Risk Management

Basic Approach to Risk Management

Effectively managing ever-more diverse and complex risks is crucial for the DIC Group to transform the growth scenario set forth in its DIC Vision 2030 long-term management plan into reality. The Group strives to address changes in its operating environment and the diversification of risks in an appropriate and flexible manner, as well as to promptly recognize and fully grasp the impact of latent risks on its businesses, preventing such risks from manifesting and minimizing the impact if they do.

Risk Management Policy

The DIC Group has formulated a risk management policy with the objective of making consistent risk management initiatives an inherent component of its corporate culture and business planning, underpinning operational and strategic decision making, and the allocation of management resources, as well as helping realize an effective corporate governance organization and responsible risk taking.

Framework for Risk Management

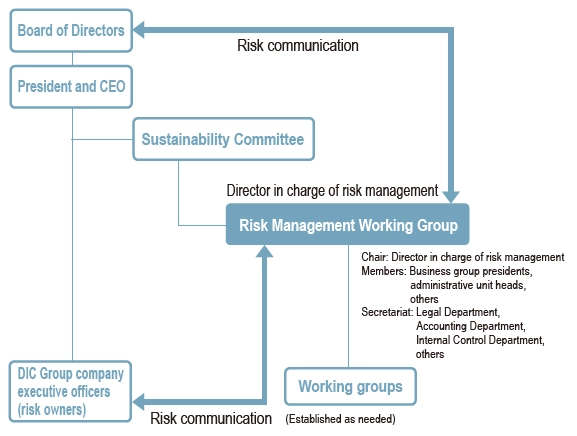

The DIC Group established the Risk Management Working Group, a subordinate entity of the Sustainability Committee chaired by the director in charge of risk management, as part of its effort to strengthen its comprehensive risk management system. The Risk Management Working Group plans and advances risk management initiatives to ensure that the Group’s risk management program are implemented appropriately and reports on its activities to the Board of Directors and the Sustainability Committee at least once a year. To address specific risk areas, working groups may be established under the Risk Management Subcommittee as necessary.

Risk Management Initiatives

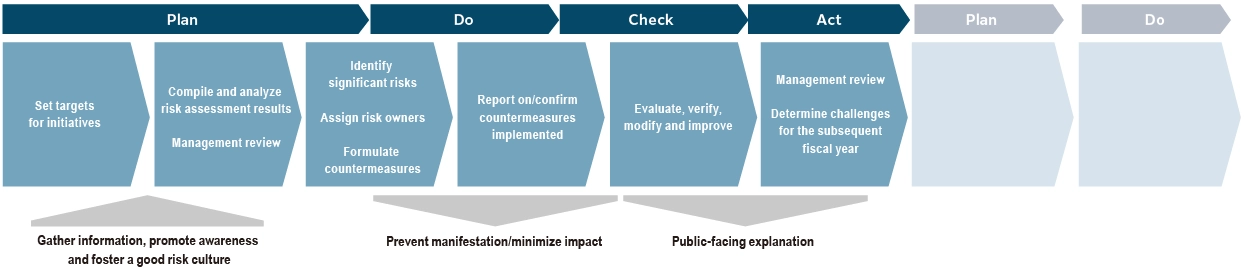

Risk assessments are conducted at the end of each fiscal year with directors, business group presidents and other relevant individuals serving as appraisers. The results of these assessments are compiled and analyzed by the Risk Management Working Group, which reports its findings to the Sustainability Committee and the Board of Directors at the beginning of the subsequent fiscal year, and significant risks facing the Group in the new period are identified. Each of these significant risks is assigned an owner, that is, the division or department responsible for implementing countermeasures.

Risk owners report the progress and outcome of their efforts, as well as any resulting changes to the risk, among others, as necessary to the Risk Management Working Group. The working group responds by providing the risk owners with critical support, evaluating and verifying the results of countermeasures, and suggesting corrections and improvements. The results of these efforts are reported to the Sustainability Committee and the Board of Directors at fiscal yearend, based on which challenges and targets to be incorporated into the following year’s sustainability activity plan are determined. The risk management framework is also honed or modified as appropriate, laying the foundation for the subsequent year’s risk management assessments. Changes to the status of risks resulting from risk management initiatives, as well as from changes in the operating environment, are disclosed publicly as appropriate in the annual securities report, among others.

Overview of Risk Management

Led by the Risk Management Working Group, DIC uses the PDCA cycle on an annual basis to enhance the effectiveness of the DIC Group’s risk management.

Business Risks

The Group sets forth “Materiality” which are matters with the potential to negatively or positively affect its business performance over the medium to long term. These Materiality items are utilized in enhancing its business, with concrete and efficient handling. The Group continues taking decisive and efficient steps in response to these materiality issues pursuant to DIC Vision 2030,1 launched in 2022, working to ensure that these efforts are beneficial to the management of its businesses. The Group also undertakes risk management initiatives with the aim of appropriately and flexibly addressing changes in its operating environment and the diversification of risks, and of swiftly minimizing damage, led by the Sustainability Committee, an advisory body, and its subordinate entity, the Risk Management Subcommittee. From a wide range of risks, the Group uses risk assessments to evaluate likelihood of occurrence and degree of potential impact and identify major risks to its performance. Risk owners are appointed to take measures against particularly the material risks. These efforts are monitored appropriately and reported on to the Sustainability Committee and the Board of Directors.

The key risks described below are recognized based on the material issues2 identified by the Group, and the findings of a survey conducted by the Risk Management Working Group, and the potential impact of each risk, should it materialize, on the Group’s businesses and stakeholders are categorized into high, medium or low.3

Forward-looking statements herein are based on projections as of December 31, 2023, and the following risks do not cover all risks that could affect the Group.

- (Notes)

- For more information on DIC Vision 2030, please visit the respective page of the DIC global website (https://www.dicglobal.com/en/ir/management/plan.html).

- For more information on the Group’s materiality issues, please see the DIC Report integrated report (https://www.dicglobal. com/en/csr/annual/).

- Details of the items in the table, such as the possibility and timing of materialization of each risk, are as follows:

Likelihood (Potential for future manifestation as of December 31, 2023)

| High: | Highly likely |

| Medium: | As likely as not |

| Low: | Unlikely |

Time Horizon (Expected timing of/period before risk is likely to manifest as of December 31, 2023)

| Long term: | Five years or more |

| Medium term: | Three to four years |

| Short term: | Within two years |

| Unknown: | Cannot anticipate the timing of its emergence |

Risk Type (Categorization by origin as of December 31, 2023)

| 1: | Externally caused risks that are beyond the Group’s control |

| 2: | Corporate risks that can be managed through Group management–led countermeasures |

| 3: | Business-related risks that should be handled by the relevant divisions/departments |

Alignment (Relationship with business strategies outlined in the DIC Vision 2030 long-term management plan)

| A: | Business portfolio transformation to achieve growth |

| B: | Strengthening of management infrastructure underpinning global environmental, social and governance (ESG) management and safety management |

| C: | Cash flow management |

| Other: | No alignment with business strategies |

Risks, the manifestation of which is likely to have an impact