BCM and Crisis Management

Reducing Business Risks and Preventing the Recurrence of Incidents

Goals and Achievements of Major Initiatives

Ensure the continuity of DIC Group businesses.

| Goals for fiscal year 2022 | Periodically revise BCPs and reinforce cooperation among product divisions and sites. |

|---|---|

| Achievements in fiscal year 2022 |

|

| Evaluation | ★★★ |

| Goals for fiscal year 2023 | Periodically revise BCPs and reinforce cooperation among product divisions and sites. |

| Goals for fiscal year 2022 | Strengthen efforts to create a global crisis management configuration and promote BCP initiatives. |

|---|---|

| Achievements in fiscal year 2022 |

|

| Evaluation | ★ |

| Goals for fiscal year 2023 | Strengthen efforts to create a global crisis management configuration and promote BCP initiatives. |

- Evaluations are based on self-evaluations of current progress.

Key: ★★★ = Excellent; ★★ = Satisfactory; ★ = Still needs work

Basic Approach to BCM and Crisis Management

The DIC Group accounts for all risks with the potential to interrupt business continuity through BCM, including those related to natural disasters such as major earthquakes, typhoons and floods; infectious diseases and pandemics; and facility accidents such as explosions, fires and leaks. The Group comprehensively estimates the probability of each risk and its impact on management, prioritizing response measures for more significant risks. The Group has also established a task force framework encompassing a headquarters task force, business task forces and on-site task forces, as well as prepared risk-specific manuals for use Groupwide, and continues to promote efforts that include producing and revising business continuity plans (BCPs) for key products, formulating BCM and crisis management countermeasures, and updating information.

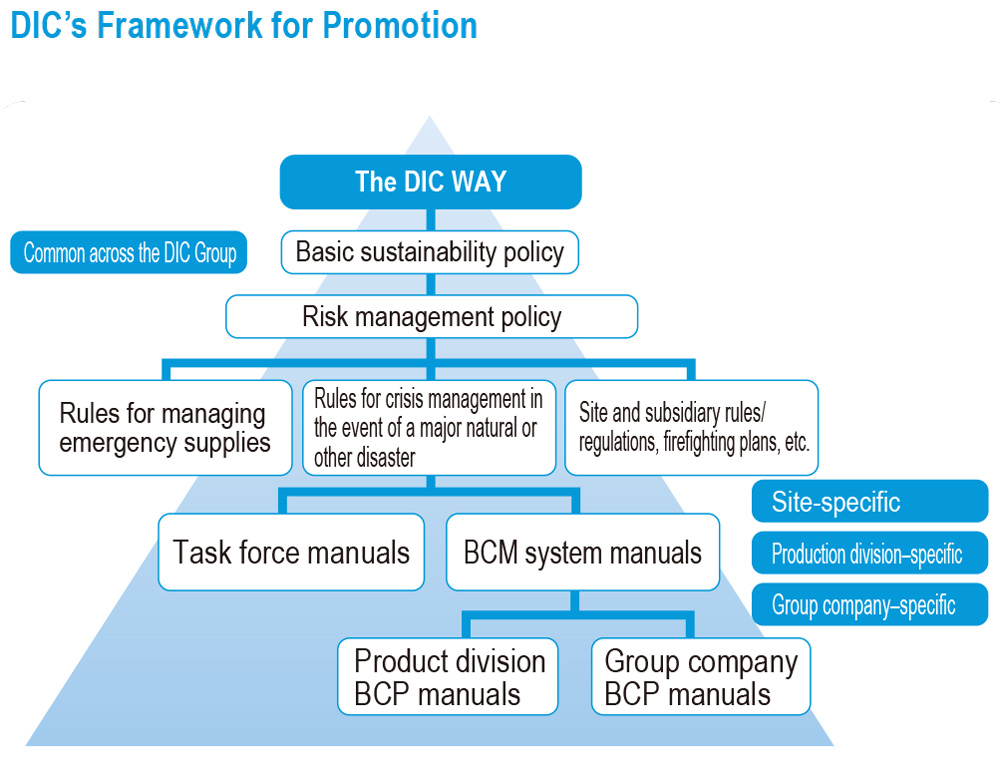

Framework for Promoting BCP

Having prepared crisis management rules and risk-specific manuals for use across the DIC Group in the event of a major disaster, DIC has formulated BCPs for individual product divisions.

The DIC Group also recognizes the need to ensure it can fulfill its supply responsibilities in the event of damage to its facilities from a large-scale disaster and thus incorporates this perspective into its BCPs. Specifically, the Group formulates BCPs for key products with a view to fulfilling its responsibilities to society and responding to customer expectations. In addition, DIC conducts BCP-focused joint product division–production facility exercises assuming the implementation of these BCPs to confirm the effectiveness of manuals, identify issues and implement ongoing improvements.

BCM in Fiscal Year 2022

As in the previous period, curbing the spread of COVID-19 once again required decisive steps in fiscal year 2022 and the DIC Group continued working to implement effective measures that reflected evolving circumstances.

