Climate Change

Basic Approach

The DIC Group works to reduce CO₂ emissions over the entire life cycle of its products and, through its business activities, to lower risks associated with climate change.

Initiatives Aimed at Preventing Global Warming

In line with its goal of contributing to the realization of sustainability for the

global environment and for society, in June 2021 the DIC Group announced

DIC NET ZERO 2050, which sets a target of achieving carbon neutrality—

net zero CO₂ emissions (Scope 1 and 2)—by fiscal year 2050. In January

2023, the Group’s CO₂ emissions target received official endorsement

from the Science Based Targets initiative (SBTi),*1 which was established

with the purpose of driving CO₂ emissions reduction in the private sector.

(Information regarding the impact of the acquisition of the Colors & Effects

pigments business will be communicated to the SBTi going forward.)

The DIC Group comprises 190 companies in 63 countries and territories.

The Group is committed to working as one to cut emissions to ensure

achievement of this target. Prior to this, in May 2019 the Group declared

its support for the Task Force on Climate-related Financial Disclosures

(TCFD),*2 pledging to disclose climate-related information in line with the

TCFD recommendations.

- The SBTi is a partnership that encourages companies to set science-based greenhouse gas emissions reduction targets that are in line with the goal of the Paris Agreement. The SBTi endorses targets set by companies for the next five to 15 years as “science-based” if they are consistent with what climate science says is necessary to limit average global warming to well below 2°C above pre-industrial levels and the pursuit of a limit of 1.5°C.

- The TCFD was established under the auspices of the Financial Stability Board and announced in June 2017 with the objective of mitigating climate-related risks in financial markets that have the potential to affect performance over the medium to long term.

Goals and Achievements of Major Initiatives

Reduce CO₂ emissions at sites (Scope 1 and 2).

| Goals for fiscal year 2022 | DIC Group (global): Reduce CO₂ emissions at DIC Group sites (Scope 1 and 2) by 50% from the fiscal year 2013 level by fiscal year 2030 (average annual decrease of 3.5%). |

|---|---|

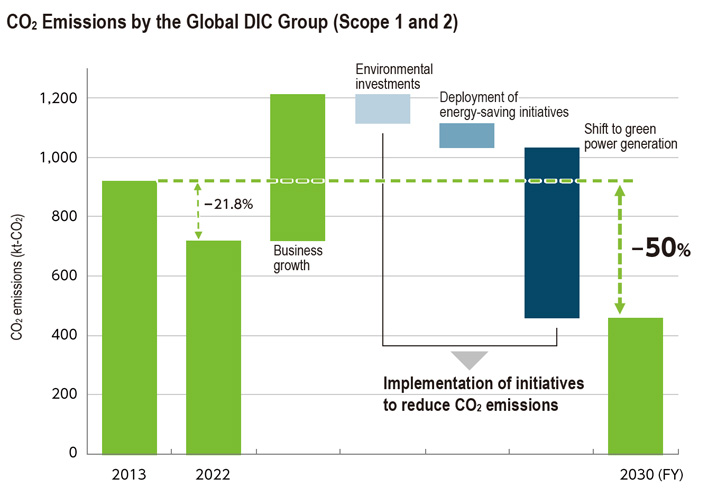

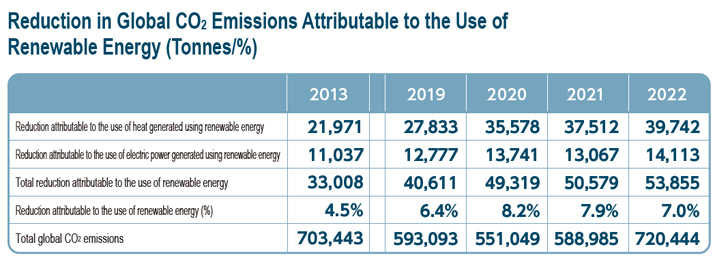

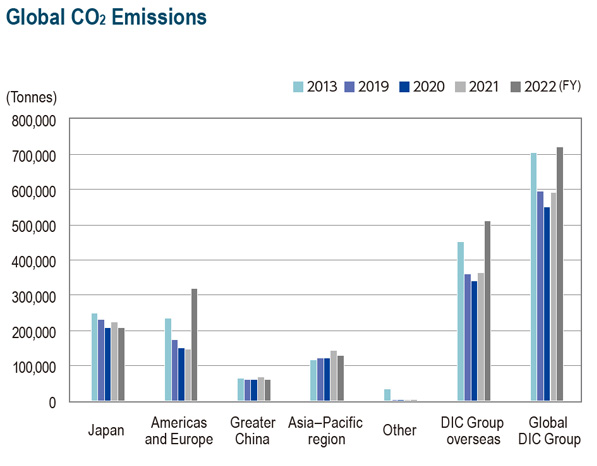

| Achievements in fiscal year 2022 | DIC Group (global): CO₂ emissions: 720,444 tonnes • Down 21.8% from fiscal year 2013 (921,386 tonnes)* * Fiscal year 2013 emissions were calculated including an estimate for the Colors & Effects pigments business for that year.) |

| Evaluation | ★★ |

| Goals for fiscal year 2023 | DIC Group (global): Reduce CO₂ emissions at DIC Group sites (Scope 1 and 2) by 50% from the fiscal year 2013 level by fiscal year 2030 (average annual decrease of 2.9%). |

