Corporate Governance

Basic Approach to Corporate Governance

The DIC Group defines corporate governance as a mechanism to ensure effective decision making pertaining to its management policy of achieving sustainable corporate growth and expansion through sound and efficient management, while at the same time guaranteeing the appropriate monitoring and assessment of and motivation for management’s execution of business activities. With the aim of achieving a higher level of trust with its shareholders, customers and other stakeholders and enhancing corporate value, the Group also promotes ongoing measures to reinforce its management system and ensure effective monitoring thereof.

Policy on Corporate Governance

DIC has prepared a Policy on Corporate Governance, which it has published on its global website.

Document Download

Corporate Governance System

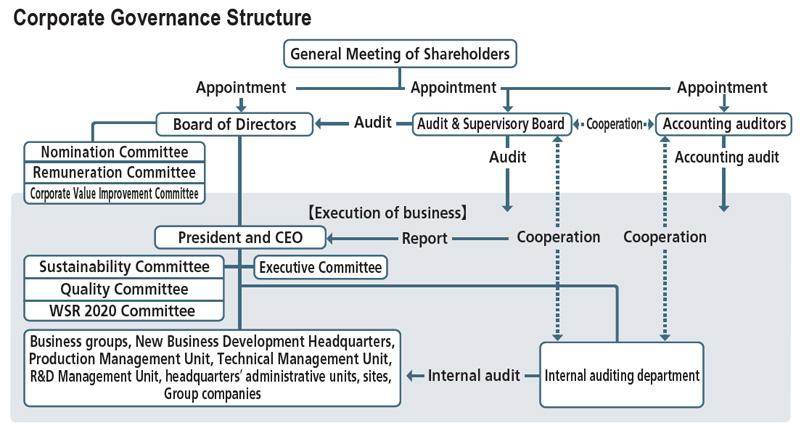

As a company with internal auditors, DIC has a Board of Directors and an Audit & Supervisory Board. The Company has also instituted an executive officer system and has established a Nomination Committee, Remuneration Committee, Executive Committee, Sustainability Committee, Quality Committee and Work Style Revolution (WSR) 2020 Committee.

-

Board of Directors

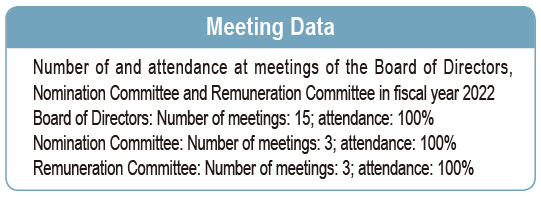

From the perspective of making business decisions in a timely manner and reinforcing corporate governance, the Board of Directors consists of nine directors, three of whom are outside directors (one of whom is female). The Board of Directors typically meets once monthly to make decisions on matters delegated to it under the Companies Act of Japan and on important business matters stated in the regulations for meetings of the Board of Directors, as well as to receive status reports on the execution of business operations and supervise the execution of the business.

-

Nomination Committee

To ensure objectivity in the nomination of directors, Audit & Supervisory Board members and executive officers, among others, the Nomination Committee was established to provide recommendations to the Board of Directors regarding the appointment and dismissal of directors, Audit & Supervisory Board members and executive officers. The committee meets as necessary and consists of five directors, three of whom are independent outside directors, with an independent outside director serving as chair.

-

Remuneration Committee

To ensure objectivity in the determination of remuneration for directors and executive officers, the Remuneration Committee was established and has been entrusted with responsibility for determining remuneration, among others, for directors and executive officers. The committee meets as necessary and consists of five directors, three of whom are independent outside directors, with an independent outside director serving as chair.

-

Executive Committee

The Executive Committee was established as a body to advise on important matters related to the execution of the DIC Group’s business. The committee meets twice monthly in principle and consists of executive officers and others designated by the Board of Directors from among the President and CEO, the Executive Vice President, the heads of the units, and the general managers of the management units and product divisions. As part of the auditing process, one Audit & Supervisory Board member also attends Executive Committee meetings. Details of deliberations at meetings and the results thereof are reported to the Board of Directors.

