A Message from the CFO

We are taking decisive steps to generate and ensure the optimal allocation of cash by promoting ROIC management.

Takeshi Asai Directer, Senior Managing Executive Officer,

Head of Finance and Accounting Unit

CFO

Operating Results and Financial Condition

In fiscal year 2024, consolidated net sales increased 3.1%, while operating income climbed 148.1%, reflecting a notable improvement over fiscal year 2023—a particularly challenging period for DIC. With the goal of enhancing capital efficiency, we made the decision to divest subsidiary SEIKO PMC CORPORATION and transferred the intellectual property related to our LC materials business to a third party. Additionally, structural reforms and efforts to reduce costs have significantly narrowed the loss in our pigments business. Our financial position also improved, as evidenced by a ¥19.0 billion decrease in net interest-bearing debt, driven by steady cash generation as a result of a recovery in operating results and the sale of assets, and by an increase in the net debt-to-equity (D/E) ratio*1 to 1.05 times, reflecting an increase in operating income and a weak yen, and remaining within our target range of 1.00 to 1.10 times.

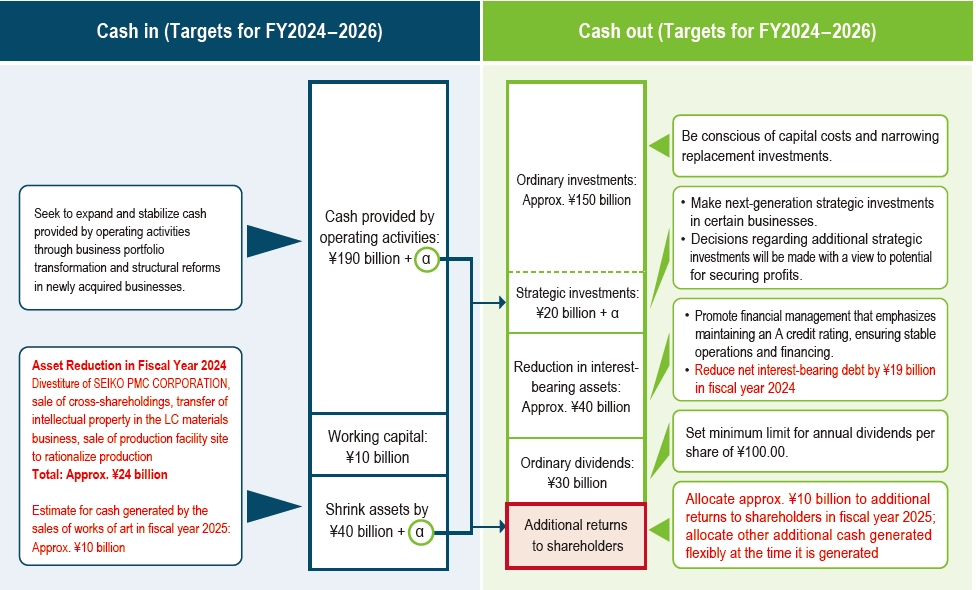

Adoption of Policies for Cash Allocation

As part of the review of our DIC Vision 2030 long-term management plan, released in the period under review, we established cash allocation policies with the goal of optimizing the allocation of cash generated. In fiscal year 2024, the first year of the revised plan, we implemented structural reforms in the pigments business and sought to maintain sales prices for printing inks in overseas markets, leading to an improvement in performance that bolstered cash provided by operating activities. We also moved to shrink assets, including the aforementioned divestiture and the active reduction of cross-shareholdings. Working capital is also on an uptrend, owing to rising sales, so we will continue taking steps to achieve reductions, primarily by optimizing inventory management, to improve the cash conversion cycle.*2

Strengthening Returns to Shareholders

Annual dividends for fiscal year 2024 were ¥100.00, the minimum limit set forth in our pertinent cash allocation policy. In fiscal year 2025, we intend to maintain annual dividends at ¥100, as well as allocate ¥10 billion to additional returns to shareholders. Going forward, applications for additional cash generated through asset sales or other means will be deliberated and applied to shareholder returns in a flexible manner in accordance with this policy.