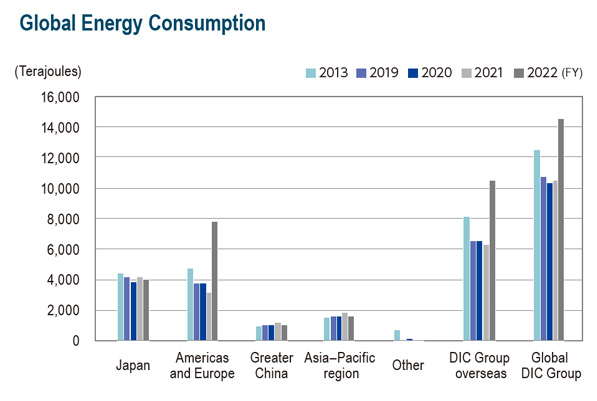

| Goals for fiscal year 2022 | DIC Group (Japan): Reduce energy consumption per unit of production by 17.0% from the fiscal year 2013 level by fiscal year 2030 (average annual decrease of 1.0%). |

|---|---|

| Achievements in fiscal year 2022 | DIC Group (Japan): Energy consumption per unit of production: 3.687 GJ/tonne • Up 0.9% from fiscal year 2020 (3.656 GJ/tonne) • Down 11.6% from fiscal year 2013 (4.170 GJ/tonne) |

| Evaluation | ★ |

| Goals for fiscal year 2023 | DIC Group (Japan): Reduce energy consumption per unit of production by 17.0% from the fiscal year 2013 level by fiscal year 2030 (average annual decrease of 1.0%). |

Reference:

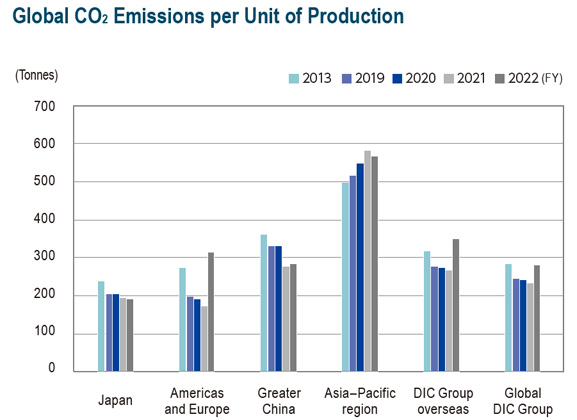

CO₂ emissions per unit of production in fiscal year 2022: DIC Group in Japan: 190.6 kg/tonne

- Down 3.0% from fiscal year 2021 (196.6 kg/tonne)

- Down 20.1% from fiscal year 2013 (238.7 kg/tonne)

- 「Evaluations are based on self-evaluations of current progress

Key: ★★★=Excellent; ★★=Satisfactory; ★=Still needs work

Framework for Promotion

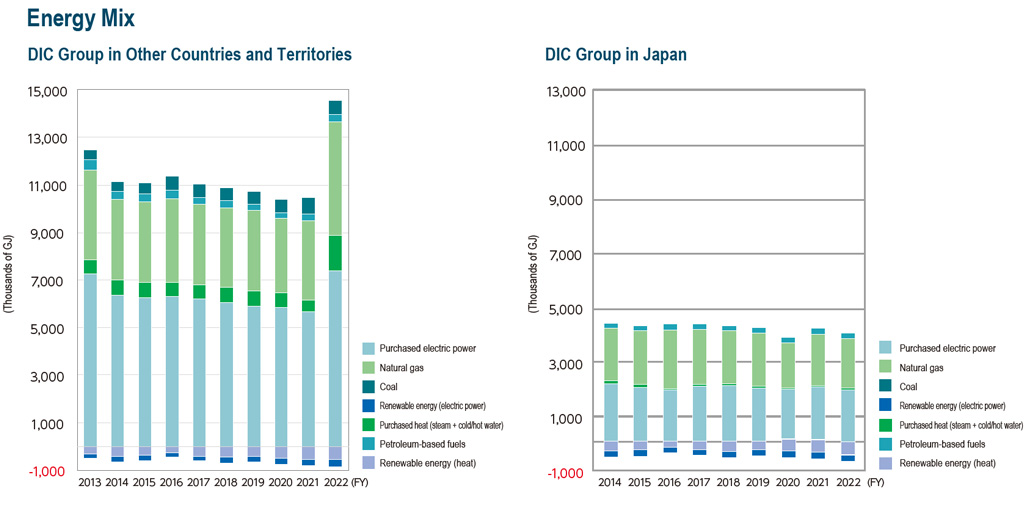

The DIC Group works to reduce CO₂ emissions through its business activities in four regions: Japan, the Americas and Europe (overseen by Sun Chemical), the Asia–Pacific region and Greater China. Despite differences in energy requirements and access to renewable energy depending on region and site location, the Group is committed to working as one to ensure it achieves its target of reducing its Scope 1 and 2 CO₂ emissions by 50% from the fiscal year 2013 level by fiscal year 2030.

Recognizing climate change as a critical social imperative, the DIC Group is working to reduce CO₂ emissions from its sites. Important measures are proposed to the Sustainability Committee to be deliberated and determined. DIC and DIC Group companies in Japan have established an Energy-Saving Promotion Committee at each site. Committee activities include confirming the progress of initiatives, engaging in discussions and conducting patrols. An Energy-Saving Working Group has also been set up at each site comprising members selected by the site itself to foster the exchange of information and research pertaining to new energy-saving measures, as well as to advance the horizontal deployment of effective measures across domestic Group sites. This combination of site- and Group-level initiatives forms the framework under which the DIC Group endeavors to reduce its CO₂ emissions.

In the Americas and Europe, Sun Chemical is promoting efforts to reduce its CO₂ emissions, a considerable challenge with the expansion of its operating scale owing to the integration of the Colors & Effects pigments business. In the Asia–Pacific region and Greater China, Group companies are encouraging a variety of independent energy-saving initiatives that align with related Group policies. DIC’s Production Management Unit provides support on multiple fronts, including managing overall progress.

Principal Efforts

- Undertake energy-saving initiatives Groupwide.

- Promote DX to optimize energy management for production and utility equipment.

- Actively establish energy-saving facilities, including efficient cogeneration systems and net zero-energy buildings (ZEBs).

- Employ energy from renewable sources—e.g., biomass boilers, wind power and net solar power—at suitable sites.

- Conduct energy-saving analyses and support the deployment of energy-saving initiatives at DIC Group companies, including those in other countries and territories.

- When installing or expanding facilities, purposefully select energy-efficient options and formulate related rules, including for investment in environmental value and the introduction of internal carbon pricing.

Disclosure in Line with the TCFD Recommendations

With the aim of helping institutional investors grasp climate-related risks and opportunities and reflect this in their investment decisions, the TCFD has structured its recommendations around four thematic areas that represent core elements of how organizations operate—governance, strategy, risk management, and metrics and targets. The DIC Group is enhancing its efforts to respond appropriately to risks and capitalize on opportunities associated with climate change with the objective of earning the trust of stakeholders through improved resilience and the proactive dissemination of information.

