Notice Regarding Conclusion of Positive Impact Finance Agreement —Efforts to ensure achievement of the SDGs earn high marks from major financial institutions—

- Sustainability

- News Release

Tokyo, Japan—DIC Corporation announced today that it has concluded an agreement for a syndicated loan, for which Mizuho Bank, Ltd., will act as arranger, though Mizuho Positive Impact Finance, a positive impact finance (PIF) scheme that conforms with the United Nations Environment Programme Finance Initiative (UNEP FI)’s *1 Principles for Positive Impact Finance.*2

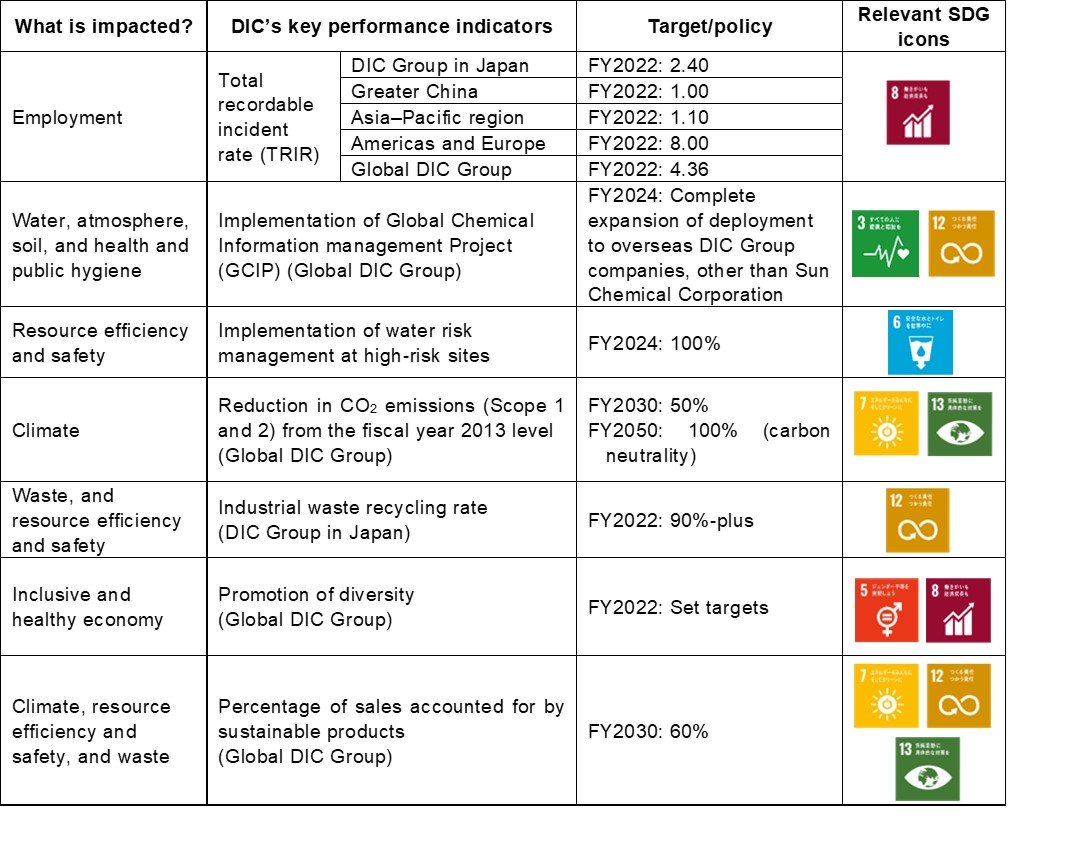

PIF is a financing framework designed to facilitate the comprehensive analysis and evaluation of the positive and negative environmental, social and economic impacts of corporate activities, and the extension of loans to support these activities on an ongoing basis. The most notable feature of a PIF is that the degree to which corporate activities, products and services contributes to the achievement of the United Nations’ Sustainable Development Goals (SDGs) is used as an evaluative indicator and monitored based on publicly available information.

In line with its vision statement, “We improve the human condition by safely delivering color and comfort for sustainable prosperity—Color & Comfort,” DIC provides solutions that respond to the needs of markets and its customers, and which contribute broadly to society. The Company also works to help realize the SDGs through efforts to address four priority materiality themes, namely, transformation to a sustainable business structure, product stewardship, response to climate change, and efforts to strengthen product development capabilities and create new businesses.

The loan agreement was concluded following a qualitative and quantitative analysis of factors that are particularly likely to impact the success of the SDGs. The Company reports on its initiatives to address these factors and the results thereof in DIC Report, its annual integrated report.

In connection with the conclusion of this agreement, a third-party opinion was obtained from Japan Credit Rating Agency, Ltd. (JCR), *3 on the loan’s conformance with the Principles for Positive Impact Finance and consistency with the Concept Paper on Impact Finance compiled Japan’s Positive Impact Finance Task Force, which was created in line with Article 2, paragraph 4, of the Outline for the Establishment of the Ministry of the Environment’s ESG Finance High Level Panel.

Going forward, DIC will continue working to help ensure the achievement of the SDGs, a key global initiative, by addressing a variety of related themes and with the aim of evolving as a unique global company that is trusted by society.

- Ends -

*1 UNEP was established in 1972 as sub-entity of the United Nations responsible for implementing the Declaration of the United Nations Conference on the Human Environment and the Action Plan for the Human Environment. UNEP FI is a broad-based closely aligned partnership between UNEP and more than 200 global financial institutions. Since its establishment in 1992, UNEP FI has worked in concert with financial institutions, as well as government and regulatory authorities, to transform the global financial system into one that integrates economic and ESG-related considerations.

*2 The Principles for Positive Impact Finance were formulated by UNEP in January 2017 as a financial framework for banks to fund businesses that contribute to the achievement of the SDGs. Under this framework, a bank comprehensively evaluates the positive and negative impacts of the borrowing company’s activities, and provides financing that aims to increase the former and mitigate the latter. The lending bank, as a responsible financial institution, also keeps track of whether impacts are ongoing by monitoring the KPIs.

*3 For more information on third-party opinions provided by JCR, please see the agency’s website.

*Note: The files are in Adobe Acrobat Format. To view them you will need Acrobat Reader.