Compliance

Toward Fair and Transparent Corporate Activities

- Goals and Achievements of Major Initiatives

- Basic Approach to Compliance

- The DIC Group Code of Business Conduct

- Initiatives to Promote Compliance

- Establishing and Operating a Whistle-Blowing System

- Measures to Prevent Misconduct in Research Activities Using Public Funds and the Misuse of Such Funds

- Preventing Violations of Antitrust and Anti-Corruption Laws

- Promoting Compliance with Legislation Regarding the Timely Payment of Subcontractors

- Taxation Compliance

Goals and Achievements of Major Initiatives

Enhancing awareness of compliance

| Fiscal year | Goals | Achievements | Evaluation |

|---|---|---|---|

| 2024 |

|

|

★★ |

| 2025 |

|

― | ― |

Conducting business fairly

| Fiscal year | Goals | Achievements | Evaluation |

|---|---|---|---|

| 2024 | Achieve zero violations of antitrust, anti-corruption and other key laws. | There were zero violations of antitrust, anti-corruption and other key laws. | ★★ |

| 2025 | Achieve zero violations of antitrust, anti-corruption and other key laws. | ― | ― |

- Evaluations are based on self-evaluations of current progress.

Key: ★★★ = Excellent; ★★ = Satisfactory; ★ = Still needs work

Basic Approach to Compliance

Compliance in the DIC Group encompasses not only obeying laws but also acting in a manner that is in keeping with social norms and the expectations of customers, communities and other stakeholders. With the aim of ensuring sustainable growth for businesses that are both fair and transparent, DIC formulated the DIC Group Code of Business Conduct, a unified set of guidelines the adherence to which it considers to be the foundation of compliance. DIC compels all DIC Group employees to comport themselves in accordance with the code.

The DIC Group Code of Business Conduct

The DIC Group Code of Business Conduct (amended in October 2024) not only mandates compliance with national laws and international rules but also presents 10 principles essential to the professional conduct of DIC Group employees.

The Group held presentations for all existing Group employees when the code was originally established, while new employees receive training at point of hire. The goal of such training is to ensure employees worldwide share values cherished by the Group and approach their work with a sense of responsibility and a commitment to doing the right thing.

Document download

10 Principles Essential to Professional Conduct

- Your Rights as an Employee: Respect, Dignity, Privacy

- Environment, Safety and Health

- Your Responsibility to Avoid Potential Conflicts of Interest and to Protect Group Property

- Anti-Corruption and Anti-Bribery Policy

- Your Relationship with Governments and Government Officials

- Your Relationship with Customers, Suppliers, and External Third Parties

- Money Laundering and Anti-Terrorism

- Forced Labor, Child Labor, Conflict Minerals

- Insider Trading

- Proper Accounting and Internal Controls Relating to Financial Reporting

Initiatives to Promote Compliance

The DIC Group promotes compliance through the following initiatives:

- Legal training that emphasizes improving compliance awareness is provided for employees at point of hire, when promoted and before transfer overseas. In addition, to promote awareness of the DIC Group Code of Business Conduct among all group employees (including contract and dispatched employees), annual e-learning and theme-specific presentations related to the code as needed, as well as to compliance, is provided in Japan, at DIC Asia Pacific Pte Ltd, at DIC (China) Co., Ltd., and in the Americas and Europe.

- Compliance officers are appointed at all regional headquarters—DIC (Japan), Sun Chemical Corporation (the Americas, Europe, the Middle East and Africa), DIC (China) People's Republic of China(PRC) and DIC Asia Pacific (Asia and Oceania)—to spearhead global compliance efforts.

- In Japan, the internal auditing department conducts annual evaluations at sites, including those of domestic DIC Group companies, to determine proper compliance with the DIC Group Code of Business Conduct, laws and regulations, and internal rules. The department also conducts on-site inspections in accordance with annual auditing plans and provides guidance on the implementation of corrective measures in the event issues are identified. The department also promotes similar initiatives for individual overseas Group companies through the relevant regional headquarters.

The DIC Group vows that it will not violate the principles of the DIC Group Code of Business Conduct, even if such a violation would appear to profit the Group. As a corporate citizen, the Group also pledges to respect social norms and act in a sound and socially acceptable manner. In fiscal year 2024, there were no serious violations of compliance laws.