-

Sustainability Committee

The Sustainability Committee, which functions as an advisory body, met four times in fiscal year 2022 to formulate sustainability policies and activity plans, and evaluate and promote sustainability initiatives, as well as to approve the content of Group sustainability policies and bolster expertise and skills crucial to sustainability. The committee consists of executive officers and others designated by the Board of Directors from among the President and CEO, the Executive Vice President, the heads of the units, the general managers of the management units and product divisions, and the CEOs of regional headquarters. As part of the auditing process, one Audit & Supervisory Board member also attends Sustainability Committee meetings. Details of deliberations at meetings and the results thereof are reported to the Board of Directors.

-

Quality Committee

In addition to reporting on the status and progress of quality management, the Quality Committee functions as a deliberative body for the DIC Group’s quality policy, principal initiatives and important issues in Japan. In principle, the committee meets once quarterly and consists of executive officers and others designated by the Board of Directors from among the President and CEO, the Executive Vice President, the heads of the units, and the general managers of the management units and product divisions. As part of the auditing process, one Audit & Supervisory Board member also attends Quality Committee meetings. Details of deliberations at meetings and the results thereof are reported to the Board of Directors.

-

WSR 2020 Committee

The WSR 2020 Committee was established to deliberate work style reform–related measures and investment plans, among others, with the aim of enhancing Group employee job satisfaction and productivity. In principle, the committee meets once quarterly and consists of executive officers and others designated by the Board of Directors from among the President and CEO, the Executive Vice President, the heads of the units, and the general managers of the management units and product divisions. Details of deliberations at meetings and the results thereof are reported to the Board of Directors.

-

Audit & Supervisory Board

The Audit & Supervisory Board comprises four members, including two who are outside (one of whom is female). In principle, the Audit & Supervisory Board meets once monthly. Board activities include debating and determining auditing policies and auditing plans. Members also report on the results of audits conducted.

Board members attend important meetings, including those of the Board of Directors, Executive Committee and Sustainability Committee, meet with representative directors on a periodic basis to exchange information and opinions, and collect business reports from directors, executive officers and employees. In addition, the Company has established an Audit & Supervisory Board Members’ Office, to which it assigns dedicated personnel to assist the Audit & Supervisory Board members in their duties.

The Company’s three outside Audit & Supervisory Board members have extensive experience in and knowledge of finance and accounting, which they are able to leverage in the performance of their duties. Full-time Audit & Supervisory Board member Hiroyuki Ninomiya oversaw corporate accounts at the Company for many years and was general manager of the Accounting Department and Head of the Finance and Accounting Unit. In addition to providing expertise in corporate law, outside Audit & Supervisory Board member Keita Nagura provides tax accounting services pursuant to Article 51 of the Certified Public Tax Accountant Act. Outside Audit & Supervisory Board member Keiko Kishigami is qualified as a certified public accountant and has engaged in the audit of companies for many years. -

Internal Auditing Department

The internal auditing department—comprising local teams of employees covering Japan, the Asia–Pacific region, the PRC, and Europe, the Americas, the Middle East and Africa—is charged with internal auditing, which includes monitoring the effectiveness of internal controls, based on annual auditing plans, and selects audit targets based on risk assessments.

-

Accounting Auditors

The Company has engaged Deloitte Touche Tohmatsu LLC as its independent auditors. The Company strives to ensure an environment that facilitates the accurate disclosure of information and fair auditing. The Audit & Supervisory Board members, accounting auditors and internal auditing department conduct audits from their respective independent positions, but also liaise periodically to facilitate close cooperation, thereby ensuring the effectiveness of audits.