TCFD Recommendations for Financial Disclosures

| Governance | Governance around climate-related risks and opportunities |

|---|---|

| Strategy | Actual and potential impacts of climaterelated risks and opportunities on businesses, strategy and financial planning |

| Risk management | Processes used to identify, assess and manage climate-related risks |

| Metrics and targets | Metrics and targets used to assess and manage relevant climate-related risks and opportunities |

01Governance

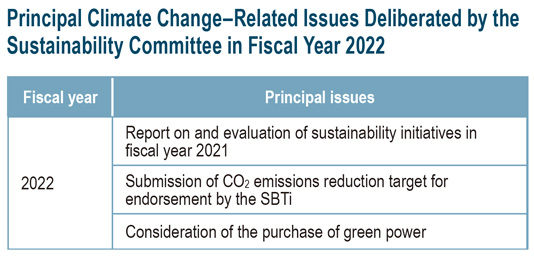

The DIC Group recognizes climate change as a key management challenge. Important matters, including the setting of medium- and long-term targets for the reduction of CO₂ emissions, are deliberated and determined by the Sustainability Committee, which meets four times annually and answers directly to the president and CEO, and the details are reported to the Board of Directors, in line with the rules governing the Board of Directors. (In principle, the Sustainability Committee reports to the Board of Directors on all of its deliberations.) A system is thus in place that ensures appropriate supervision of the Sustainability Committee is provided by the Board of Directors.

To appropriately assess and manage climate change–related risks and opportunities, thereby ensuring the effective management of its operations, the Sustainability Committee consists of the president and CEO, the general managers of the Production Management Unit and Technical Management Unit, and the heads of the Corporate Strategy Unit, General Affairs and Legal Unit, Finance and Accounting Unit, and ESG Unit, as well as the presidents of the business groups and the general managers of the product divisions.

02Strategy

With pressure on the global community to achieve carbon neutrality by 2050 intensifying rapidly, changes to rules governing competitiveness are expected to transform the socioeconomic system going forward. DIC is promoting sustainable business strategies, recognizing the importance of risks and opportunities associated with climate change. Because the impacts of climate change are likely to surface over the medium to long term, the Company is working to enhance its understanding of the principal climate-related risks and opportunities (transition as well as physical) that are likely to have a financial impact over the medium to long term.

Based on scenario analysis conducted in fiscal year 2020, the Company will work to raise its awareness of foreseeable opportunities and risks from a medium- to long-term perspective and at the same time to formulate and execute effective strategies on an appropriate time line. In fiscal year 2020, DIC also established the Climate Change Subcommittee, which is tasked with helping facilitate the achievement of net zero CO₂ emissions by fiscal year 2050. The activities of the subcommittee are reported to and debated by the Sustainability Committee.

Key Risk Management Perspectives

- Should carbon pricing or carbon border taxes be introduced in the future, there is a risk that raw materials, fuel and electric power prices will rise and/ or that taxes will be imposed on exported products, making CO₂ emissions a factor that directly affects costs.

- Should the Group be unable to respond to any sudden changes in demand resulting from the shift to a circular economy to advance decarbonization, there is a risk of a significant decline in profits generated by its businesses (climate change–related transition risk).

- Should climate-related disasters arising from the increasing seriousness or frequency of extreme weather events occur, resulting in product supplies becoming impossible or being delayed due to the suspension of operations at production facilities and the instability of raw materials supplies, there is a risk that it will cause a significant decline in profits generated by Group businesses or threaten business continuity (extreme physical risk).

Principal Climate-Related Risks

| Type | Description |

|---|---|

| Emerging regulations (Transition) | There is a risk that emerging regulations (e.g., the introduction of carbon pricing) will increase direct costs and impact on the operating environment/profitability (e.g., facility costs and raw materials prices). |

| Technology (Transition) | With technological innovations, there is a risk of products and services becoming obsolete and demand declining. |

| Market (Transition) | There is a risk that an insufficient grasp of evolving customer/consumer preferences will mean the loss of market opportunities. There is also a risk that businesses will shrink if demand related to the realization of a circular economy cannot be met. |

| Market (Transition) | There is a risk that businesses will be affected, including through the loss of commercial rights, if rapidly expanding market/customer demand for products with a reduced carbon footprint cannot be met. |

| Reputation (Transition) | If DIC’s attitude toward and ability to respond to climate change is seen by external observers as insufficient for a manufacturer of fine chemicals, there is a risk that its reputation will sufer. |

| Acute (Physical) | Should extreme weather events become more frequent, there is a risk that operations at production sites will be afected. |

| Chronic (Physical) | If temperatures remain persistently high, there are risks of increased production site maintenance and operating costs and of damage to health. |

| Upstream (Physical) | In addition to a risk of uncertainty regarding the supply of raw materials monopolized by certain suppliers, there are BCP risks and risks that costs may increase due to, among others, rising prices for fuel and electric power, or to the imposition of taxes on exported products. |

Principal Climate-Related Opportunities

| Type | Description |

|---|---|

| Emerging regulations (Transition) | With emerging regulations, there is an opportunity to establish new business models that demonstrate the superiority of DIC’s businesses. |

| Technology (Transition) | Technological innovation provides opportunities to create new low-carbon/decarbonized businesses that respond to climate change and to increase product cost competitiveness through the use of revolutionary technologies to improve processes. |

| Market (Transition/physical) | Accurately grasping evolving customer/consumer preferences—e.g., shift to low-carbon business models, chance that certain existing businesses will be avoided—provides the opportunity to develop new products and services that anticipate lifestyle changes. |

| Upstream/downstream (Transition/physical) | Addressing climate change (adaptation and mitigation) over products’ entire life cycles through organic collaboration with customers and suppliers provides the opportunity to create new businesses and systems. |

Strategies for Reducing CO₂ Emissions

As an organization with a CO₂ emissions reduction target, the DIC Group will promote a variety of related initiatives as outlined below. The Group currently plans to make environmental investments of approximately ¥15 billion in Japan between fiscal years 2022 and 2030.

