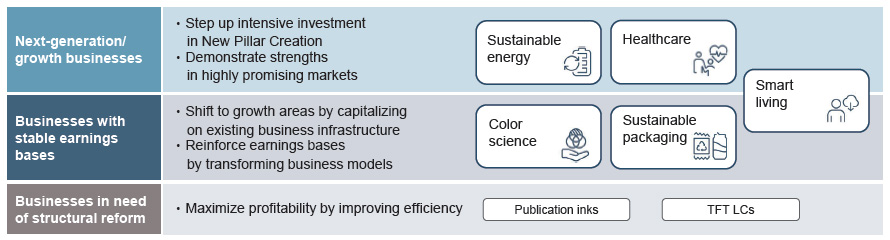

Business Portfolio Transformation: Five Priority Business Areas

We have established five priority business areas for promoting business portfolio transformation, maximizing our impacts on market growth and society: Sustainable energy, healthcare, smart living, color science, and sustainable Packaging. We have determined that these are five business areas offerin us the greatest opportunities to help address social imperatives by leveraging the DIC Group’s strengths.

By concentrating management resources in these five areas, we will enhance promote the efficiency of efforts to promote Value Transformation and New Pillar Creation. Notably, in sustainable energy and healthcare, we will leverage DIC Group strengths to deliver products such as materials for high-capacity, long-life next-generation secondary batteries and high-performance nutritional products made with naturally derived materials, investing to grow these into new business pillars.

In smart living, color science and sustainable packaging, we will continue expanding our business and maximizing synergies through mergers and acquisitions (M&As). In this plan, we have positioned mature markets businesses such as publication inks and TFT LCs for structural reform, and we plan to continue optimizing business operations through rightsizing while closely monitoring market conditions (figure 3).

Figure 3: Five Priority Business Areas

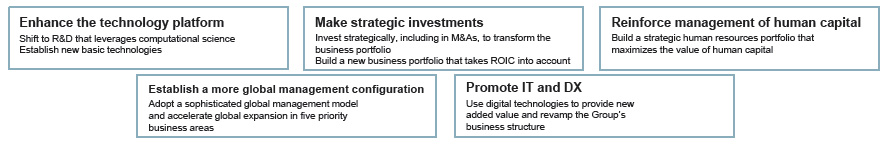

Business Portfolio Transformation: Five Measures to Support Transformation

In addition to concentrating management resources on five priority business areas, we have also developed five vital strategies crucial to business portfolio transformation (figure 4).

Figure 4: Five Measures

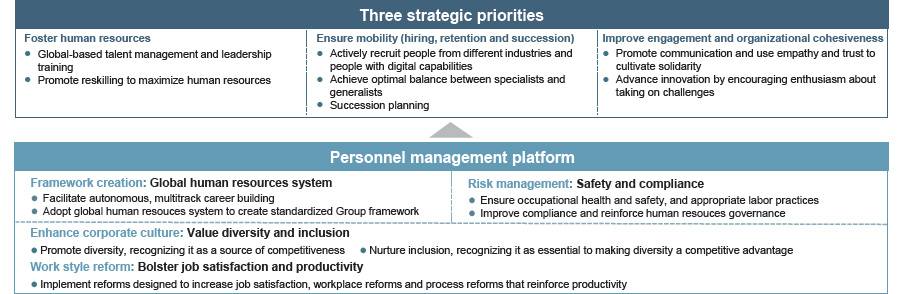

Strengthening human capital management is one of the most vital of these strategies. We need all DIC Group members to share our “corporate purpose” to truly become a Group pursuing social value. To that end, we must invest in a global human resources system that helps our members maximize their value. As 74% of all DIC Group employees (as of December 31, 2021) work for affiliates based outside Japan, the DIC Group is truly a global organization. And as our diversity is a major source of our competitiveness, we must continue to promote human resources development, actively acquiring talent from external sources while increasing meaningful roles fir employees across the Group, regardless of a member’s nationality or gender. Moreover, with an eye toward a post-COVID-19 world, we must also improve member motivation, promote workplace reforms through digitalization and enhance productivity through process reforms. Moving forward, we must focus on promoting internal communications, both within and outside Japan, fostering a sense of unity through empathy and trust, and advancing innovation by encouraging enthusiasm about taking on challenges (figure 5).