Rationale behind Current Corporate Governance System

The Company has instituted an executive officer system, a move aimed at separating decision making and implementation and thereby accelerating business execution and clarifying responsibilities. The Company has appointed three highly independent outside individuals to its Board of Directors to reinforce its monitoring of business execution. The Company also has a Nomination Committee and a Remuneration Committee, which include three outside directors, to ensure objectivity in the nomination of, and in determining remuneration for, directors and executive officers. Four Audit & Supervisory Board members, which include one attorney and one certified public accountant as outside members, conduct audits in liaison with the accounting auditors and the internal auditing department. This structure ensures the effective functioning of the Company’s corporate governance system.

System of Internal Controls

01Status of the System of Internal Controls and the Establishment of a Framework for Risk Management

In striving to conduct its operations in accordance with The DIC Way, the DIC Group has prepared and operates a system of internal controls based on the Companies Act of Japan to ensure the appropriateness of its operations.

- The Company shall work to set forth the DIC Group Code of Business Conduct as the standard regarding compliance, which directors and employees should comply with, and to disseminate the same.

- The Company shall, as part of its compliance activities, establish an internal notification system as a channel available for the employees of the DIC Group and set up multiple notification channels independent from channels used in the execution of business, thereby creating a structure that can quickly respond to domestic and international notifications.

- To ensure that the duties of directors are performed properly and efficiently within the DIC Group, the Company shall establish regulations for company organization and authority.

- The Company shall formulate long-term management plans and the annual budget based on DIC Group management policies and management strategies, and, through dissemination of the same, ensure common goals are shared within the DIC Group. The Company shall make progress reports to the Board of Directors.

- Information pertaining to the performance of duties by directors shall be recorded, retained and managed appropriately in accordance with the regulations for document management. The Company shall establish regulations for systems of information management and shall prepare a system for preventing leakage of confidential information of the DIC Group.

- The Company shall formulate a risk management policy and shall identify, assess, prioritize and address any risks that may have a significant impact on management of the DIC Group.

- The Company shall determine an administrative department for each subsidiary from the standpoints of business execution and management, and shall supervise the execution of business by dispatching a director to each subsidiary.

- The Company shall clarify important matters, including those pertaining to subsidiaries, that must be approved by or reported to the Company.

02Basic Policy toward Eliminating Demands by Antisocial Elements

This basic policy, which is outlined in the DIC Group Code of Business Conduct, is to stand firmly against antisocial elements and in no way to acquiesce to demands presented by such elements. The General Affairs and HR Department is responsible for coordinating efforts to respond to extortion or other demands presented by antisocial elements, while individuals have been put in charge of efforts at each site and within each Group company. These individuals work in close collaboration with legal counsel and the police to ensure the Company’s responses are resolute. The Company has also prepared and distributed a manual on appropriate responses to such demands with the aim of raising awareness among employees.

Outside Directors and Outside Audit & Supervisory Board Members

01Number and Role of Outside Directors and Outside Audit & Supervisory Board Members

The Company currently has three outside directors and two outside Audit & Supervisory Board members. In addition to attending meetings of the Board of Directors, the three outside directors—who have extensive experience in corporate management—serve as members of the Nomination Committee and the Remuneration Committee, enabling them to provide supervision with an independent point of view, thereby helping to reinforce the Company’s corporate management. The two Audit & Supervisory Board members—one a certified public accountant and the other an attorney—advise management of the DIC Group from an expert, multifaceted and independent perspective, thereby helping to reinforce the auditing function.

02Independence Standards for Outside Directors and Outside Audit & Supervisory Board Members

The Company recognizes the need to appoint individuals to the position of outside director and outside Audit & Supervisory Board member, which are shown below. The Company’s outside directors and outside Audit & Supervisory Board members are individuals who, based on these standards, are unlikely to have conflicts of interest with ordinary shareholders and who comply with criteria for the independence of directors and Audit & Supervisory Board members set by the Tokyo Stock Exchange.

Independence Standards for Outside Directors and Outside Audit & Supervisory Board Members

The Company does not recognize individuals with the connections listed below as being independent in the appointment of outside officers.