- Notes:

- In Japan, Scope 1 CO₂ emissions are calculated using emissions factors set by the country’s Ministry of the Environment. In other regions, Scope 1 emissions are calculated using emissions factors set by the United States Environmental Protection Agency (EPA)

- In Japan, Scope 2 emissions—attributable to the consumption of purchased electric power—are calculated using emissions factors of electric power utilities with which Group companies have contracts or, in cases where such data is not available, using emissions factors set by the country’s Ministry of the Environment. Scope 2 emissions in North America are calculated using the EPA’s Emissions & Generation Resource Integrated Database (eGRID), while those in other countries and territories, they are calculated using emissions factors set by the International Energy Agency (IEA).

Scenario Analysis

| Scenario information | 2ºC scenario | 4ºC scenario |

|---|---|---|

| Scenario details | Based on the IEA’s World Energy Outlook (WEO) Sustainable Development Scenario and Energy Technology Perspectives (ETP) 2017 2ºC Scenario | Based on the Intergovernmental Panel on Climate Change (IPCC) Representative Concentration Pathway (RCP) 8.5 |

| Time frame | 2030 | 2030 |

| Carbon price assumption | ¥8,000/tonne | — |

Results of Scenario Analysis

| Implications for society and the business environment | Risk and opportunity assessment | DIC Group countermeasures | ||

|---|---|---|---|---|

| 2ºC scenario: Strengthening of policies and regulations | Introduction of carbon pricing (direct implications for manufacturing and the procurement of raw materials) | Possible direct impact on manufacturing costs: ¥5.03 billion* (Annual CO₂ emissions in fiscal year 2018: 617,964 tonnes) Reference: Possible impact on procurement costs: ¥11.8 billion (Annual CO₂ emissions (Scope 3, Category 1) in fiscal year 2018: 1,480,561 tonnes) |

|

|

|

|

|||

| 2ºC scenario: Changes in demand attributable to circular economy | Global movement to minimize use of oneway plastics and efforts by brand owners seeking to reduce packaging | Demand for some plastics (one-way plastics) will decrease, but increased demand for plastic alternatives will mean only a negligible impact on materials suitable for applications other than plastics. |  |

|

| Increase in production and sales of recycled plastics | While it is unclear what will happen vis-à-vis demand changes, a failure to launch commercial distribution will mean the loss of future market opportunities. |  |

|

|

|

|

|||

| 2ºC scenario: Reduction of CO₂ emissions attributable to manufacturing | Introduction of energy-saving and renewable energy equipment | Annual investment in energy-saving and renewable energy equipment is estimated at ¥2.0 billion (direct impact on manufacturing costs). Ongoing efforts to reduce CO₂ emissions attributable to production will also be necessary. |

|

|

| Shift of focus to the achievement of net zero CO₂ emissions by fiscal year 2050 | Efforts to reduce CO₂ emissions enough to keep the increase in global average temperature over the current century to 1.5ºC from the pre-industrial level are already underway. There is an increased risk that this target will be imposed across entire supply chains. |  |

|

|

| 4ºC scenario: Risk that supply chains will be interrupted due to an increase in climate-related disasters | Suspension of production at suppliers’ facilities due to frequent climate-related disasters Suspension of supplies of plant-derived raw materials |

|

|

|

| 4ºC scenario: Risk that operations at production facilities will be interrupted due to an increase in climate-related disasters | Suspension of production at own facilities due to frequent climate-related disasters Depletion of groundwater resources |

|

|

|

| Increases in non-life insurance fees | Insurance premiums may increase. |  |

|

|

| 4ºC scenario: Response to changes in lifestyles attributable to rising temperatures | Changes in lifestyles and consumption patterns attributable to rising temperatures and resulting changes in demand |

|

|

|

- These figures are based on results in fiscal year 2018, the year the scenario analysis was conducted. As CO₂ emissions in fiscal year 2022 amounted to 720,444 tonnes, the impact of carbon pricing under the same conditions would be as much as ¥5.76 billion.

Initiatives for Fiscal Years 2020–2023

- Introduce internal carbon pricing.

Quantify climate change risk and provide economic incentives for reducing CO₂ emissions to accelerate the promotion of investments and innovations to further advance emissions reductions. In fiscal year 2021, introduce internal carbon pricing for new investment projects as an internal framework for factoring the cost of related CO₂ emissions into estimates of investment benefits. - Promote full-scale collaboration with FP Corporation (FPCO) in the practical implementation of a closed-loop recycling system for polystyrene, used in plastic containers for food products, among others.

- Establish the Climate Change Subcommittee, implement various measures and announce new targets for achieving carbon neutrality by fiscal year 2050.

- Raise funds through sustainable finance.

- Build ZEBs.

Group company DIC Kyushu Polymer Co., Ltd., completed a new office building that employs ZEB-compliant construction methods. The new building has earned certification under the highest of four ZEB series’ ranks. - Embark on efforts to reduce the carbon footprint of products.

