Long-Term Management Plan

Notice Regarding the Formulation of DIC Vision 2030 Phase 2

1. Basic policy of Phase 2

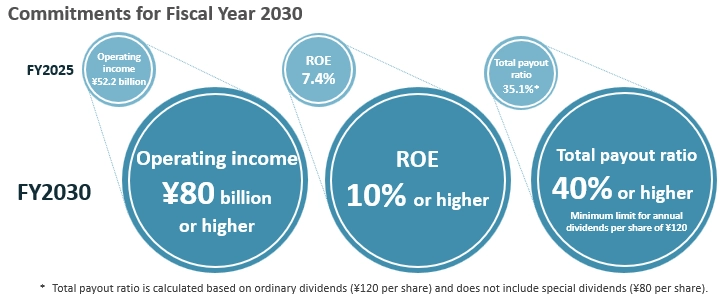

- DIC Vision 2030 positions, Phase 1 (fiscal years 2022–2025) as a period for is foundation building and Phase 2 (fiscal years 2026–2030) as a period for realizing DIC’s Vision for itself.

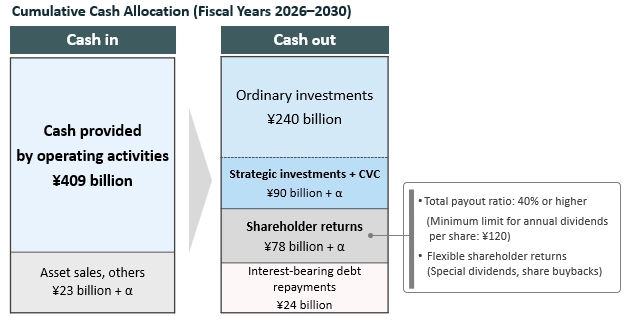

- During Phase 2, the company will take further steps to ensure the achievement of its targets for fiscal year 2030, with an emphasis on building a business portfolio that delivers sustainable growth and profitability, and on bolstering corporate value by improving capital efficiency and enhancing shareholder returns.

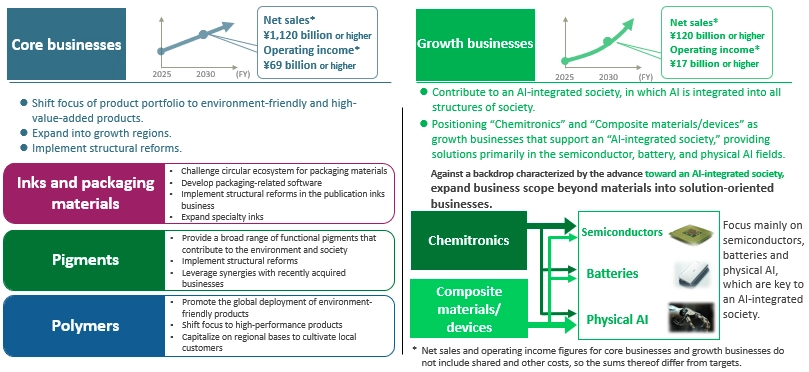

2. Target business portfolio

- DIC aims to achieve steady business expansion by enhancing the profitability of its core businesses through structural reforms and the transformation of its product portfolio, while at the same time focusing its allocation of resources on growth businesses.

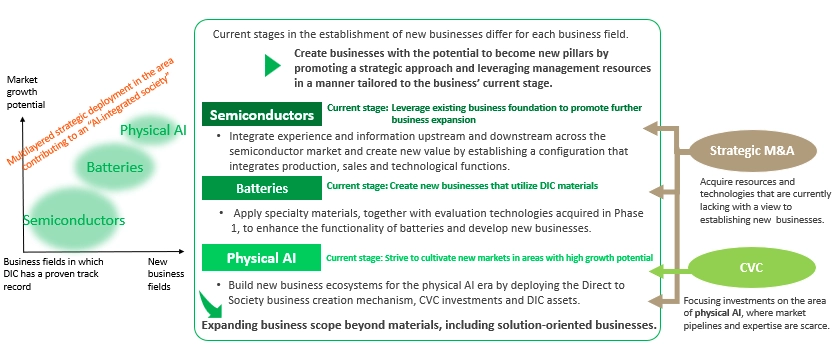

3. Initiatives aimed at establishing growth businesses

- An AI-integrated society is one in which AI is integrated into all aspects of social systems. DIC provides materials and solutions in areas that support an AI-integrated society, notably semiconductors, batteries, and physical AI, in which it can leverage its management resources.

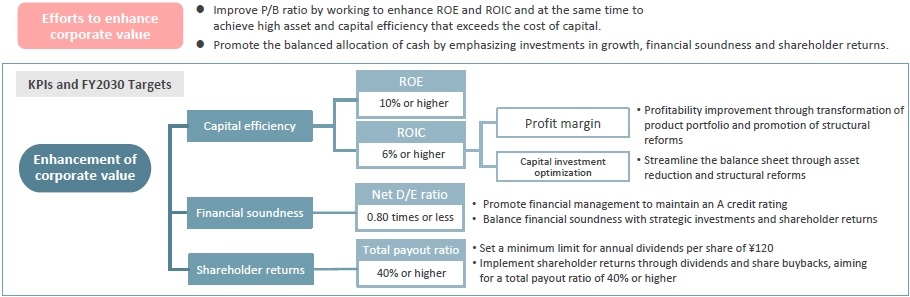

Measures to Implement Management that is Conscious of Capital Costs and SharePrice

Policy and Targets for Improvement of Capital Efficiency

We recognize the improvement of capital profitability as a key management priority and are actively working toward that goal. Our target is to achieve ROIC of 6.0% or higher—exceeding our weighted average cost of capital (WACC)—and ROE of 10% or higher, surpassing our cost of equity, at an early stage by 2030.

Sustainability Initiatives

Goals and Initiatives for Reducing CO₂ Emissions

With the aim of achieving carbon neutrality by fiscal year 2050, we set a target for reducing CO₂ emissions by 50% from the fiscal year 2013 level by fiscal year 2030. By fiscal year 2024, we had succeeded in lowering CO₂ emissions (Scope 1 and 2) by 37.4% from fiscal year 2013.

Initiatives aimed at reducing CO₂ emissions

Internal emissions reduction initiatives (Scope 1 and 2)

- Advance environmental investments, CO₂ emissions factor improvements and energy-saving initiatives

- Advance the electrification of production equipment

- Actively employ green power generation

- Introduce an internal carbon pricing system

Emissions reduction initiatives across the supply chain (Scope 3)

- Promote supplier engagement

- Encourage the use of recycled and bioderived raw materials

- Increase the recycling rates of and reduce the disposal of used products by customers

- Leverage proprietary technologies to improve the efficiency of materials recycling

- Contribute to reduction through business activities

Priority issues in sustainability initiatives

- In working to reduce CO₂ emissions by 50% from the fiscal year 2013 level by fiscal year 2030, be mindful of the need to balance the two priorities of resolutely achieving this target and ensuring robust cost competitiveness.

- In addressing a circular economy, realize a recyclingbased society and bolster the competitiveness of DIC products and solutions by leveraging our strengths and uniqueness.

Related Documents

For further details, please refer below:

Materials on the Revision of DIC Vision 2030 Phase 1 Targets

For further details, please refer below:

New Vision Statement and DIC Vision 2030 Long-Term Management Plan

DIC Corporation announced its redefined vision statement and new long-term management plan DIC Vision 2030 on February 18th, 2022. For further details, please refer below.

![Revision of DIC Vision 2030 Phase 1 Targets [747KB]](/images/ir/management/plan/dic_vision_Revision2030_en.jpg)