Compliance E-Learning

| Fiscal year 2020 |

|

| Fiscal year 2021 |

|

| Fiscal year 2022 |

|

| Fiscal year 2023 |

|

| Fiscal year 2024 |

|

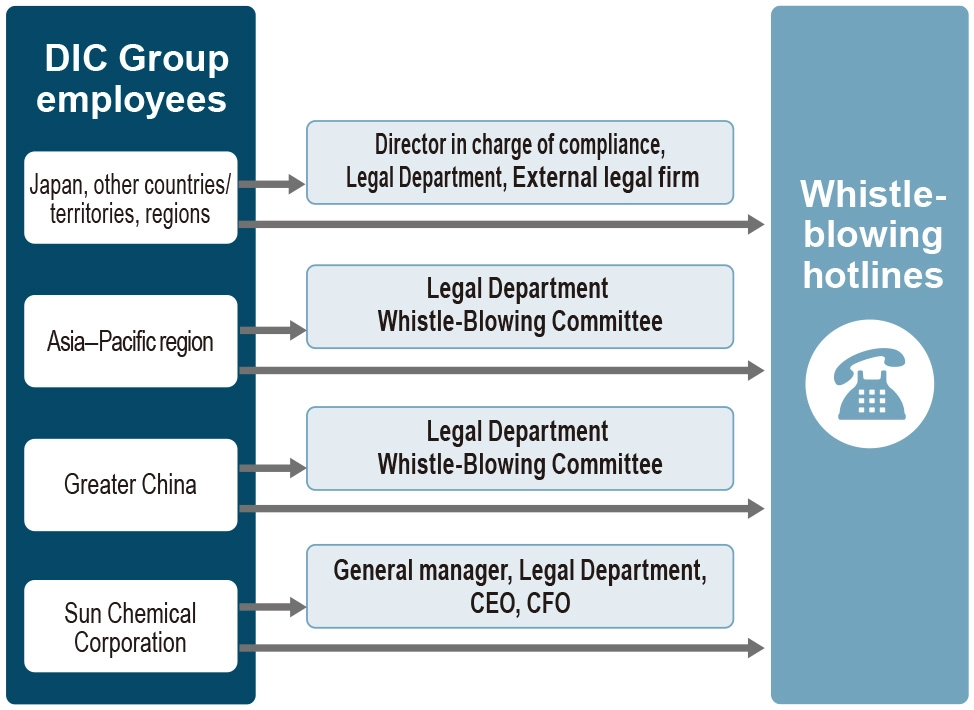

Establishing and Operating a Whistle-Blowing System

The DIC Group has established a compliance whistle-blowing system independent from channels for communication used in the conduct of business. (This system also encompasses external hotlines that can accommodate more than 160 languages.) The Group encourages use of this system to promptly address compliance-related issues and suspected compliance violations. The Group has also devised strict rules under this system to protect whistle-blowers from retaliation and works to ensure the system functions in a proper manner.

When a report is received, the DIC Group responds swiftly and appropriately, giving due consideration to pertinent laws while also incorporating internal and external opinions, to identify and correct violations and where necessary to take disciplinary action. Details of reports and steps taken in response are reported to the Board of Directors. The Group will continue to use its whistle-blowing system to ensure the prompt discovery and correction of misconduct.

In fiscal year 2024, 45 reports were received on compliance issues and labor-related matters such as power harassment and discrimination, but none were judged to be serious. The substance of these reports was conveyed to the Board of Directors.

Measures to Prevent Misconduct in Research Activities Using Public Funds and the Misuse of Such Funds

In accordance with the “Guidelines for Responding to Misconduct in Research Activities” (August 26, 2014, Decision of the Minister of Education, Culture, Sports, Science and Technology) and the “Guidelines for the Management and Audit of Public Research Funds at Research Institutions (Implementation Standards)” (Revised February 1, 2021, Decision of the Minister of Education, Culture, Sports, Science and Technology), DIC is committed to preventing misconduct in research activities conducted with public funds—such as fabrication, falsification, and plagiarism—as well as the improper use of such funds, including fictitious claims, fictitious transactions, and expenditures for purposes other than those intended. Our basic policy regarding this initiative is as set forth in “Basic Policy on the Prevention of Misconduct Related to Public Research Funds” available at the link below.

If you have any inquiries or concerns regarding this matter, please contact our reporting desk using the link below.

Preventing Violations of Antitrust and Anti-Corruption Laws

The DIC Group established a basic policy for compliance with antitrust legislation in February 2006 and has since made efforts Groupwide to ensure fair business practices. Strict rules for compliance with antitrust legislation and the prohibition of involvement in corruption are contained in the DIC Group Code of Business Conduct. These are also among the themes addressed in e-learning held annually to bolster employee understanding and advance awareness.

Promoting Compliance with Legislation Regarding the Timely Payment of Subcontractors

With the aim of enhancing understanding of the importance of appropriate and fair transactions with subcontractors, the Legal Department held presentations on legislation regarding the timely payment of subcontractors, incorporating case studies, for the purchasing departments of domestic DIC Group companies, and offered e-learning, principally for employees in charge of subcontractors. In addition, DIC has prepared the Manual for Internal Auditing of the DIC Group’s Compliance with Japan’s Act Against Delay in Payment of Subcontract Proceeds, Etc., to Subcontractors and created a framework for conducting audits in a more efficient manner. The Group also encourages employees in related positions to participate in programs sponsored by external organizations, including a workshop promoting adherence to the Act sponsored by the Japan Fair Trade Commission and the Small and Medium Enterprise Agency.

Taxation Compliance

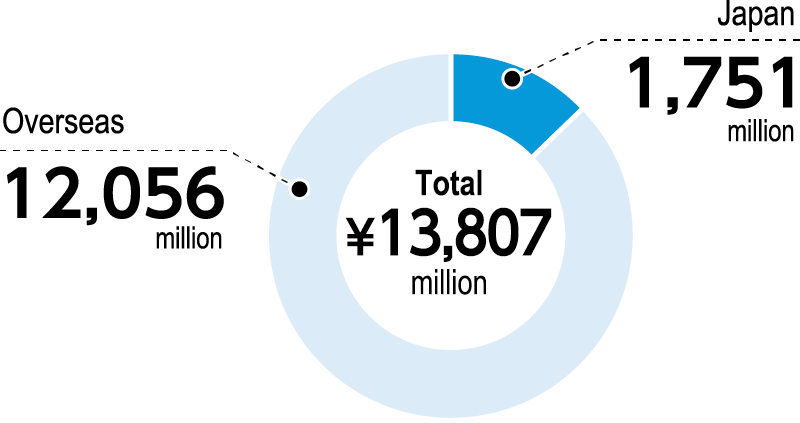

In November 2017, the DIC Group formulated the DIC Group’s Approach to Tax. As an organization with global operations, the Group engages in fair and appropriate tax planning that reflects the nature of its businesses. The Group is also aware of risks associated with transfer price taxation and the use of tax havens, and of its obligation to pay appropriate taxes in the proper jurisdictions as appropriate for its operations. The chart below shows a breakdown of taxes in Japan and overseas in fiscal year 2024.

Related link