Regional Initiatives in Fiscal Year 2022

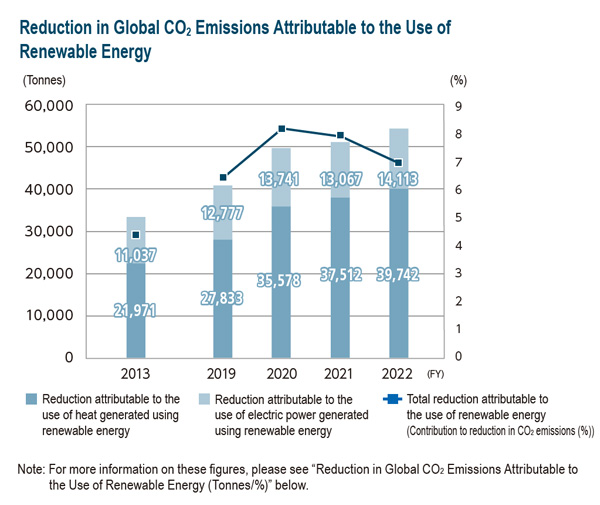

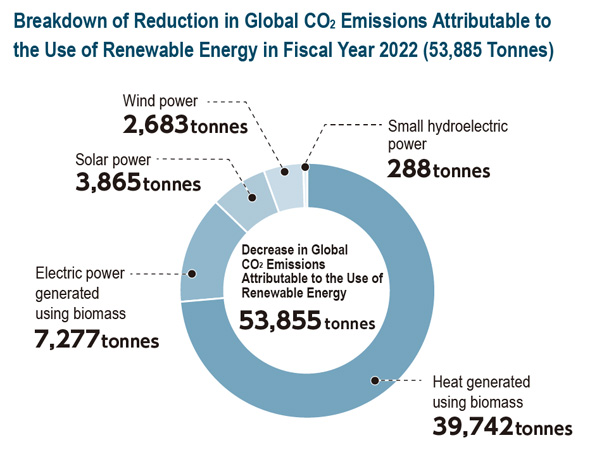

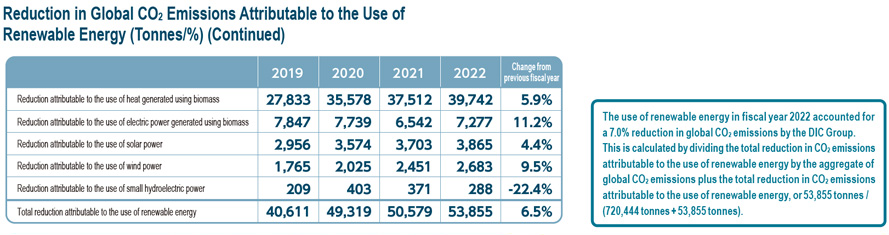

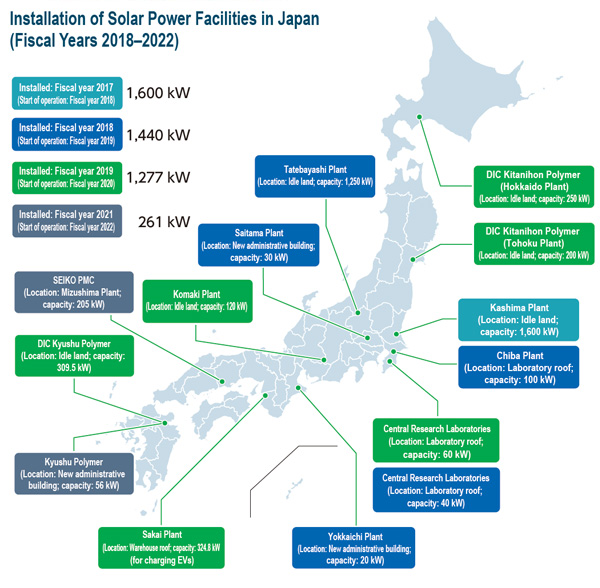

Japan

The bulk of renewable energy used by DIC Group companies

in Japan is natural energy generated by a biomass boiler, as

well as wind and solar power facilities, at the Kashima Plant. In

fiscal year 2022, the DIC Group in Japan used 742,000 GJ of

renewable energy (equivalent to 19,136 kl of crude oil), up 5.5%

from fiscal year 2021 and equivalent to 15.5% of total energy

(steam and electric power) used by these companies.

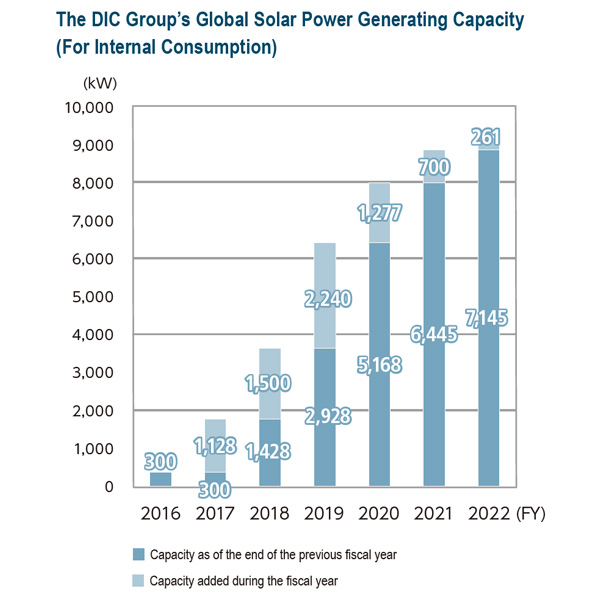

The use of renewable energy by DIC Group companies in Japan in fiscal year 2022 accounted for a reduction in CO₂ emissions of 47,173 tonnes, equivalent to 18.5% of the total annual reduction achieved by the Group in Japan. Highlights of the period include the start of operations at a new solar power facility with a generating capacity of 205 kW at Group company SEIKO PMC’S Mizushima Plant. Looking ahead, the Group will continue taking decisive steps to advance its use of renewable energy with the aim of meeting its DIC NET ZERO 2050 target.

Americas and Europe

To reduce its greenhouse gas emissions and contribute to achievement of the goals of DIC Vision 2030, Sun Chemical has formulated a plan to significantly increase its purchases of green power, while at the same promoting energy savings and reducing its use of fossil fuels, and is advancing a variety of related initiatives.

One successful project aimed at cutting fossil fuel use in fiscal year 2022 was the installation of a thermal oxidizer on the premises of Sun Chemical’s factory in Caleppio, Milan, in Italy, that controls the emission of waste solvent vapor into the atmosphere. This unit concentrates waste solvent emissions in a zeolite bed, significantly lowering the amount of natural gas required for its operation, facilitating an annual decrease in CO₂ emissions of 3,100 tonnes. At its Osterode site in Germany, Sun Chemical installed a large-scale photovoltaic array that significantly reduces the amount of purchased electric power required for production at the site. This will lower annual CO₂ emissions by 166 tonnes. Going forward, Sun Chemical will step up its green procurement plan, which combines efforts to purchase green power and use green power generated on-site, to further reduce its carbon footprint.