- Individuals who are executives of the Company or of one of its consolidated subsidiaries (collectively, the “DIC Group”) at present or have been in the preceding 10 years

- Individuals to whom any of the following items have applied in the preceding three years:

- A principal business partner of the DIC Group (a business partner with which transactions in a single fiscal year exceed 3% of the DIC Group’s consolidated net sales in that year) or an executive of a business partner to which this description applies

- An individual for which the DIC Group is a principal business partner (a business partner with which transactions in a single fiscal year exceed 3% of the partner’s consolidated net sales in that year) or an executive of an entity to which this description applies

- A shareholder who holds 5% or more of the voting rights in the Company or an executive of a said shareholder to which this description applies

- A principal lender to the DIC Group (a lender from which loans in a single fiscal year exceed 3% of the DIC Group’s total assets in that year) or an executive of a lender to which this description applies

- An individual who has received contributions from the DIC Group in a single fiscal year that exceed ¥10 million or an individual who belongs to an entity to which this description applies

- An accountant who serves as an accounting auditor or accounting advisor for the DIC Group or an individual who is an employee, partner or associate of an audit firm to which this description applies

- Any individual to whom ❻ does not apply but who has received remuneration from the DIC Group that exceeds ¥10 million in a year, excluding remuneration received as a director or corporate officer of the DIC Group, as a provider of professional services, such as consulting, accounting or legal services, or an individual of an organization that received remuneration in excess of 3% of its consolidated net sales in a fiscal year as compensation for professional services

- An executive of another company, in the event that an executive of the Company is appointed to an outside officer position at that company

- Spouses and relatives within the second degree of kinship of individuals listed in 1 or 2 above

- An individual whose term as an outside officer of the Company exceeds eight years

03Support System for Outside Directors and Outside Audit & Supervisory Board Members

Prior to meetings of the Board of Directors, relevant materials are distributed to all outside directors and outside Audit & Supervisory Board members. In addition, the executive officers in charge provide explanations of the agenda to outside directors, while full-time Audit & Supervisory Board members provide explanations as necessary to outside Audit & Supervisory Board members.

Other Initiatives to Enhance the Corporate Governance System

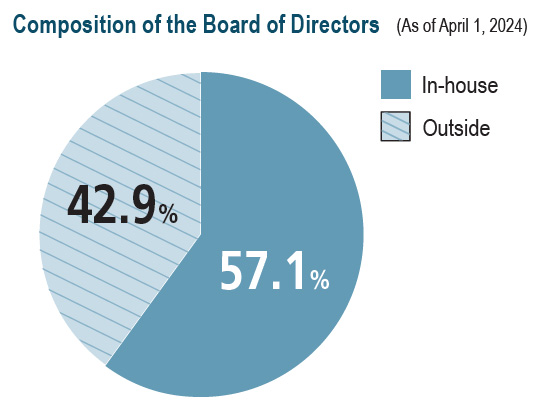

01Composition of the Board of Directors

-

To enable the Board of Directors to resolve major operations-related issues as well as to facilitate the effective oversight of management, the Board of Directors comprises outside directors, who maintain independence, and other individuals having a thorough knowledge of the businesses of the DIC Group, with consideration given to ensuring a balance among necessary knowledge, experience and capabilities. The Board is of an appropriate scale based on the presumption that authority will be delegated to management. Additionally, in light of the DIC Group’s global operations, the Company also strives to ensure diversity in the Board’s composition. The Board currently has two female members (one director and one outside director.)