Figure 5: Reinforcing Human Capital Management

DIC is currently promoting work style reform through the Work Style Revolution 2020 (WSR2020) committee, which I am chairing myself. This initiative seeks to promote behavioral changes by reviewing and radically changing the work style of every employee. We believe that senior management must work together with employees at all levels to effectively transform our organization together, creating an ideal environment where all members can work effectively with a sense of challenge, supporting mutual growth and unbound by archaic customs or implicit rules. We seek to transform our culture to create an environment where all people can interact freely and feel happy that they I joined DIC.

We will conduct internal research to measure how employee awareness and behavior changes, and determine necessary course corrections, while maintaining open dialogue with employees to facilitate flexible responses. Using the opportunity created by the Color & Effects pigments business acquisition, we are strengthening our global management structure by promoting the global exchange of human resources and information. For example, we made the president of Sun Chemical Corporation—our controlling entity in Europe and the U.S.—an executive officer at DIC Corporation—our global headquarters—so we can be involved in reforms not only in the Americas and Europe, but also across the entire global DIC Group. Moving forward, we will continue increasing opportunities for Japanese and non-Japanese employees to work together and progress on the same career tracks in various departments within DIC.

For strategic investments, we have budgeted ¥230 billion for strategic investments between fiscal year 2022 and fiscal year 2025 growing the Company, transforming our business portfolio and launching new businesses. This encompasses M&As aimed at acquiring new technologies and businesses, as well as capital investments for launching new products. For example, we make a wide range of investments in sustainable energy—which we’ll seek to cultivate as a new business pillar—and the five priority business areas, particularly smart living. We promptly respond to changes in the environment and determine investment targets.

Beside strategic investments, we have planned total investments of ¥70 billion, including in green electricity, to reduce CO₂ emissions, enhance our technology platform, and promote IT digitalization. For our technology platforms, we will shift to research and development utilizing AI and materials informatics (MI)* while expanding design technology for inorganic materials and biomaterials acquired in the Color & Effects pigments business acquisition and joint developments with venture capital firms. We’ll also strengthen and accelerate our development of new technologies and new products.

*MI: Efforts to improve technological development efficiency using informatics (information science) and methods that utilize statistical analysis, etc.

Our Sustainability Strategy

Our sustainability strategy seeks to demonstrate our strengths by providing sustainable products that contribute to a society that is increasingly green, digital and QOL-oriented, defining “sustainable products” using a proprietary sustainability index that balances social contributions and environmental impact reductions, as we seek to increase our sustainable products from 40% to 60% by fiscal year 2030. By providing new products as a percentage of net sales, such as inks and pigments using biomaterials as raw materials, low-dielectric materials compatible with high-capacity, high-speed communications, such as 5G and 6G, and natural materials that support safe, secure and convenient living, we believe we can provide a wide range of value beyond traditional chemistry.

Moreover, we have been promoting DIC NET ZERO 2050 since 2021. Through initiatives aimed at reducing Scope 1 and Scope 2 emissions, such as promoting the green electrification of production equipment, we aim to reduce annual CO₂ emissions by 50% from the fiscal year 2013 levels by fiscal year 2030. Furthermore, by further reducing carbon contributions across the value chain, including Scope 3—for example, by promoting recycling the use of and the use of biomaterials—we aim to achieve carbon neutrality by 2050.

Promoting Sustainable Prosperity

The DIC Group’s acquisition of the Color & Effects pigments business in fiscal year 2021 has attracted more diverse human resources, strengthening our global network. We anticipate a significant increase in net sales in fiscal year 2022 as we resolve logistics issues that emerged upon closing the acquisition, expanding business activities with an eye toward the post- COVID-19 world. Conversely, earnings remain uncertain due to the fluid situation amid ongoing geopolitical unrest and the accompanying rise in energy prices.

Given current circumstances, to realize our revised vision statement and DIC Vision 2030 long-term management plan, we must share our corporate purpose with stakeholders, promoting it among all DIC Group employees. It is especially vital that we all internalize this approach on a personal level. Since announcing DIC Vision 2030, senior management, including yours truly, has commenced visits to our domestic facilities to discuss our renewed purpose and its significance, enhancing understanding among all employees. Moving forward, as conditions allow, I also hope to visit sites outside Japan as well. Senior management must create a common understanding through direct dialogue with all employees, engaging in frank discussions to realize our plans.

The DIC Group shall strive to maximize Group profits as well as our social significance, to secure a brighter future for the planet and humanity as expressed in our revised Vision. Recognizing the preciousness of peace, and how the Group can contribute to the world, we must work with stakeholders to deliver sustainable prosperity and promote DIC’s evolution as a unique and trusted global company.

Related Link