Greater China

DIC Zhangjiagang Chemicals Co., Ltd., was the first DIC Group company to adopt an on-site power purchase agreement. Using its roof and other on-site locations made it possible to install a 700 kW solar power generating facility without incurring initial investment costs, greatly contributing to the reduction of CO₂ emissions.

03Risk Management

Processes Used to Identify and Assess Climate Change–Related Risks

The DIC Group recognizes risks related to its response to climate

change—a key component of its framework of sustainability themes,

the foundation of its sustainability activities—and works to evaluate,

address and manage them effectively. In fiscal year 2022, the Group

began addressing climate change–related risk—until the previous fiscal

year treated as a component of ESH—as an independent risk theme.

The Sustainability Working Group, a subsection of the Sustainability

Committee, is charged with identifying and debating priority risks.

Risks designated as priorities are submitted for consideration to the

Sustainability Committee.

04Metrics and Targets

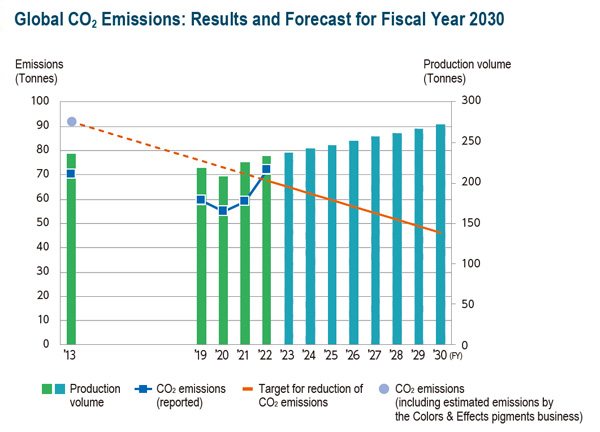

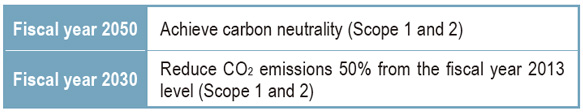

In light of accelerated global efforts to decarbonize, the DIC Group has set new targets for the reduction of its CO₂ emissions and pledged to step up related efforts. DIC now aims to achieve carbon neutrality—net zero CO₂ emissions—by fiscal year 2050 and will seek to reduce CO₂ emissions by 50% from the fiscal year 2013 level by fiscal year 2030.*

- Targets are for Scope 1 and 2 emissions.

Principal Initiatives in Fiscal Year 2022

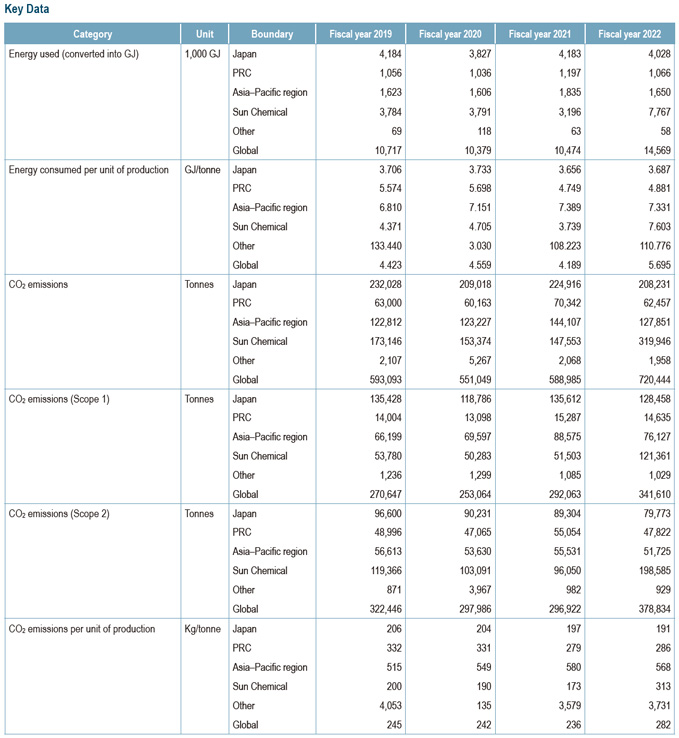

01Energy Consumption and CO₂ Emissions by the Global DIC Group (Scope 1 and 2)

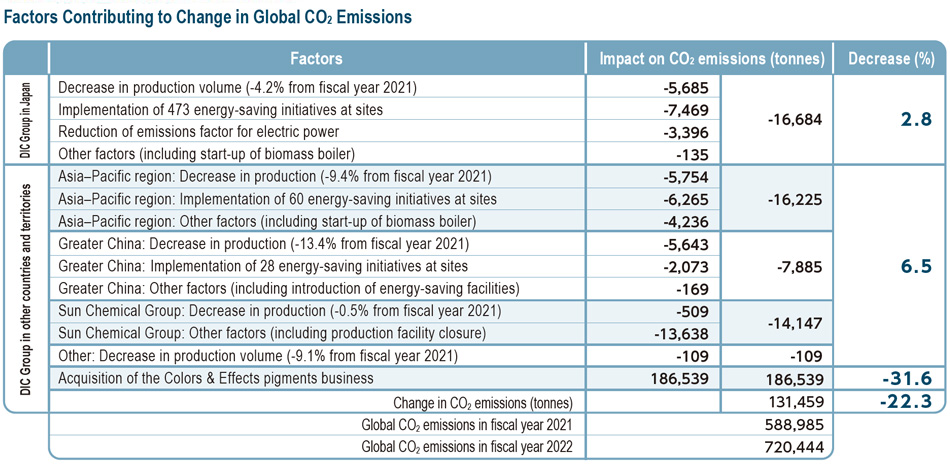

Energy consumption by the global DIC Group in fiscal year 2022

amounted to 14,569,201 GJ, while CO₂ emissions totaled 720,444

tonnes. CO₂ emissions per unit of production were 281.6 kg/tonne.

Both energy consumption and CO₂ emissions were up sharply from

fiscal year 2021, owing to the acquisition of the Colors & Effects

pigments business. The Group intends to obtain third-party verification

of its energy consumption and CO₂ emissions (Scope 1 and 2) data,

including the impact of this change.