-

Composition of the Board of Directors

| In-house | Outside | Total | Percentage of outside members | |

|---|---|---|---|---|

| Directors | In-house:6 | Outside:3 | Total:9 | Percentage of outside members:33.3% |

| Audit & Supervisory Board members | In-house:2 | Outside:2 | Total:4 | Percentage of outside members:50.0% |

| Total | In-house:8 | Outside:5 | Total:13 | Percentage of outside members:38.5% |

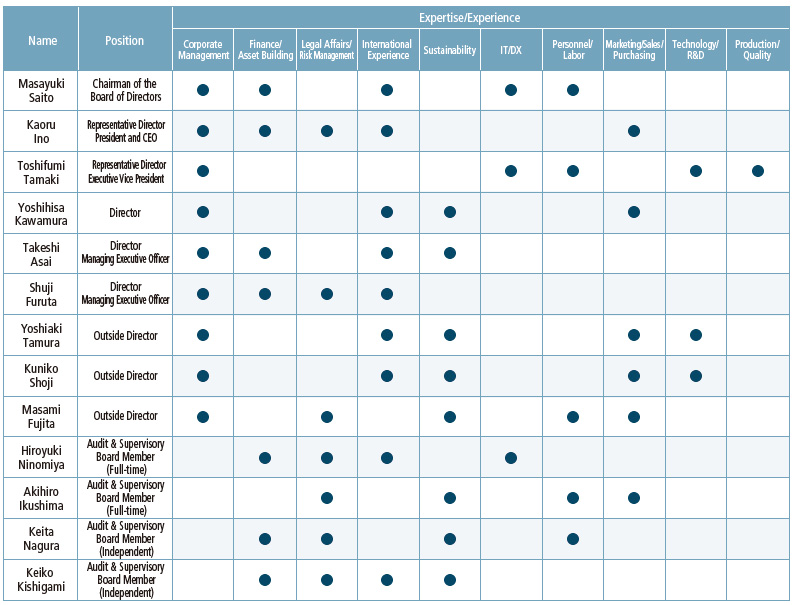

Skills Matrix for Directors and Audit & Supervisory Board Members

The table to the right is a skills matrix summarizing the knowledge, experience and capabilities of current directors and Audit & Supervisory Board members.

Note: The diagram above lists the directors and auditors as elected at the 124th General Meeting of Shareholders held on March 29, 2023.

02Remuneration for Directors and Audit & Supervisory Board Members

Remuneration for directors is determined by the Remuneration Committee, taking into account prevailing market rates, and consists of basic remuneration; bonuses, which are linked to consolidated operating results and achievement of individual targets; and stock compensation, which is linked to the achievement of medium- to long-term performance targets. Directors who serve concurrently as executive officers are eligible for bonuses and stock compensation, in addition to basic remuneration, while other directors and outside directors are eligible for basic remuneration only. Remuneration for Audit & Supervisory Board members consists of basic remuneration only, which is determined in accordance with internal rules established by the Audit & Supervisory Board, with consideration given to ensuring a balance with remuneration for directors and to prevailing market rates.

Remuneration for Directors and Audit & Supervisory Board Members in Fiscal Year 2022

| Total remuneration (Millions of yen) | Composition of remuneration (Millions of yen) | Number of directors and Audit & Supervisory Board members | |||

|---|---|---|---|---|---|

| Basic remuneration | Bonuses | Stock compensation | |||

| Directors (excluding outside directors) |

342 | 230 | 54 | 58 | 6 |

| Audit & Supervisory Board members (excluding outside Audit & Supervisory Board members) |

60 | 60 | - | - | 2 |

| Outside officers | 72 | 72 | - | - | 5 |

-

Notes:

- The total amount of stock compensation is the total monetary value of shares corresponding to the points granted for fiscal year 2021 based on the Company’s performance-based stock compensation plan.

03Evaluating the Effectiveness of the Board of Directors

DIC analyzes and evaluates the effectiveness of the Board of Directors annually via a self-evaluation conducted by directors and Audit & Supervisory Board members. In fiscal year 2022, all directors and Audit & Supervisory Board members were surveyed regarding self-evaluations, Board administration and other issues, and interviewed on an individual basis, with responses analyzed and evaluated by the Board of Directors.

Owing to the aforementioned efforts, it was confirmed that free and lively discussions had been held, led by outside directors and outside Audit & Supervisory Board members, and that appropriate deliberations had been conducted by the Board of Directors. In addition, regarding issues identified in the evaluation conducted in fiscal year 2021, it was judged that discussions pertaining to the progress of the Company’s DIC Vision 2030 long-term management plan and of major investment projects had been enhanced through improvements such as the creation of multiple opportunities for explanation and deliberation and the development of global internal control and risk management systems. Accordingly, the effectiveness of the Board of Directors was confirmed.