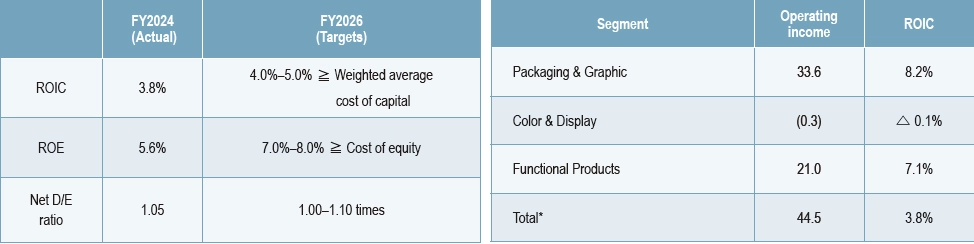

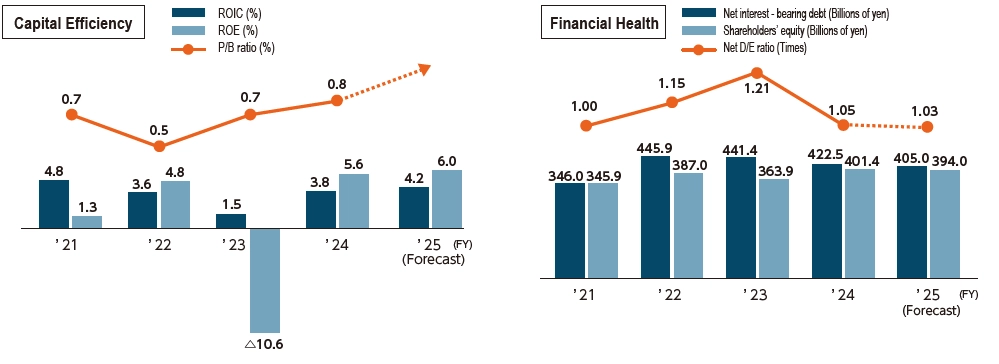

Promoting Management that Is Conscious of Capital Costs

Despite increases in our share price, our P/B ratio in fiscal year 2024 was 0.80 times, falling short of our goal of improving this indicator, which has persistently been below 1.0 times. Recognizing that improving capital profitability is a management challenge crucial to increasing corporate value, we will work to bolster capital efficiency by implementing a strategy of selectivity and concentration. We will also continue to make decisions regarding capital investments and strategic investments with an emphasis on capital costs and potential for securing profits. ROIC in fiscal year 2024 improved to 3.8%, while ROE rose to 5.6%. Our target ranges remain between 4.0% and 5.0% for the former and between 7.0% and 8.0% for the latter.

Managing Segment ROIC

We have long used segment ROIC as an internal management indicator to promote the optimal allocation of management resources, but we took the decision to disclose these figures publicly for the first time as part of our fiscal year 2024 results announcement. This marks a step toward clarifying the factors behind our widening ROIC spread*3 and the measures we plan to implement in response, while also strengthening our engagement with shareholders and investors, and with capital markets. ROIC in the Packaging & Graphic and Functional Products segments in the period under review exceeded targets, both of which reported robust operating results. In the Color & Display segment, however, improving profitability remained a challenge despite a significant narrowing of the segment’s operating loss. Efforts to dramatically reduce fixed costs in this segment will continue, focusing on merging certain production facilities and shuttering others in the Americas and Europe, and on promoting structural reforms. We will also encourage the development of strategic products and emphasize high-performance products with the goal of restoring the segment to growth and improving segment ROIC.

- Net D/E ratio is calculated as net interest-bearing debt / shareholders’ equity.

- Cash conversion cycle is a metric that expresses the time (in days) it takes for a company to convert capital investments in raw materials and inventory into cash.

- ROIC spread is the difference between ROIC and weighted average cost of capital (WACC), which represents the cost of financing a company’s operations.

Policies for Cash Allocation

* Total operating income includes operating expenses for the above three segments and for the Company as a whole.

July 3, 2025