Responding effectively to accidents and disasters depends on employees having a correct understanding of BCM and of how to properly execute the DIC Group’s BCPs. This in turn requires education and training. In an average year, training includes conducting workshops and map-based simulation exercises—originally developed for senior management—for headquarters task force members under the supervision and guidance of experts, as well as BCP-focused joint production division–production facility exercises.

In fiscal year 2022, the DIC Group conducted a drill based on the premise of which was a fire breaking out at a production facility, rather than the usual premise of a natural disaster, resulting in damage affecting a number of production lines. The drill included using online meetings involving corporate headquarters, product divisions and production facilities in combination with the DIC BC Portal system to report and discuss responses and included an exercise in dealing with local governments and residents.

The DIC Group also sought to address issues associated with the aforementioned DIC BC Portal system in its first year since rollout in fiscal year 2021. This focused on making improvements to ensure stable operation. Specifically, the Group reviewed criteria for activating the system, as well as initial reporting rules, preparing a manual for night-shift personnel, and developing training environments for sites. To increase the system’s effectiveness, presentations were held at individual sites to encourage understanding and utilization.

Improving the Effectiveness of BCPs and Preventing Them from Becoming Empty Formalities

The DIC Group works to refine its BCP templates to prevent these plans from becoming mere formalities. In fiscal year 2022, as in the previous period, the Group adjusted its BCP templates in anticipation of the future evolution of Group companies, to comply with the requirements of ISO 22301, the ISO’s standard for business continuity management systems. To bring its BCPs closer in line with the ISO standard, the Group incorporated measures to prevent production bottlenecks that obstruct business continuity.

The DIC Group also conducts annual status update meetings, attended by relevant executives, to verify the content of revised product division BCPs, thereby ensuring they remain relevant. The fiscal year 2022 status update meeting included interviews regarding bottlenecks arising from revision of the format of BCPs designed to ensure business continuity in the event of a major disaster and the creation of the new BCP template based on the assumption of widespread outbreak of a novel infectious disease.

Conducting Emergency Response Exercises and Drills

In addition to annual headquarters task force–led training, the DIC Group has developed and works to maintain a system designed to ensure its ability to minimize damage in the event of a disaster, as well as to facilitate the swift restoration of operations. This system includes a wide range of exercises and drills, including employee safety confirmation drills, site-to-site emergency radio warning drills and sitespecific comprehensive disaster drills. With the rollout of the DIC BC Portal system, steps were taken to develop training environments for sites and to advance its use in the sharing of information among sites on emergency response exercises and drills conducted.

Crisis Management

Efforts to Reinforce Safety Measures in Other Countries and Territories

Opportunities for employees to travel to other countries and territories on business, which had come to a temporary halt, are recovering to prepandemic levels. Given the increasing risks not only of the outbreak of an infectious disease but also of terrorist attacks and insurgencies, the DIC Group has prepared a safety manual for use by employees embarking on overseas business trips. In fiscal year 2022, the Group revised this manual, focusing on sections related to infectious diseases, terrorism, demonstrations and riots, and the operation of vehicles, and began deploying the new version. The Group also prepared a manual for the evacuation of expatriate employees in the event a major geopolitical risk becomes manifest.

Community Efforts to Cope with Major Disasters

Japan is one of the most earthquake-prone countries in the world. As a consequence, ensuring earthquake readiness, that is, the ability to prevent and mitigate the impact of earthquakes, is recognized as a critical challenge for society as a whole.

Tokyo’s Nihonbashi district, home to DIC’s corporate headquarters, is noted for its tightly clustered large commercial complexes and office buildings. A comprehensive neighborhood disaster drill is conducted annually on an empty lot near the DIC Building, but given the rapid spread of COVID-19 in fiscal year 2022 the drill was replaced by disaster response awareness training, provided by the fire department that has jurisdiction over the area, with the goal of maintaining existing know-how and skills.

The DIC Building, designed with state-of-the-art earthquakeresistant technologies, has been designated as a temporary shelter for people stranded in Chuo-ku, the ward in which Nihonbashi is located, while DIC, as a member of Chuo-ku’s management council for emergency shelters for stranded individuals, promotes a variety of initiatives aimed at assisting people stranded in the wake of a serious earthquake or other disaster. The Company also participates in drills in collaboration with local authorities designed to guarantee the effective sharing of information regarding evacuations, among others, even in the midst of post-disaster chaos. DIC will continue to play an active role in community-based efforts to reinforce local disaster preparations. In doing so, the Company seeks to help ensure Tokyo’s disaster resilience.

Responding to New Infectious Diseases

The DIC Group revised its existing BCP template, premised on the outbreak of a new strain of influenza, in fiscal year 2021 with the objective of ensuring its preparedness to respond in the event of a widespread outbreak of a novel infectious disease. This new template was created and deployed at corporate headquarters in fiscal year 2022, forming the basis of new BCPs, which were completed by all of the product divisions during the period.