In fiscal year 2023, the Company will seek to further bolster the Board of Directors’ effectiveness by reviewing the progress of priority measures set forth in DIC Vision 2030, as well as by taking steps to strengthen the Board’s supervision of the risk management system, as part of its ongoing effort to promote improvement.

Other Initiatives

01Ensuring Diversity in the Promotion of Core Human Resources

With regard to ensuring diversity, DIC works to foster a corporate culture that draws on its understanding and respect for diversity to produce creative ideas and to incorporate the concept of diversity into management, thereby creating workplaces that enhance job satisfaction for employees. Respect for diversity is also stipulated in the Company’s Basic Sustainability Policy.

The Company’s policy for fostering human resources and creating work environments in a manner that ensures diversity is to “promote efforts to ensure diverse human resources are in the right places and the creation of work environments that enable employees to maximize their capabilities.” An executive officer has been put in charge of diversity to create an effective configuration.

In its long-term management plan, the Company identifies “ensure mobility (hiring, retention and succession)” as a strategic priority for reinforcing management of human capital. From the perspective of business strategy, as well as to advance diversity, the Company actively promotes the hiring of experienced mid-career individuals from different industries and with digital capabilities.

As measurable targets for ensuring diversity, the Company has set targets for percentage of directors and Audit & Supervisory Board members accounted for by women and/or foreign nationals, percentage of executive officers accounted for by women and/or foreign nationals, percentage of management positions in Japan occupied by women and percentage of mid-career hires accounted for by women, publishing actual figures in its integrated report along with other yardsticks such as mid-career hires as a percentage of total new hires.

02Sustainability Initiatives

DIC promotes sustainability initiatives in line with key themes that reflect its belief that, as a manufacturer of fine chemicals, it has a responsibility to address ESG-related issues, and discloses the progress thereof in its integrated report. In January 2006, the Company reaffirmed its support for Responsible Care management by signing the CEO’s Declaration of Support for the Responsible Care Global Charter, while in December 2010 it became a signatory to the UNGC. In May 2019, DIC declared its support for the TCFD and in April 2022 it joined the Japan Business Initiative for Biodiversity (JBIB). In February 2023, the Company’s target for achieving carbon neutrality by fiscal year 2050, set in June 2021, received official endorsement from the SBTi as being consistent with levels that climate science says are necessary to limit average global warming to well below 2°C above pre-industrial levels. In recognition of these and other initiatives, DIC has been selected for inclusion in the Dow Jones Sustainability Indices (DJSI) Asia Pacific Index for eight consecutive years.

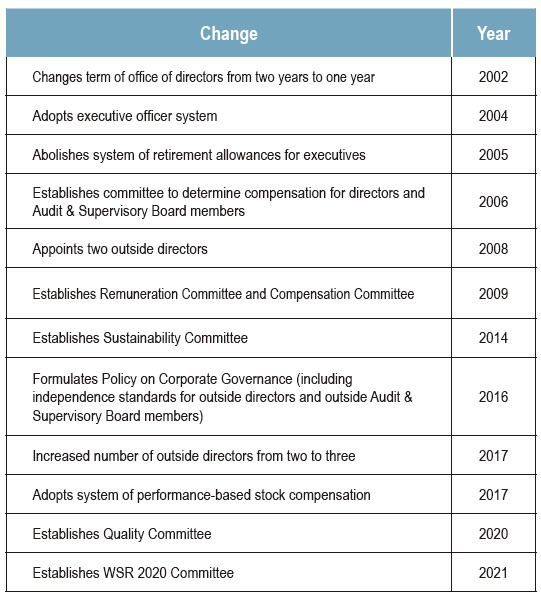

Changes Implemented to Enhance Corporate Governance System