The DIC Group achieved its goals for reducing its CO₂ emissions and

CO₂ emissions per unit of production worldwide as a result of efforts

by Group companies to break down the target set forth in the threeyear

management plan that concluded in fiscal year 2021—a 50%

decrease from the fiscal year 2013 level by fiscal year 2030—into an

annual average decrease of 3.5% from the fiscal year 2018 level—and

the promotion of more ambitious energy-saving and decarbonization

initiatives, including the adoption of internal carbon pricing. Some of

these initiatives are outlined below.

Going forward, the DIC Group will continue to implement a variety of

energy-saving measures, including introducing highly efficient facilities,

promoting process improvements and boosting capacity utilization

rates, while at the same time further advancing its use of renewable

energy by shifting to biomass and other clean fuels and installing solar

power facilities.

In addition, the Sustainability Committee has made the decision to

adopt CO₂-free electric power at all DIC Group sites in Japan. The DIC

Building (DIC’s corporate headquarters) and the No. 2 DIC Building in

Tokyo switched fully to CO₂-free purchased electric power. Remaining

sites will begin gradually changing over in fiscal year 2023.

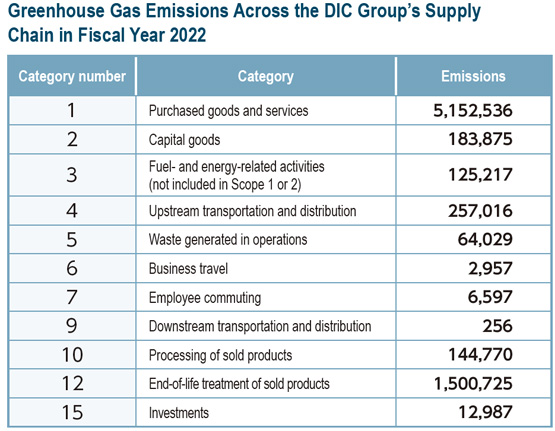

02Grasping CO₂ Emissions Across the DIC Group’s Supply

Chains (Scope 3)

The DIC Group recognizes the importance of reducing emissions of greenhouse gases across its supply chains and works to ensure a grasp of emissions in all categories of Scope 3. The Group has also revised its calculation for emissions in category 1 (Purchased goods and services) with the aim of refining data reported in this category.

Initiatives in Areas Other than Production(Offices and Research Facilities)

In fiscal year 2022, energy consumed by the DIC Group’s 21 offices and research sites in Japan (excluding the Central Research Laboratories) rose 17.6%, with contributing factors being an increase in the number of sites and the inclusion in the calculation, for the first time, of fuel used by Company cars. Principal energy-saving initiatives implemented include replacing aged light fixtures and air conditioning equipment with newer, high-efficiency models that satisfy standards set by the Energy Conservation Center, Japan (ECCJ) for its Top Runner program, turning off lights when not needed and implementing mandatory 22°C winter and 28ºC summer air conditioning settings, working

with facility management companies to implement diligent energy-saving

measures and instituting a year-round no-jacket/no-tie dress code under

the WSR 2020 project.

In fiscal year 2022, Group company DIC Kyushu Polymer Co., Ltd., completed

construction of a new office building that incorporates net zero-energy building

(ZEB)*1 construction, which aims to achieve virtually zero energy consumption.

The new office building was designed with a variety of energy-saving equipment

and fixtures, including solar power generation facilities, heat insulation

materials and LED lighting fixtures, allowing it to achieve a reduction in primary

energy consumption (energy saving + energy creation) of 111% and earning

it certification as a top-level ZEB*2 building. DIC Kyushu Polymer participated

in the 2021 ZEB demonstration project conducted by the Ministry of Economy,

Trade and Industry’s Agency for Natural Resources and Energy, earning that

company certification as a ZEB Leading Owner.*3 DIC Kyushu Polymer is the

first Group company to pursue such an initiative. The DIC Group will continue

working actively on building ZEB-compliant offices.

- A ZEB is a building with considerably reduced annual energy consumption by saving as much energy as possible via better heat insulation, solar shading, natural energy and high-efficiency equipment as well as creating energy (e.g., with photovoltaic power generation), while maintaining comfortable environments.

- The ZEB series consists of four ranks based on net reduction in primary energy consumption achieved: ZEB (net energy saving of 100% or more), Nearly ZEB (buildings that achieve net energy saving of 75% or more), ZEB Ready (buildings that achieve net energy saving of 50% or more) and ZEB-oriented (buildings with a floor space in excess of 10,000 m2 that achieve net energy saving of 40% or more).

- A ZEB Leading Owner is an owner of a ZEB building that publicly discloses its targets for promoting awareness of ZEB, introduction plans and implementation results, as well as the results of related efforts.

Procurement Initiatives

Based on the DIC Group Sustainable Procurement Guidelines, DIC formulated the DIC Group Sustainable Procurement Guidebook, version 3 of which was published in February 2020, which it uses to survey suppliers and encourage them to reduce their emissions of greenhouse gases. With the objective of better understanding and lowering the carbon footprint of DIC products, the Group is also making provisional calculations of the carbon footprint of the raw materials it uses, as well as seeking to expand its used of bioderived and recycled raw materials. The Group is also working to reduce greenhouse gas emissions by using common tools such as EcoVadis to expand dialogue with suppliers.

Logistics Initiatives

In Japan, DIC Group companies are using fewer, larger trucks and taking decisive steps to improve loading efficiency, as well as promoting the use of modal shift and the efficient combination of truck, rail and marine transport. Group companies in other countries and territories are advancing initiatives tailored to local circumstances. Over the long term, the Group expects that the expanded use of next-generation vehicles and LNG carriers will further help reduce greenhouse gas emissions attributable to logistics.

Internal Carbon Pricing System

In fiscal year 2021, the DIC Group introduced an internal carbon pricing system. Instituting its own internal price places a monetary value on greenhouse gas emissions (Scope 1 and 2) that the Company can then factor in cost–benefit assessments. This will allow more accurate capital investment decisions by making it possible to quantify the impact of emissions reductions while also raising awareness of the relationship between capital investments and CO₂ emissions. With the goal of expanding applications for its internal carbon pricing system, DIC will also look at using internal carbon pricing to factor the cost of emissions into calculations for energy procurement and rationalization efforts.