In fiscal year 2022, DIC also continued to promote actions designed to help thwart the further spread of COVID-19 and protect employees from infection. These included encouraging employees to make use of telework arrangements, including by normally ineligible temporary staff, and staggered working hours, as well as mandating individuals remain at home when they or any of the people they live with feel unwell, and avoiding holding meetings and events.

COMMENT

We built an internal information sharing and communication system that will ensure the smooth communication of instructions in the event of a disaster or accident.

Infocom Corporation’s crisis management business offers the BC Portal information management portal system, a communication tool that addresses the need

to swiftly and accurately grasp and share information on damage suffered in the event of a disaster or accident, to companies and municipalities across Japan.

After signing an agreement with DIC in 2020 to develop a customized version of this system, the DIC BP Portal system became fully operational in 2021.

In building the DIC BC Portal system, we paid particular attention to needs engendered by the Company’s far-fl ung network of production bases and

operational rules. We sought to customize the system from the user’s perspective, including by adjusting the home screen and tailoring order of input fields, to

ensure superior practicality. Management participated actively in the subsequent headquarters task force–led training incorporating the DIC BC Portal system

to ensure its effective deployment and I found myself impressed by the high level of crisis management awareness throughout the entire Company. I look

forward to seeing DIC expand deployment of this system and that it will help further bolster the Company’s crisis management capabilities in the years ahead.

Certified Business Continuity Specialist Grade II, Crisis Management Department, Infocom Corporation Yukikazu Hayasaka

We are working to realize truly functional initial response and business continuity support systems.

We began providing assistance to DIC in July 2019, particularly in the area of initial response and BCP training based on hypothetical scenarios involving major earthquakes. DIC products are used widely and many can be said to be essential to society. In my view, it is important for DIC to further strengthen its disaster response system to ensure its ability to maintain stable supplies, even in the event of a major earthquake or other disaster.

In fiscal year 2019, we helped DIC conduct BCP-focused joint production division–site exercises at the Yokkaichi, Sakai and Tokyo plants. With the aim of examining the effectiveness of initial response manuals and identifying areas requiring improvement, participants in these exercises used damage assumptions with the aim of achieving a heightened level of reality for scenarios used, proceeding with simulations as well as confirming rules for and identifying issues related to information sharing and collaboration between product divisions and sites. We also helped with headquarters task force–led training, which employed a scenario involving a Nankai Trough earthquake, confirming the flow of reporting from production facilities and product divisions and incorporating instructions for critical tasks in exercises, among others.

Through these and other efforts, DIC is working to build a system that ensures information related to the Company’s initial response and BCPs is shared with management swiftly and accurately. I hope that readers will continue to follow DIC’s efforts to further enhance its BCPs going forward.

Advisor, Rescuenow Inc. Kazuki Hakamada

Our goal is to help facilitate the formulation of effective and genuinely practical BCPs.

Our organization has provided assistance to DIC in its efforts to promote awareness of and revise its BCPs since October 2016. What makes DIC’s BCP and risk management efforts different from the more standard undertakings of many other companies is their focus on ascertaining the essence of issues. In 2017, we assisted with visiting BCP lectures at domestic Group sites, the objective of which was to promote awareness by focusing on the people actually responsible for formulation while confirming the basics of BCP and examining the state of related initiatives to clarify where issues exist. During 2018, we will help arrange joint drills for sites—primarily plants—and product divisions and continue advancing initiatives designed to fortify the framework for collaboration between sites and product divisions. Our efforts are designed to avoid turning this process into mere formality, but rather to facilitate the formulation of effective and genuinely practical BCPs. Expect good things from DIC’s BCP and risk management initiatives in the years ahead.

President, Legal & Risk Management Institute Ken Mori

DIC is promoting measures that will ensure sustainable safety for Japan-based employees when they are abroad.

Effective risk management is indispensable to meeting the expectations of stakeholders worldwide in today’s increasingly global corporate society. We have been assisting DIC in formulating safety- and healthcare-related measures for its Japan-based employees when they go overseas since fiscal year 2016. Since the beginning, DIC has worked actively to create a robust framework that is capable of responding to whatever issues might arise and has taken decisive steps with a view to ensuring effective corporate governance and fulfilling its obligation to ensure its employees’ safety. In fiscal year 2018, DIC prepared various handbooks and conducted training sessions for approximately 760 employees at four sites.

As this shows, DIC’s initiatives are not limited to the creation of a framework, but also focus on fostering a common crisis awareness on the front lines. Such efforts to leverage the framework it has created are enabling DIC to promote measures that will ensure sustainable safety for its Japan-based employees when they are abroad.

In fiscal year 2019, DIC will take steps to strengthen its framework. The Company will also apply this framework in a manner that responds to the needs of employees at sites around the world, thereby providing further support for its global business activities.

Senior Executive Advisor, Relo Panasonic Excel International Co., Ltd. Hiromichi Tsuji