DIC Sustainability Index

The DIC Sustainability Index was established as a yardstick for measuring the social value of DIC Group products. The index’s vertical axis quantifies each product’s contribution to the reduction of environmental impact, which the Group is working continuously to reduce. In particular, the Group is focused on reducing greenhouse gas emissions (Scope 1 and 2) and ensuring steady progress toward achievement of the targets it has set for fiscal years 2030 and 2050.

Calculating Products’ Carbon Footprint

To lower CO₂ emissions across its supply chain, the DIC Group calculates and works to minimize emissions associated with its products from the sourcing of raw materials through to provision to the customer. The Group is currently developing a scheme to calculate each product’s carbon footprint, which it believes will assist its efforts to foster dialogue with suppliers and respond to customer expectations and social imperatives. In response to requests from global customers, the Group is also creating guidelines for calculating products’ carbon footprint that are consistent with those employed by Sun Chemical, as well as to create an information-sharing mechanism. For customers in Japan, the Group set up a system for responding to inquiries related to products’ carbon footprint that is spearheaded by the Sustainability Department and held related presentations for technical and sales teams.

Avoided Emissions

The term “avoided emissions” refers to CO₂ emissions that can be avoided through the use of a product. Examples include products that contribute to improving fuel efficiency by reducing vehicle body weight and products that help reduce energy used for heating and cooling by improving insulation. The DIC Group is working to appropriately calculate avoided emissions’ contribution to emissions across the supply chain, as well as to quantify their importance to the value its products deliver.

Innovation

By capitalizing on open innovation to promote the chemical recycling of its products, as well as the recycling and conversion of recovered CO₂ into new raw materials, the DIC Group is working to realize manufacturing that does not rely on fossil fuels, thereby helping contribute to sustainability for the global environment and for society, as set forth in DIC Vision 2030.

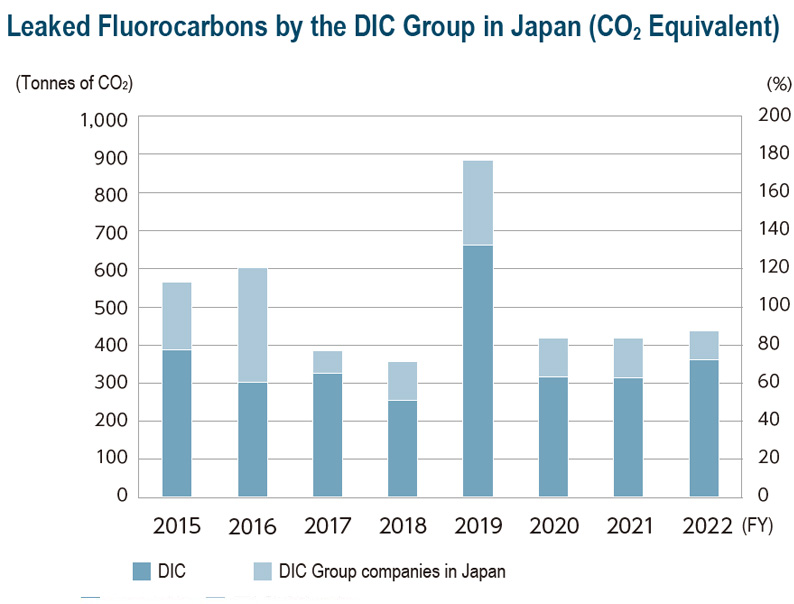

Protecting the Ozone Layer

Hydrofluorocarbons (HFCs) are used widely as refrigerants in

equipment and facilities. While not an ozone-depleting substance

(ODS), HFCs have a warming potential 100–10,000 times that of

CO₂ and their use is expected to account for a 0.5°C increase in the

global average temperature by the end of the 21st century. At the 28th

Meeting of the Parties in Kigali, Rwanda, held in October 2016, the

Parties to the Montreal Protocol on Substances that Deplete the Ozone

Layer reached an agreement to phase out the production and use of

HFCs (the Kigali Amendment). Japan subsequently amended its Act

on the Protection of the Ozone Layer Through the Control of Specified

Substances and Other Measures in line with the amendment, which

as of September 26, 2022, had been ratified by 138 Parties. (Having

surpassed the condition of ratification by at least 20 Parties, the Kigali

Amendment entered into force on January 1, 2019.)

In April 2015, Japan also revised its Fluorocarbons Recovery and

Destruction Law. The same month, the Act on Rational Use and

Proper Management of Fluorocarbons entered into force, compelling

stakeholders to ascertain and report leaks of fluorocarbons from

commercial equipment and facilities.

In fiscal year 2022, leaked fluorocarbons from DIC Group sites were

equivalent to 439 tonnes of CO₂. (Leaks in excess of 1,000 tonnes per

site or per company must be reported to the Japanese authorities.) The

Company has worked to effectively manage fluorocarbons since fiscal

year 2015, when the Act on Rational Use and Proper Management

of Fluorocarbons entered into force, and has managed to keep leaks

below the level requiring reporting. In fiscal year 2022, the Group’s efforts to comply with laws governing leaked fluorocarbons were

recognized in the Japan Refrigerant and Environmental Organization’s

second JRECO Fluorocarbon Rating, which selected it as one of 49

A-rank performers from among 1,840 companies surveyed. Going

forward, the Group will continue working to ensure compliance

with pertinent laws and regulations, as well as to reduce leaked

fluorocarbons from its sites by, among others, choosing air conditioning

equipment with low environmental impact refrigerants, including those

containing no fluorocarbons.

Back number

- Principal Initiatives in Fiscal Year 2021

- Principal Initiatives in Fiscal Year 2020

- Principal Initiatives in Fiscal Year 2019

- Principal Initiatives in Fiscal Year 2018

- Principal Initiatives in Fiscal Year 2017

- Principal Initiatives in Fiscal Year 2016

- Principal Initiatives in Fiscal Year 2015

- Principal Initiatives in Fiscal Year 2014

- Principal Initiatives in Fiscal Year 2013